Energy and industrial distributor Dnow (NYSE:DNOW) missed Wall Street’s revenue expectations in Q3 CY2024 as sales rose 3.1% year on year to $606 million. Its non-GAAP profit of $0.21 per share was in line with analysts’ consensus estimates.

Is now the time to buy Dnow? Find out by accessing our full research report, it’s free.

Dnow (DNOW) Q3 CY2024 Highlights:

- Revenue: $606 million vs analyst estimates of $614.9 million (1.5% miss)

- Adjusted EPS: $0.21 vs analyst expectations of $0.21 (in line)

- EBITDA: $42 million vs analyst estimates of $43.5 million (3.4% miss)

- Gross Margin (GAAP): 22.3%, in line with the same quarter last year

- Operating Margin: 3.8%, down from 6.3% in the same quarter last year

- EBITDA Margin: 6.9%, in line with the same quarter last year

- Free Cash Flow was $72 million, up from -$2.78 million in the same quarter last year

- Market Capitalization: $1.46 billion

Company Overview

Spun off from National Oilwell Varco, Dnow (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

Infrastructure Distributors

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

Sales Growth

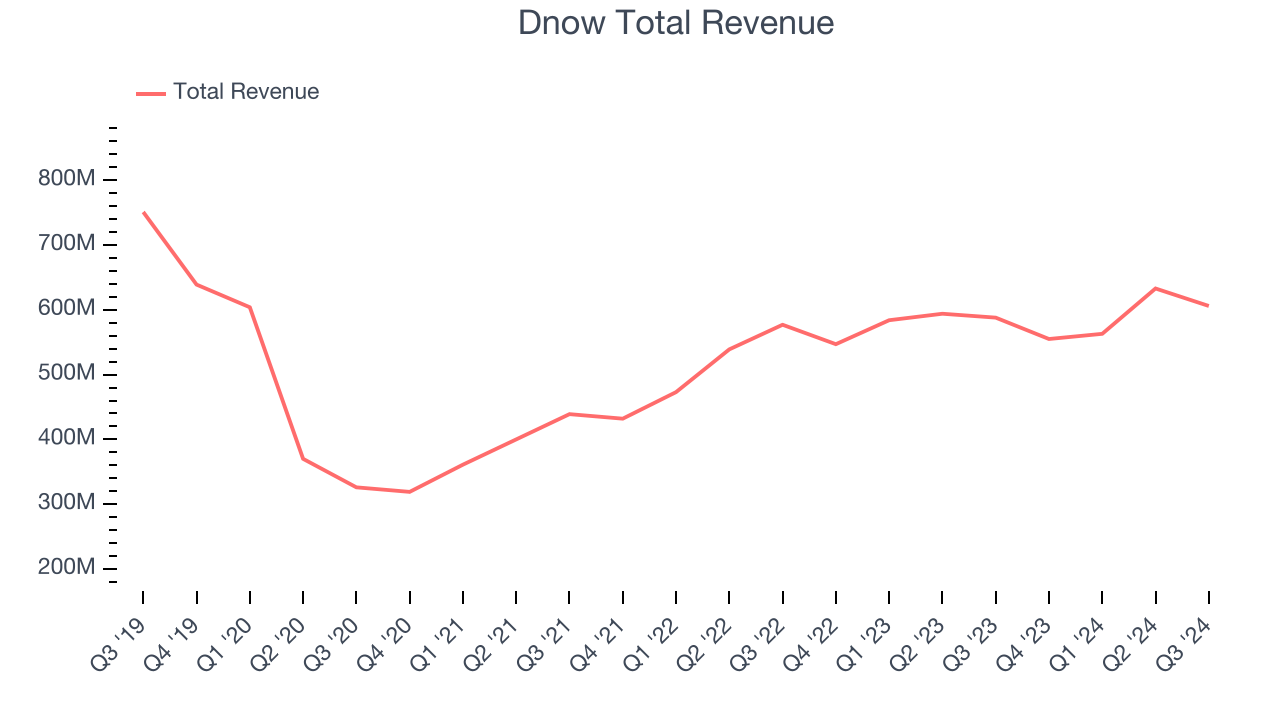

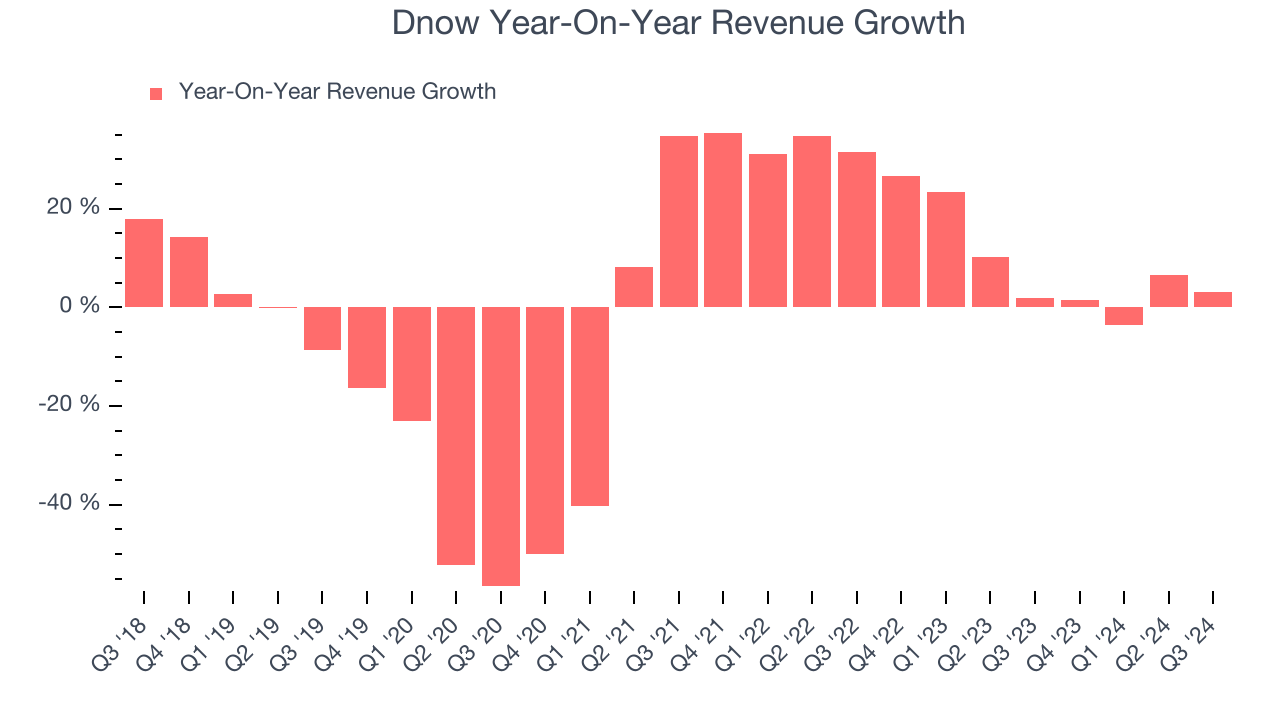

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Dnow struggled to generate demand over the last five years as its sales dropped by 5.2% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Dnow’s annualized revenue growth of 8% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Dnow’s revenue grew 3.1% year on year to $606 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

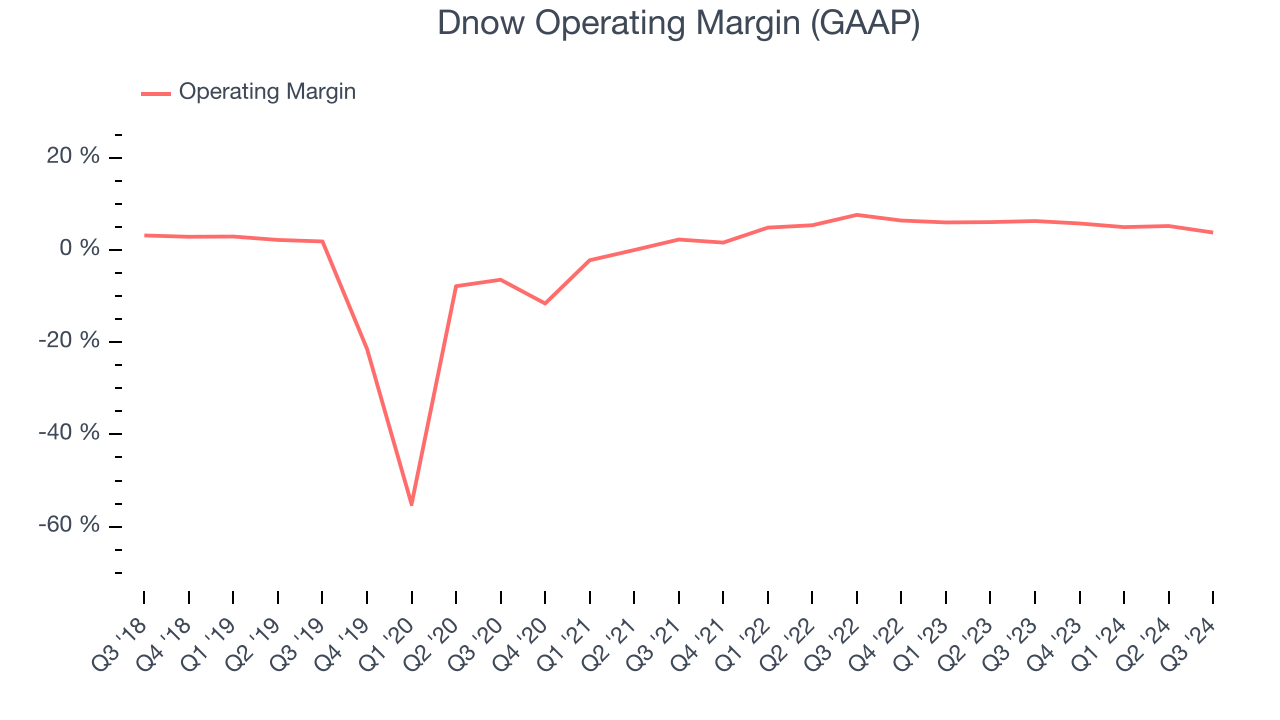

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Although Dnow was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Dnow’s annual operating margin rose by 31.7 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

In Q3, Dnow generated an operating profit margin of 3.8%, down 2.5 percentage points year on year. Since Dnow’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

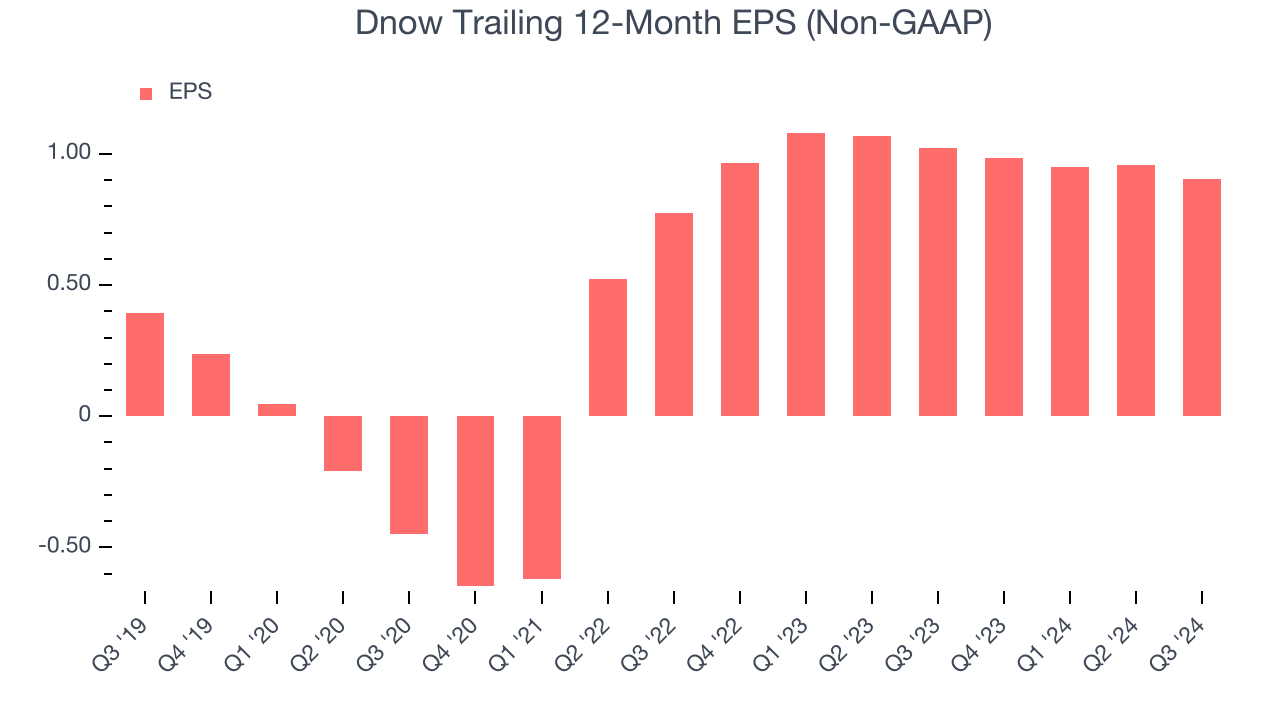

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Dnow’s EPS grew at an astounding 18% compounded annual growth rate over the last five years, higher than its 5.2% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

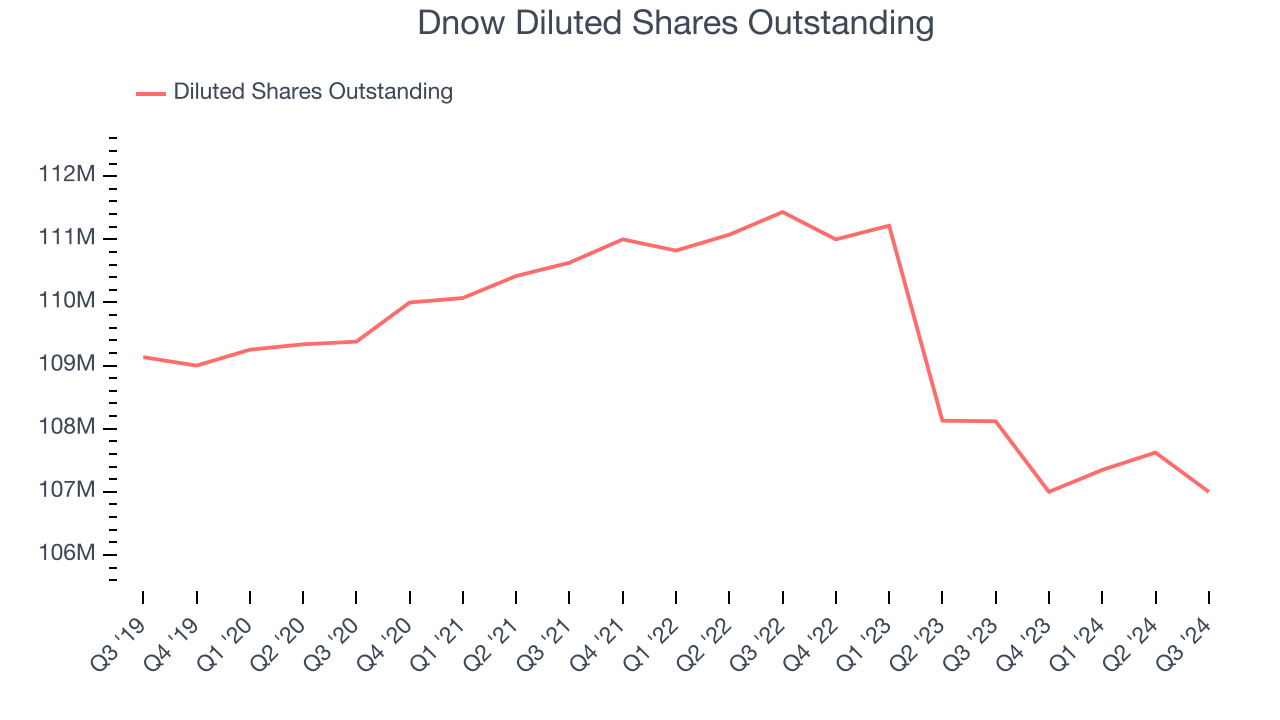

We can take a deeper look into Dnow’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Dnow’s operating margin declined this quarter but expanded by 31.7 percentage points over the last five years. Its share count also shrank by 2%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Dnow, its two-year annual EPS growth of 8% was lower than its five-year trend. We hope its growth can accelerate in the future.In Q3, Dnow reported EPS at $0.21, down from $0.26 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Dnow’s full-year EPS of $0.90 to shrink by 4.6%.

Key Takeaways from Dnow’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $13.75 immediately after reporting.

So do we think Dnow is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.