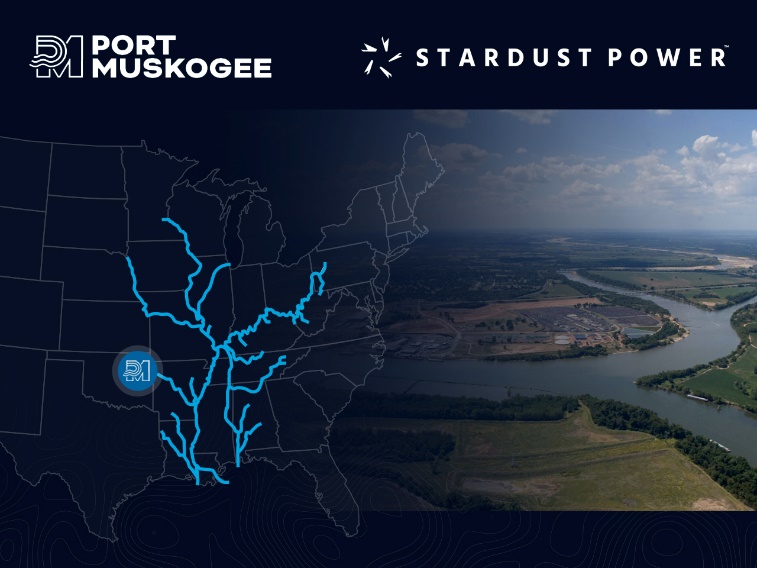

GREENWICH, Conn., and TULSA, Okla., Jan. 11, 2024 (GLOBE NEWSWIRE) -- Stardust Power Inc. (“Stardust Power” or the “Company”), a development stage American manufacturer of battery-grade lithium products, announced today that it has selected Southside Industrial Park in Muskogee, Oklahoma to build a new battery-grade lithium refinery, and is expected to be eligible to receive up to $257 million in state and federal economic incentives for the facility build-out. The Company may also be eligible for further federal grants and or incentives offered by the Department of Energy and the Department of Defense.

Stardust Power selected Muskogee, Oklahoma for its central refinery because of Oklahoma’s central U.S. location, facilitating delivery of lithium inputs and shipment of battery-grade lithium products over multiple transportation routes to support the Company’s refining operations. The area’s superior intermodal freight transport options as well as a highly skilled workforce trained in oil and gas engineering were other key factors. Additionally, Oklahoma is recognized as an emerging national leader in sustainable power, including solar and wind, supporting Stardust Power’s commitment to limit its carbon footprint.

“Stardust Power’s more than a billion-dollar investment is a testament to Oklahoma’s ‘all-of-the-above’ approach to energy, and our focus on workforce development,” said Oklahoma Governor Kevin Stitt. “As we see more energy manufacturers moving to our state, due in part to our competitive, performance-based incentives, Stardust Power’s new lithium refinery will create hundreds of new jobs while cementing Oklahoma’s place as the best state in the nation for critical mineral manufacturing. I’m proud to welcome Stardust Power to Oklahoma, and I applaud their commitment to American energy dominance.”

Muskogee Mayor Marlon Coleman also commented, "Muskogee is excited to welcome Stardust Power to our community, embracing a future filled with innovation and sustainable growth. Stardust Power's choice to establish its cutting-edge lithium refinery here underscores Muskogee's strategic advantages. We anticipate a prosperous partnership that contributes to our community's continued success."

“We welcome Stardust Power to Muskogee and are proud that our city and Port will be at the forefront of powering the future of America’s automotive industry,” said Kimbra Scott, Executive Director of Port Muskogee. “The decision to establish a state-of-the-art lithium refinery reinforces Port Muskogee's unmatched advantages and our commitment to supporting emerging industries. We look forward to a longstanding partnership as Stardust Power plants its roots in Northeastern Oklahoma.”

“We would like to thank Governor Stitt and officials at the Oklahoma Department of Commerce, Tulsa Chamber, City and Port of Muskogee for their strong support,” said Roshan Pujari, Founder and CEO of Stardust Power. “Oklahoma offers many advantages for private employers, including a strong, well-trained workforce and an eye on the future of energy production and mobility.”

“Currently there is no large-scale refinery for battery-grade lithium in the United States, exposing the country to undue national security and supply chain risk,” continued Mr. Pujari. “We will work with oil and gas producers to address America’s growing energy demands. When fully operational, our new lithium refinery will both speed America’s energy transition and boost Oklahoma’s local economy, creating significant new investment and employment opportunities. We are excited to call Oklahoma our new home.”

The total value of the economic incentive package will ultimately be determined by Stardust Power achieving certain business milestones around job creation and local investment, including new machinery, equipment and manufacturing. The Oklahoma Department of Commerce performed an illustrative analysis of the incentive package based on the Company’s inputs. The Company currently expects to break ground in the first half of 2024.

About Stardust Power Inc.

Stardust Power Inc. is a development stage manufacturer of battery-grade lithium products designed to supply the EV industry and help secure America’s leadership in the energy transition. Stardust Power is developing a strategically central lithium refinery in Greater Tulsa, Oklahoma capable of producing up to 50,000 metric tonnes per annum of battery-grade lithium. Committed to sustainability at each point in the process, the company enjoys a diversified supply of lithium from American brine sources. Stardust Power is expected to become a publicly traded company on Nasdaq under the ticker symbol “SDST” via a planned business combination with Global Partner Acquisition Company II (NASDAQ:GPAC), a special purpose acquisition company.

For more information, visit stardust-power.com

Forward-Looking Statements

The information included herein include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. All statements, other than statements of present or historical fact included herein, regarding the proposed business combination, GPAC II’s and Stardust Power’s ability to consummate the business combination transaction, the benefits of the transaction, GPAC II’s and Stardust Power’s future financial performance following the transaction, as well as GPAC II’s and Stardust Power’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

These forward-looking statements are based on GPAC II’s and Stardust Power’s management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. GPAC II and Stardust Power caution you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of GPAC II and Stardust Power. These risks include, but are not limited to, (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of GPAC II’s securities; (ii) the risk that the proposed business combination may not be completed by GPAC II’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by GPAC II; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by GPAC II’s shareholders and Stardust Power’s stockholders, the satisfaction of the minimum trust account amount following redemptions by GPAC II’s public shareholders and the receipt of certain governmental and regulatory approvals; (iv) the effect of the announcement or pendency of the proposed business combination on Stardust Power’s business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts current plans of Stardust Power and potential difficulties in Stardust Power’s employee retention as a result of the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted against GPAC II or Stardust Power related to the agreement and the proposed business combination; (vii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination; (viii) the ability to maintain the listing of GPAC II’s securities on the Nasdaq; (ix) the price of GPAC II’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Stardust Power plans to operate, variations in performance across competitors, changes in laws and regulations affecting Stardust Power’s business and changes in the combined capital structure; (x) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities; (xi) the impact of the global COVID-19 pandemic; and (xii) other risks and uncertainties related to the transaction set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in GPAC II’s prospectus relating to its initial Public Offering (File No. 333-351558) declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on January 11, 2021 and other documents filed, or to be filed with the SEC by GPAC II, including GPAC II’s periodic filings with the SEC, including GPAC II’s Annual Report on Form 10-K filed with the SEC on March 31, 2023 and any subsequently filed Quarterly Report on Form 10-Q and other SEC filings. GPAC II’s SEC filings are available publicly on the SEC’s website at http://www.sec.gov.

The foregoing list of factors is not exhaustive. There may be additional risks that neither GPAC II nor Stardust Power presently know or that GPAC II or Stardust Power currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should carefully consider the foregoing factors and the other risks and uncertainties that are described in GPAC II’s Extension Proxy and will be described in GPAC II’s proxy statement contained in the registration statement on Form S-4 (the “Registration Statement”), including those under “Risk Factors” therein, and other documents filed by GPAC II from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and GPAC II and Stardust Power assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither GPAC II nor Stardust Power gives any assurance that either GPAC II or Stardust Power will achieve its expectations.

Important Information About the Business Combination and Where to Find It

In connection with the proposed business combination, GPAC II will file a Registration Statement with the SEC that will include a preliminary prospectus with respect to GPAC II’s securities to be issued in connection with the proposed transactions and a preliminary proxy statement with respect to the shareholder meeting of GPAC II to vote on the proposed transactions (the “proxy statement/prospectus”). GPAC II may also file other documents regarding the proposed business combination with the SEC. The proxy statement/prospectus will contain important information about the proposed business combination and the other matters to be voted upon at an extraordinary general meeting of GPAC II’s shareholders to be held to approve the proposed business combination and other matters and may contain information that an investor may consider important in making a decision regarding an investment in GPAC II’s securities. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF GPAC II AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GPAC II, STARDUST POWER AND THE PROPOSED BUSINESS COMBINATION.

After the Registration Statement is declared effective, the definitive proxy statement/prospectus to be included in the Registration Statement will be mailed to shareholders of GPAC II as of a record date to be established for voting on the proposed transaction. Once available, shareholders of GPAC II will also be able to obtain free copies of the Registration Statement, including the proxy statement/prospectus, and other documents containing important information about GPAC II and Stardust Power once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov or by directing a request to Global Partner Acquisition Corp II, 200 Park Avenue 32nd Floor, New York, New York 10166, attention: Global Partner Sponsor II LLC.

Participants in the Solicitation

GPAC II, Stardust Power and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from GPAC II’s shareholders with respect to the proposed business combination. A list of the names of those directors and executive officers of GPAC II and a description of their interests in GPAC II is set forth in GPAC II’s filings with the SEC (including GPAC II’s prospectus relating to its initial public offering (File No. 333-251558) declared effective by the SEC on January 11, 2021, the Extension Proxy, GPAC II’s Annual Report on Form 10-K filed with the SEC on March 31, 2023 and subsequent filings on Form 10-Q and Form 4). Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement. The documents described in this paragraph are available free of charge at the SEC’s website at www.sec.gov, or by directing a request to Global Partner Acquisition Corp II, 200 Park Avenue 32nd Floor, New York, New York 10166, attention: Global Partner Sponsor II LLC. Additional information regarding the names and interests of such participants will be contained in the Registration Statement for the proposed business combination when available.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and is not intended to and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of GPAC II, Stardust Power or the combined company or a solicitation of any vote or approval, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Stardust Power Contacts

For Investors:

William Tates

Stardust Power Inc.

william@stardust-power.com

For Media:

Alyssa Barry

alyssa@irlabs.ca

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c1cbd718-f575-405b-b8c3-4cf903836839