As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the specialty equipment distributors industry, including Herc (NYSE:HRI) and its peers.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 10 specialty equipment distributors stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.1% since the latest earnings results.

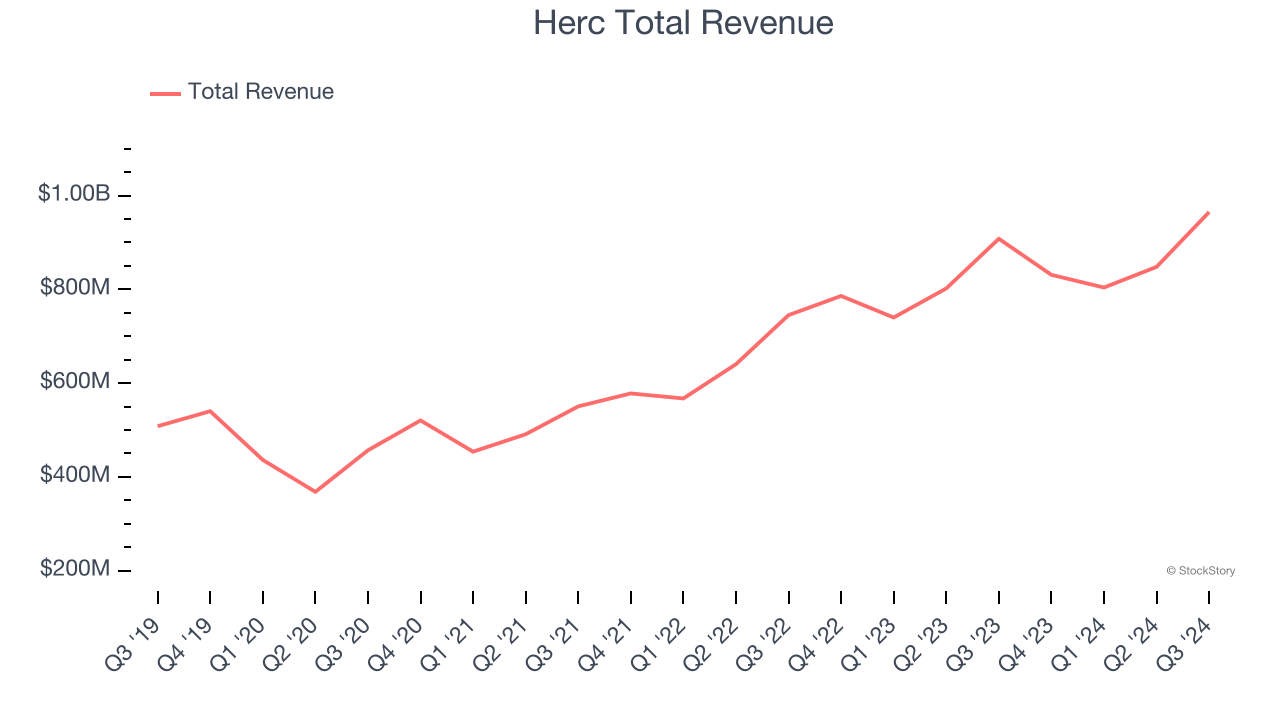

Herc (NYSE:HRI)

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

Herc reported revenues of $965 million, up 6.3% year on year. This print exceeded analysts’ expectations by 3.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ Equipment rentals revenue estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

“In the third quarter, we significantly outpaced overall industry growth on both a total rental revenue basis and from an organic revenue perspective,” said Larry Silber, president and chief executive officer.

Interestingly, the stock is up 9.4% since reporting and currently trades at $185.01.

We think Herc is a good business, but is it a buy today? Read our full report here, it’s free.

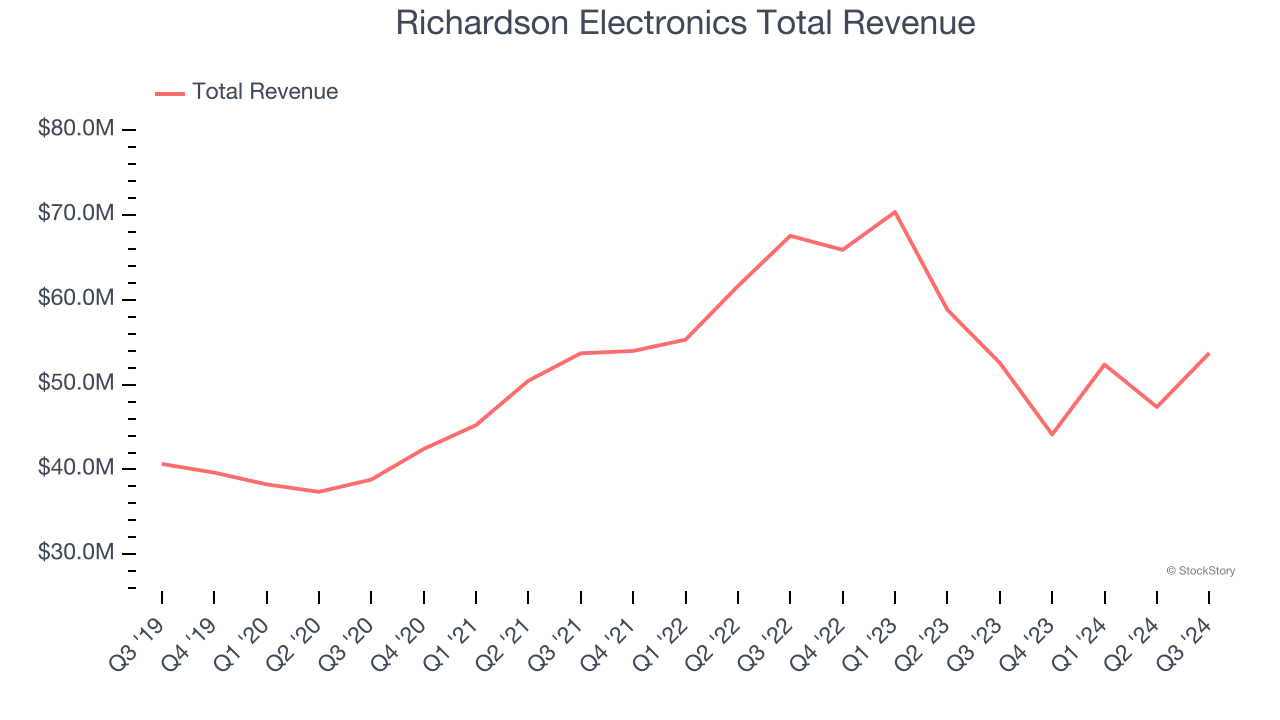

Best Q3: Richardson Electronics (NASDAQ:RELL)

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $53.73 million, up 2.2% year on year, outperforming analysts’ expectations by 8.7%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Richardson Electronics scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 5.1% since reporting. It currently trades at $13.55.

Is now the time to buy Richardson Electronics? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Alta (NYSE:ALTG)

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $448.8 million, down 3.7% year on year, falling short of analysts’ expectations by 6.5%. It was a disappointing quarter as it posted and a significant miss of analysts’ adjusted operating income estimates.

Alta delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 16.3% since the results and currently trades at $6.72.

Read our full analysis of Alta’s results here.

H&E Equipment Services (NASDAQ:HEES)

Founded after recognizing a growth trend along the Mississippi River and opportunities developing in the earthmoving and construction equipment business, H&E (NASDAQ:HEES) offers machinery for companies to purchase or rent.

H&E Equipment Services reported revenues of $384.9 million, down 4% year on year. This result came in 0.9% below analysts' expectations. Overall, it was a softer quarter as it also logged a significant miss of analysts’ adjusted operating income and EPS estimates.

The stock is down 13.2% since reporting and currently trades at $49.20.

Read our full, actionable report on H&E Equipment Services here, it’s free.

Titan Machinery (NASDAQ:TITN)

Founded in 1980, Titan Machinery (NASDAQ:TITN) is a distributor of agricultural and construction equipment across the United States and Europe.

Titan Machinery reported revenues of $679.8 million, down 2.1% year on year. This result topped analysts’ expectations by 0.7%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ EPS estimates.

The stock is down 11.6% since reporting and currently trades at $13.63.

Read our full, actionable report on Titan Machinery here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.