The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 19-Jul-2024)*

- Trading model: Bullish (Last changed from “neutral” on 15-Oct-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

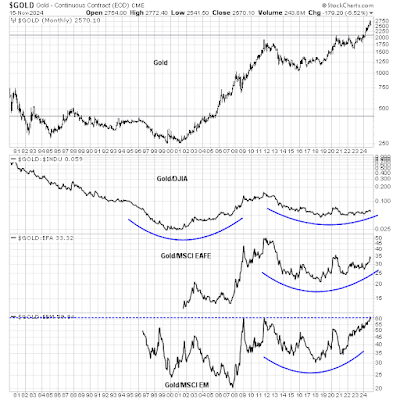

Subscribers can access the latest signal in real time here.Why gold will beat stocksLooking ahead to 2025, I am reiterating my bullish call on gold from a long-term viewpoint. The recent pullback represents a buying opportunity in the metal from an asset allocation perspective.Going back to 1980, we can see several distinct gold bull-bear cycles. Gold topped out at 850 in early 1980 and began a bear market that bottomed in 1985. It traded sideways and made a second bottom in 1999 and broke out to new recovery highs in 2004 and topped in 2011. It subsequently broke out again at 2,100 in early 2024. More importantly, it is tracing out saucer-shaped multi-year bases against different regional equity indices. The gold/Dow ratio is the weakest owing to the strength of U.S. stocks, but it is nevertheless distinctive. The Gold/EAFE ratio (all ratios are in USD) is about to stage a relative breakout, and the gold/EM ratio has marginally broken out of a 12-year base.

These technical patterns argue for a bullish commitment to gold for 2025 and beyond for all investors in all major currencies from an asset allocation perspective.

The full post can be found here.