- The rate of equity growth dropped from 8% to 2.5% from the second to third quarter.

- Total homeowner equity for borrowers with a mortgage reached $17.5 trillion in third quarter.

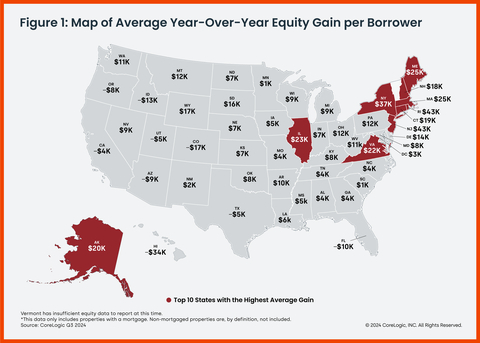

- For the third quarter of 2024, the average U.S. homeowner gained approximately $5,700 in equity during the past year.

- The largest average national equity gains in the third quarter were seen in Rhode Island ($43K), New Jersey ($43K), and New York ($37K).

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the Homeowner Equity Report (HER) for the third quarter of 2024. The report shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by $425 billion since the third quarter of 2023, a gain of 2.5% year over year, bringing the total net homeowner equity to over $17.5 trillion in the third quarter of 2024.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241206435270/en/

Figure 1: Map of Average Year-Over-Year Equity Gain per Borrower (Graphic: Business Wire)

For the first time since the fourth quarter of 2022, the share of negative equity rose in the U.S. on a quarterly basis. Just compared to last quarter, the number of residential properties that fell into negative equity increased by 30,000 homes or 1.8%.

While almost 1 million residential homeowners are now contending with negative equity on their homes, many other homeowners are benefitting from the continued rise in home prices and the resulting boost in equity.

While average equity gains were $5,700 between Q3 2023 and Q3 2024, this is far less than the jump seen last quarter when annual equity gains hit $25,400.

States in the Northeast, where equity gains are strongest, also saw the most home price growth. Prices in New Jersey and Rhode Island reached new highs in October, with these states claiming the top two spots for year-over-year price gains, rising 8.1% and 7.5%, respectively.

Meanwhile, Hawaii, Colorado, and Idaho, which were former work-from-home hotspots that attracted people with their picturesque landscapes, saw home equity drop this quarter. Hawaii saw the most significant dip in home equity with an average loss of $34,000.

“As home prices flattened in the third quarter, home equity gains also slowed, even declined in some regions of the country,” said Dr. Selma Hepp, CoreLogic Chief Economist. “While home equity closely depends on home price changes, equity losses are also tied to natural disaster events since households can lose a lot of their equity following a catastrophe, particularly if not property insured. As a result, following Maui’s 2023 devastating wildfire, Hawaii now tops the list with largest decline in home equity.”

“Nevertheless, Hawaiian homeowners still rank highest for homeowner equity, with equity averaging $700,000,” Hepp continued. “Nationally, average homeowner equity remains near a historical peak at over $311,000. Still, recent devastating weather events underscore the importance of maintaining that equity, particularly for households for which this is the only source of wealth.”

The national aggregate value of negative equity was approximately $324 billion at the end of the third quarter of 2024. This is up quarter over quarter by approximately $4.3 billion, or 1%, from $319 billion in the second quarter of 2024 and up year over year by approximately $9.1 billion, or 3%, from $315 billion in the third quarter of 2023.

Negative equity peaked at 26% of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

For the third quarter of 2024, the average U.S. homeowner gained approximately $5,700 in equity during the past year.

Rhode Island ($43K), New Jersey ($43K), and New York ($37K) experienced the largest average national equity gains. Three states posted annual equity losses: Hawaii (-$34K), Colorado (-$17K), and Idaho (-$13K).

CoreLogic provides homeowner equity data at the metropolitan level. While negative equity has seen a recent increase nationally, Las Vegas and Los Angeles are the least challenged, with negative equity shares of all mortgages at 0.6% and 0.8%, respectively.

The next CoreLogic Homeowner Equity Report will be released March 6, 2025, featuring data for Q4 2024. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The amount of equity for each property is determined by comparing the estimated current value of the property against the mortgage debt outstanding (MDO). If the MDO is greater than the estimated value, then the property is determined to be in a negative equity position. If the estimated value is greater than the MDO, then the property is determined to be in a positive equity position. The data is first generated at the property level and aggregated to higher levels of geography. CoreLogic uses public record data as the source of the MDO, which includes more than 50 million first- and second mortgage liens and is adjusted for amortization and home equity utilization in order to capture the true level of MDO for each property. Only data for mortgaged residential properties that have a current estimated value are included. There are several states or jurisdictions where the public record, current value or mortgage data coverage is thin and have been excluded from the analysis. These instances account for fewer than 5% of the total U.S. population. The percentage of homeowners with a mortgage is from the 2019 American Community Survey. Data for the previous quarter was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Robin Wachner at newsmedia@corelogic.com. For sales inquiries, please visit https://www.corelogic.com/support/sales-contact/. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading provider of property insights and innovative solutions, working to transform the property industry by putting people first. Using its network, scale, connectivity and technology, CoreLogic delivers faster, smarter, more human-centered experiences that build better relationships, strengthen businesses and ultimately create a more resilient society. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241206435270/en/

Contacts

Media Contact:

Robin Wachner

newsmedia@corelogic.com

Sales Contact:

https://www.corelogic.com/support/sales-contact/