AutoZone trades at $3,170 per share and has stayed right on track with the overall market, gaining 14.3% over the last six months. At the same time, the S&P 500 has returned 14%.

Is AZO a buy right now? Find out in our full research report, it’s free.

Why Is AutoZone a Good Business?

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE:AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

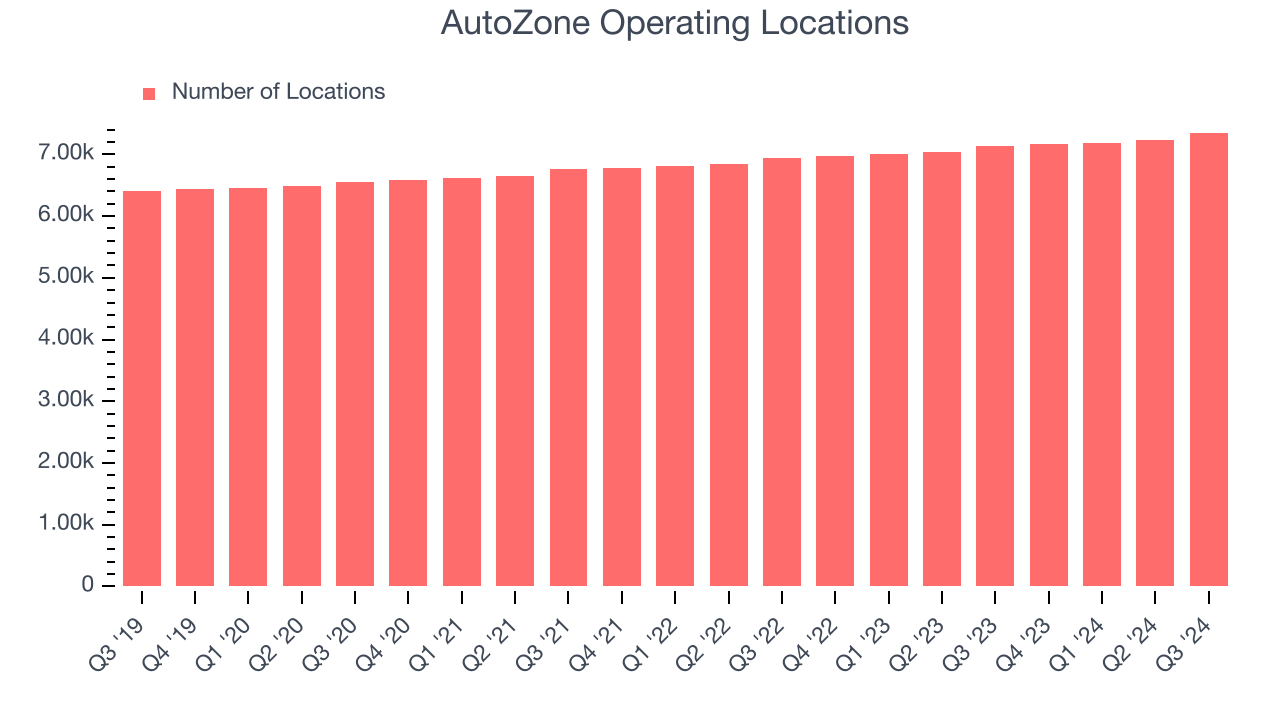

1. New Stores Popping Up Gradually, Supports Growth

A retailer’s store count often determines how much revenue it can generate.

AutoZone sported 7,353 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 2.8% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

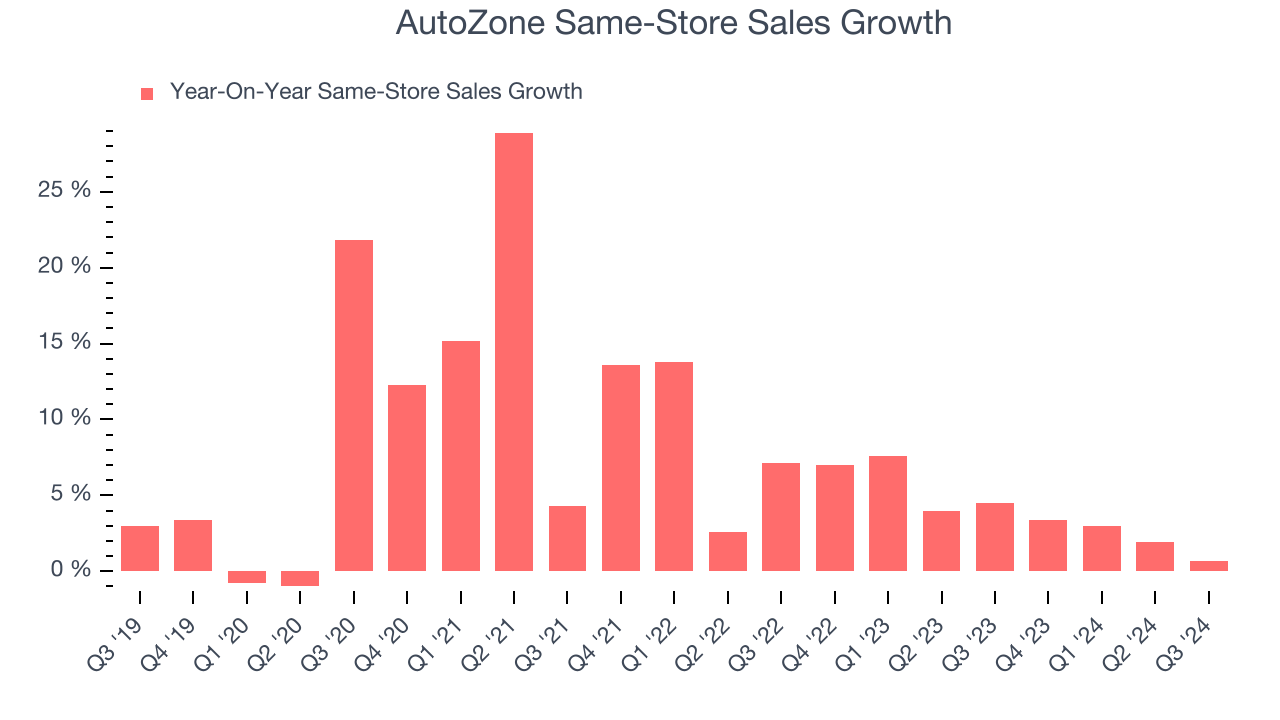

2. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

AutoZone’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 4% per year.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AutoZone’s five-year average ROIC was 38.1%, placing it among the best consumer retail companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why we think AutoZone is a great business, but at $3,170 per share (or 19.5x forward price-to-earnings), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than AutoZone

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.