Wyoming’s Natrona County and Idaho’s Blaine County have the highest percent of its housing stock at risk of wildfire damage

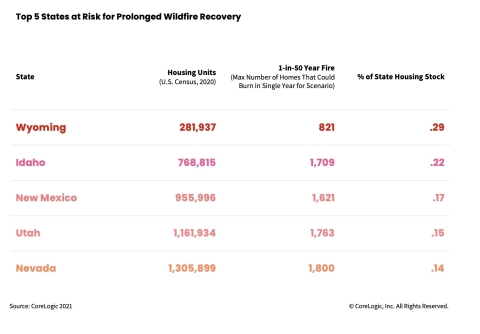

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its annual Wildfire Report for 2021, following a summer of smoky skies and nearly 80 days after the start of the Dixie Fire, now the second largest fire in California history. While California traditionally tops the list each year for wildfire risk simply because it’s the most populous state, CoreLogic’s approach for this year’s report examined property-related wildfire risk alongside reconstruction resource availability, temporary housing capacity for displaced individuals, and community economic recovery potential among fire-prone regions. By analyzing this risk through a housing stock comparison lens, CoreLogic identified Wyoming and Idaho as the states most at risk for a prolonged wildfire recovery.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210929005158/en/

Top 5 States at Risk for Prolonged Wildfire Recovery (Graphic: Business Wire)

Understanding Risk and Resilience

If a fire destroys 800 homes in California, the road to recovery and lasting impact is not synonymous with 800 homes burning in Wyoming, when considering the size of each state’s housing stock. In states like Wyoming and Idaho, the number of homes at risk is a larger fraction of the total number of homes in the state. If a larger portion of the population is displaced at a single time, recovery times may be elongated, fewer local workers might be available — and likely distracted rebuilding their own lives — and fewer hotels and housing options may be available to outside workers due to local populace demand.

“There’s no denying a state like California is at severe risk for wildfire destruction every year, as seen in the ongoing Dixie Fire,” said Tom Larsen, principal, insurance solutions at CoreLogic. “But it’s important to acknowledge that not all communities and their catastrophic events are the same, and the road to recovery can look drastically different. Resilience is often measured as how fast you can recover from a catastrophe — and the deeper the wound, the longer it takes to heal.”

Within these states, CoreLogic identified the five counties at highest risk. These counties, if impacted by wildfire, would likely have a longer and more difficult road to recovery than counties in more populous states.

Anticipating Climate Change Complications

The changing climate creates abnormal weather activity, like unusually high rainfall during seasons of vegetative growth, that then creates an overgrowth of plants known as ground fuels. The environment is changing too rapidly to rely solely on wildfire loss history to plan for future wildfire mitigation and response. Probabilistic risk models, which can evaluate simulations of weather variation in today’s environment, can produce planning scenarios relevant to communities now.

Looking ahead, insurers, city planners and homeowners each play an important role in reducing the devastating impacts of wildfires and they can work together to mitigate future events. While these natural catastrophes are often unavoidable, they can be prepared for. By equipping clients with the latest data and insights, CoreLogic’s goal is to help its clients better inform homeowners of their risk and accelerate their recovery.

The full CoreLogic 2021 Wildfire Report, including maps, charts and analysis can be found here.

To follow CoreLogic coverage of ongoing natural catastrophe events, including wildfires, visit the company’s natural hazard risk information center, Hazard HQ™ at www.hazardhq.com.

Methodology

CoreLogic used its Wildfire Risk model to identify a 1-in-50-year fire scenario in each of the 14 wildfire-prone states (13 western U.S. states plus Florida) to understand how many homes would be at risk of being damaged in a wildfire at least once in 50 years (the average length to which residential homes are built to last, via building codes). CoreLogic compared the number of homes at risk of damage from a 1-in-50-year fire (an extreme event) to the total housing stock in each state to determine the communities that have the most economic risk from wildfire. Wildfires that devastate large numbers of homes are infrequent. The number of homes included in the 1-in-50 year fire analysis has a 98% probability of not being exceeded in a single year (or the maximum number of homes that could burn in a single year).

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210929005158/en/

Contacts

Media Contact:

Robin Wachner

CoreLogic

newsmedia@corelogic.com