Clients were net sellers of equities overall, with the strongest selling in the Information Technology sector

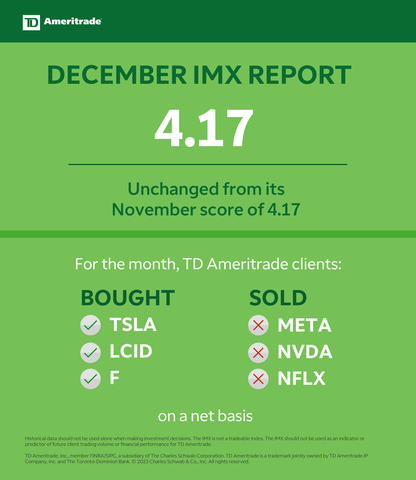

The Investor Movement Index® (IMXSM) remained at 4.17 in December, unchanged from its score in November. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230109005200/en/

TD Ameritrade December 2022 Investor Movement Index (Graphic: TD Ameritrade)

The reading for the five-week period ending December 30, 2022 ranks “low” compared to historic averages.

“December included both macroeconomic catalysts and the tail-end of earnings season, but ultimately the whiplash retail traders experienced from the up-down nature of the news cycle left TD Ameritrade clients’ overall market exposure unchanged,” said Shawn Cruz, head trading strategist, TD Ameritrade. “We did see buying interest in the Consumer Discretionary, Consumer Staples, Energy, Financial, and Real Estate sectors, but for the most part, clients net sold equities during the period. It’s a fitting end to a year that exposed some significant headwinds to addressing the macroeconomic challenges impacting the markets, but it also leaves substantial room for optimism as we head into 2023.”

The beginning of the December IMX period was marked by a strong bounce in equities after comments from Federal Reserve Chairman Jerome Powell shifted marginally from the more hawkish tone of the central bank throughout the year of 2022. However, as the month rolled on, volatility returned to the financial markets. Equity markets were particularly volatile on December 13th as the monthly Consumer Price Index (CPI) showed a rate of inflation that indicated signs of moderation, causing equity futures to initially surge over 3% but ultimately losing almost all of the reactionary gains over the next few hours of trading. The very next day the Federal Open Market Committee released updated interest rate projections which were perceived as more hawkish than expected, leading to a sharp, immediate decline in equity markets. The equity markets were interrupted by holiday seasonality for much of the rest of the month, but the tone never recovered. The S&P 500 finished down 4.64% during the during the December IMX period, but interestingly the CBOE Market Volatility Index (VIX) was relatively muted, ending the period at a moderate 21.67. The U.S. Treasury markets were choppy again during the December period, with the 10-year yield finishing up near 3.9%. The U.S. Dollar Index continued to slide, finishing at its lowest level since June. Crude oil bounced back after a down November to finish up over 5% in the December IMX period, possibly sparking additional inflation concerns.

TD Ameritrade clients were net sellers overall, but they did find individual names to buy during the period, including:

- Tesla Inc. (TSLA)

- Lucid Group Inc. (LCID)

- Ford Motor Co. (F)

- Apple Inc. (AAPL)

- Walt Disney Co. (DIS)

Names sold during the period included:

- Meta Platforms Inc. (META)

- NVIDIA Corp. (NVDA)

- Netflix Inc. (NFLX)

- Boeing Co. (BA)

- Starbucks Corp. (SBUX)

Millennial Buys & Sells

TD Ameritrade millennial clients reduced exposure during the December period, but unlike the overall TD Ameritrade client population, they were net buyers of equities.

Both TD Ameritrade millennial clients and the overall TD Ameritrade client population were net buyers of Tesla (TSLA) as the electric vehicle (EV) maker cratered over 30% amid CEO Elon Musk’s Twitter activities and as reports of production cuts due to slow demand dominated headlines. Another EV company, Lucid Group (LCID), was net bought by both TD Ameritrade millennial clients and the overall TD Ameritrade client population after also sinking over 30% during the tumultuous period for EV makers. Financial services company SoFi Technologies (SOFI) saw buying interest during the period from TD Ameritrade millennial clients, as it rebuffed the overall market’s weakness and finished the period roughly unchanged.

Notable online sports-gaming companies DraftKings (DKNG) and PENN Entertainment (PENN) struggled during the December period as economic uncertainty continued to weigh on discretionary spending outlooks, and TD Ameritrade millennial clients reduced exposure in both names. Meta Platforms (META), parent company of Facebook and Instagram, had a bounce-back period, finishing up over 8%, and TD Ameritrade millennial clients as well as the overall TD Ameritrade client population saw this bounce as an opportunity to reduce exposure into some recent strength.

Despite being net buyers of equities overall, TD Ameritrade Millennial clients were only net buyers of three of the S&P sectors: Consumer Discretionary, Financials, and Real Estate.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from December 2022, or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success. Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

About TD Ameritrade

TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. A leader in U.S. retail trading, we leverage the latest in cutting edge technologies and one-on-one client care to help our clients stay on top of market trends. Learn more by visiting www.tdameritrade.com.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co. Inc. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230109005200/en/

Contacts

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com