The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how FTAI Aviation (NASDAQ:FTAI) and the rest of the vehicle parts distributors stocks fared in Q3.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Transportation parts distributors that boast reliable selection in sometimes specialized areas combined and quickly deliver products to customers can benefit from this theme. Additionally, distributors who earn meaningful revenue streams from aftermarket products can enjoy more steady top-line trends and higher margins. But like the broader industrials sector, transportation parts distributors are also at the whim of economic cycles that impact capital spending, transportation volumes, and demand for discretionary parts and components.

The 4 vehicle parts distributors stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.8%.

Luckily, vehicle parts distributors stocks have performed well with share prices up 11.8% on average since the latest earnings results.

FTAI Aviation (NASDAQ:FTAI)

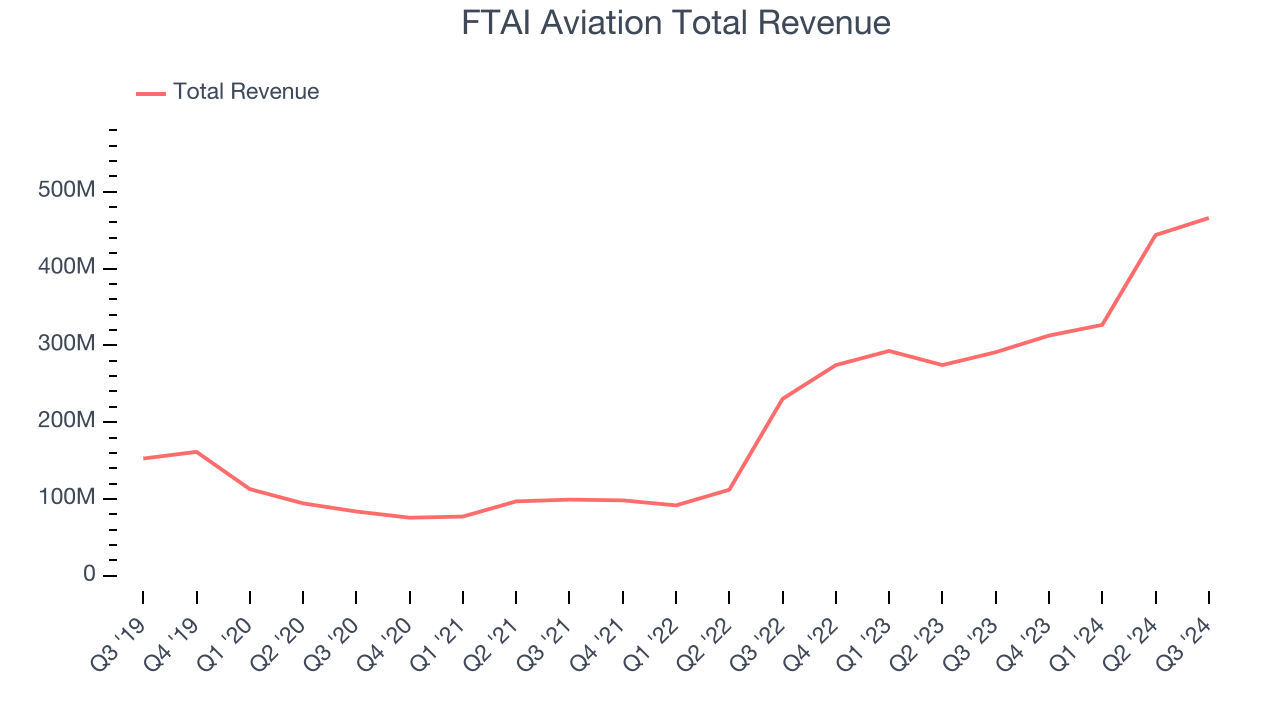

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation (NASDAQ:FTAI) sells, leases, maintains, and repairs aircraft engines.

FTAI Aviation reported revenues of $465.8 million, up 60% year on year. This print exceeded analysts’ expectations by 10.8%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

FTAI Aviation pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 4.1% since reporting and currently trades at $150.89.

Best Q3: GATX (NYSE:GATX)

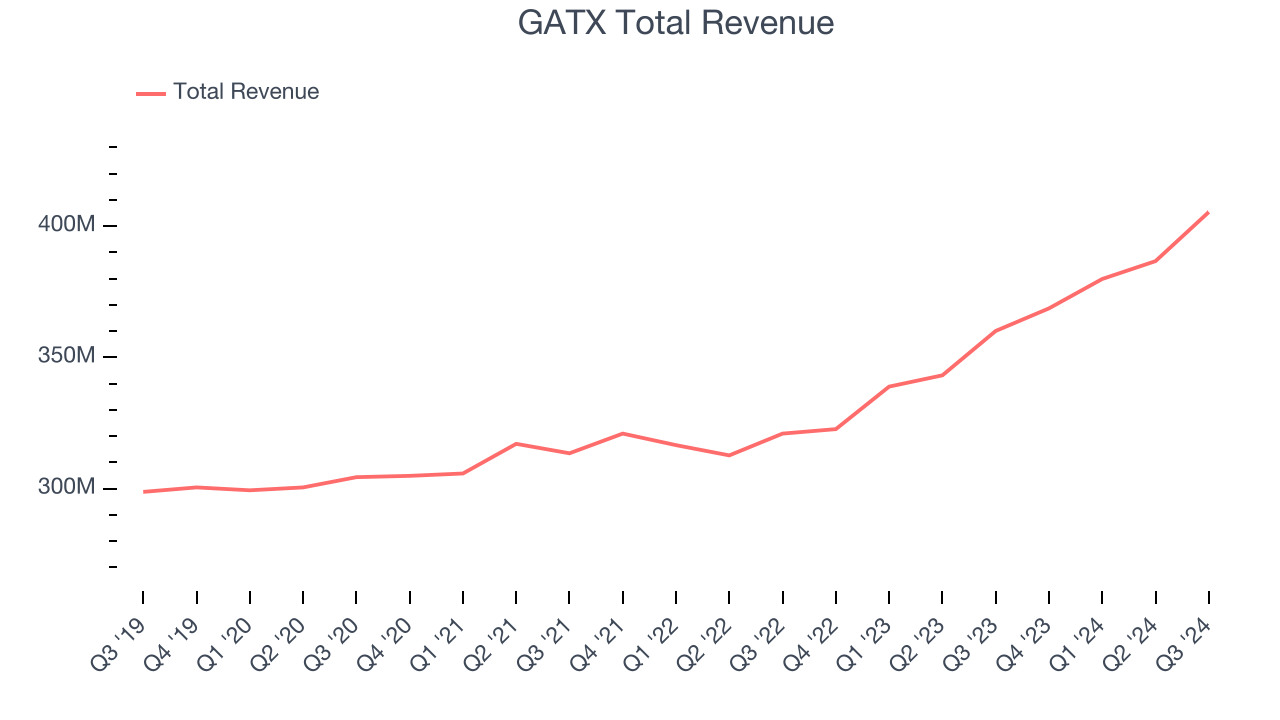

Originally founded to ship beer, GATX (NYSE:GATX) provides leasing and management services for railcars and other transportation assets globally.

GATX reported revenues of $405.4 million, up 12.6% year on year, outperforming analysts’ expectations by 3.5%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and full-year EPS guidance beating analysts’ expectations.

The market seems happy with the results as the stock is up 27.3% since reporting. It currently trades at $166.79.

Is now the time to buy GATX? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Air Lease (NYSE:AL)

Established by a founder of Century City in Los Angeles, Air Lease Corporation (NYSE:AL) provides aircraft leasing and financing solutions to airlines worldwide.

Air Lease reported revenues of $690.2 million, up 4.7% year on year, exceeding analysts’ expectations by 2.1%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

Air Lease delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 4.2% since the results and currently trades at $49.30.

Read our full analysis of Air Lease’s results here.

Rush Enterprises (NASDAQ:RUSHA)

Headquartered in Texas, Rush Enterprises (NASDAQ:RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

Rush Enterprises reported revenues of $1.90 billion, down 4.3% year on year. This number beat analysts’ expectations by 2.9%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ adjusted operating income and EPS estimates.

Rush Enterprises had the slowest revenue growth among its peers. The stock is up 11.7% since reporting and currently trades at $61.29.

Read our full, actionable report on Rush Enterprises here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.