BitPencil (https://bitpencil.xyz/), a decentralized financial derivative agreement initiated by the Access Bitcoin Foundation, its business includes funds, insurance, options and other financial derivatives. BitPencil is set up on the Ethereum second-layer network Starkware and uses the StarkEx transaction engine to realize the decentralized self-custody of user assets throughout the process. Its fund (initiation and follow-up investment) sector is expected to officially launch for public testing at the end of March 2023. For more details, please visit the official website of BitPencil.

High performance, High availability, High reliability and System Underlying Architecture that Collects Massive Amounts of Data

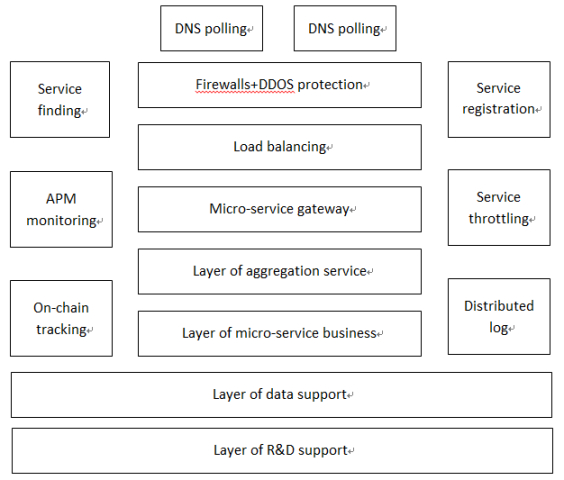

BitPencil builds the R&D support layer on distributed servers and the data support layer on the second-tier network of Ethereum. The powerful system underlying architecture ensures the smooth operation of the micro-service business and aggregated service layers. The load balancing and micro-service gateway undertake data distribution, scheduling, and monitoring functions and can support a QPS of 1 million+/s while supporting unlimited horizontal expansion. Self-developed firewalls and DDOS protection can protect the continuous availability of services, prevent most hacker attacks, and have AI intelligent learning capabilities.

Auxiliary functions such as DNS polling, service discovery, APM monitoring, link tracking, service registration, service current limiting, and distributed logs form additional support around the entire system architecture.

Create a Decentralized Fund Investment and Financing Tool

BitPencil fund business is an investment and financing ecological agreement composed of investors, fund managers and platform operators. Investors can freely choose fund products that meet their preferences. Fund managers can establish funds through the assessment rules, and platform operators formulate and maintain ecological regulations. The transactions of all fund managers are open and transparent. Investors will give priority to high-quality fund managers to maximize their profits. Fund managers must strive for better fund performance to expand their fund size. Through the survival of the fittest in the market and the law of natural selection, investors and fund managers are spontaneously matched and docked.

Realize the Isolation of Assets and Trading Engines

Bitpencil hosts the fund assets purchased by users in the Ethereum smart contract, and the smart contract interacts with DYDX's asset agency contract. The Bitpencil transaction engine adopts the Ethereum two-layer network. It is connected to the API port of the DYDX order book. When the fund manager operates the fund for contract transactions, he can only issue transaction instructions and not touch user assets. Only when the user sends a redemption instruction will the purchases return to the user's address in the original way. In this way, assets are isolated from transaction engines to ensure the security of fund assets.

Diversified Reward Model

After the fund manager initiates the fund's establishment, he accesses the API port of the DYDX order book through the BitPencil transaction engine to conduct contract transactions. After the fund realizes a profit, the fund manager shares the profit with the user.

Through the promotion of fund products, users can get rebates for each transaction fee that other users subscribe to the fund, and they can also introduce fund managers to get the overall profit share of the fund.

BitPencil will be the aircraft carrier of decentralized financial derivatives.

At the initial stage of BitPencil’s launch, it will prioritize operating its fund business and accumulating more community users. Services such as decentralized insurance are expected to be launched in mid-2023. The decentralized insurance business mainly aims at risk-averse investors who purchase investment insurance policies with small funds but resist the extreme risks generated by investment behavior.

In the future, BitPencil will launch services such as decentralized options and decentralized lending one after another. BitPencil may become an upstart on the global DeFi track in 2023. Let us wait and see!

BitPencil's first "Superstar Cup" margin trading marathon will start soon. Be the winner! For more information: https://medium.com/@BartonF/be-the-winner-bitpencils-first-superstar-cup-margin-trading-marathon-will-start-soon-1b050a2af784

Stay up to date with BitPencil:

Twitter: https://twitter.com/bitpenciltrade

Telegram: https://t.me/BitPencilofficial

Discord: https://discord.gg/7a3EgkNZut

Media Contact

Company Name: BitPencil

Contact Person: Kelvin Stanley

Email: Send Email

Country: Canada

Website: BitPencil.xyz