Positive Trends in Revenue and Gross Margin Continue

Anticipates Improved Q2 2022 EBITDA Performance

(Spark Power reports in Canadian dollars unless otherwise specified)

OAKVILLE, ON / ACCESSWIRE / June 13, 2022 / Spark Power Group Inc. (TSX:SPG), parent company of Spark Power Corp. ("Spark Power" or the "Company"), is pleased to provide the following corporate update. This update is being provided in response to the recent material reduction in the Company's share price. It is management's strong belief that the current trading range is not indicative of the Company's current trajectory and near- and long-term accretive earnings opportunities and therefore materially undervalues the business. Management believes that investors would benefit from being aware of the following current information:

Financial

- Demand for the Company's key offerings, including core Technical Services and Renewables Services across all markets remains strong.

- Monthly revenues in the second quarter continue to grow across all segments, including a progressive and intentional shift in mix away from larger scale, lower-margin jobs to more transactional service work which carry higher-margins (i.e., time and material or T&M work).

- As a result of the shift in revenue mix, and other margin enhancing initiatives, Gross Margins are continuing to trend upwards.

- Through continued integration activities, annualized S,G&A cost reductions in the range of $5.5 - $6.5 million will have been affected YTD as at the end of Q2 2022, with additional reductions expected in the second half of the year (see "Forward-Looking Statements").

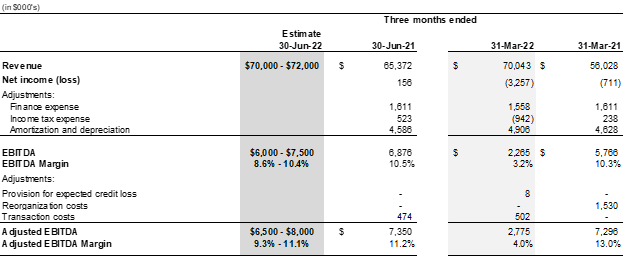

- Based on the above preliminary information, it is expected that Q2 2022 Adjusted EBITDA will be in a range of $6.5 - $8.0 million; in line with Q2 2021 Adjusted EBITDA of $7.4 million, and more than doubling from Q1 2022 Adjusted EBITDA of $2.8 million (see "Forward-Looking Statements" and "Non-IFRS Measures").

Capital

- The Company remains in compliance with the terms of its Waiver and Amending Agreement with its lender.

- The Company continues to have sufficient liquidity to operate the business in the normal course.

- The Company does not anticipate requiring or raising additional capital in the near-term (see "Forward-Looking Statements").

"We continue to experience high levels of demand for our services and increasing margins across all of our business segments," said Richard Jackson, President & CEO, Spark Power Corp. "The actions we have taken to address the challenges we faced as a result of the pandemic and other related macro-economic headwinds, are proving to be effective; we are optimistic that the worst of it is behind us, and we will see much improved results for the second quarter and the balance of the year," added Jackson.

"As we move through the second quarter, we are continuing to see sustained growth in higher quality monthly revenues and improvements in gross margins," said Richard Perri, Executive Vice President & CFO, Spark Power Corp. "Combined with the significant S,G&A cost reductions underway as part of our accelerating business integration strategy, we are expecting to see a return to our traditional double-digit EBITDA Margin range in the quarter, which positions us well for scalability and profitable, long-term growth," added Perri.

Selected Consolidated Financial Information

About Spark Power

Spark Power is a leading independent provider of end-to-end electrical services, operations and maintenance services, and energy sustainability solutions to the industrial, commercial, utility, and renewable asset markets in North America. We work to earn the right to be our customers' Trusted Partner in Power™. Our highly skilled and dedicated people, located in the communities we serve, combined with our knowledge of the power industry, technology expertise, and commitment to safety, ensures we deliver the right solutions that keep our customers' operations up and running today and better equipped for tomorrow. Learn more at www.sparkpowercorp.com.

Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws), which reflect Spark Power's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this press release include forecast Revenue, EBITDA and Adjusted EBITDA for Q2 2022, expected future reductions in S,G&A and that the Company does not anticipate requiring or raising additional capital in the near-term. They also include statements regarding demand for the Company's services, the Company's opportunities for future growth, margin realizations, future liquidity and other statements that are not historical fact. The Q2 2022 Revenue, EBITDA and Adjusted EBITDA forecast is based on the following material assumptions and factors: ongoing Revenue growth over prior periods, improving gross margins across all key segments, and lower S,G&A. The forecast S,G&A reduction is based on the following material assumptions and factors: reduction in S,G&A headcount of more than ten percent combined with lower discretionary spend related to cost rationalization initiatives. That the Company does not anticipate requiring or raising additional capital in the near-term is based on the following material assumptions and factors: the capital raise in the first quarter in conjunction with improving operational results and more rigorous cash management efforts. The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements. The material risks to the Q2 2022 EBITDA and Adjusted EBITDA forecast are ongoing COVID impacts on labor productivity and a shift in business mix that could impact realized gross margins. The material risk to the forecast S,G&A reduction is timing of related headcount reductions. The material risk to not requiring or raising additional capital in the near-term is unforeseen macro-economic impacts that could impact operating results or cash flows. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, Spark Power assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-IFRS Measures

The Company prepares and releases unaudited consolidated interim financial statements and audited consolidated annual financial statements prepared in accordance with IFRS. In this and other earnings releases and investor conference calls, as a complement to results provided in accordance with IFRS, the Company also discloses and discusses certain financial measures not recognized under IFRS and that do not have standard meanings prescribed by IFRS, including "Adjusted EBITDA" and "EBITDA Margin", and may not be comparable to similar financial measures disclosed by other issuers. Adjusted EBITDA is defined by the Company as EBITDA adjusted for any reorganization and transaction costs, discontinued operations and changes in estimate which management considers to be not representative of Spark Power's ongoing operating performance. EBITDA is defined by the Company as net income (loss) before amortization, finance costs, and provision for income taxes. EBITDA Margin means EBITDA divided by revenue. The Company uses Adjusted EBITDA and EBITDA Margin to provide investors with supplemental measures of Spark Power's operating performance and highlight trends in Spark Power's business that may not otherwise be apparent when relying solely on IFRS measures. Spark also believes that providing such information to securities analysts, investors and other interested parties who frequently use non-IFRS measures in the evaluation of issuers will allow them to better compare Spark Power's performance against others in its industry. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. Non-IFRS measures such as Adjusted EBITDA and EBITDA Margin should not be construed as alternatives to results prepared in accordance with IFRS such as Net Income.

Investor and Regulatory Inquiries:

Richard Perri, Executive Vice President & Chief Financial Officer

investor@sparkpowercorp.com

+1 (905) 829-3336

Media Inquiries:

April Currey, Vice President, Sales & Marketing

media@sparkpowercorp.com

+1 (905) 829-3336

SOURCE: Spark Power Group Inc.

View source version on accesswire.com:

https://www.accesswire.com/704836/Spark-Power-Provides-Corporate-Update