VANCOUVER, BC / ACCESSWIRE / August 11, 2021 / (TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce it has signed two agreements with Meridian Gold Company ("Meridian") a wholly owned subsidiary of Yamana Gold Inc., for the option of the Raven and Callaghan gold projects (the "Option Agreement") and a three-year partner-funded generative exploration alliance (the "Alliance Agreement") in Nevada.

Under the terms of the Option Agreement, Meridian can earn up to a 100% interest in the Raven and Callaghan projects by making cash payments totaling US$300,000 and exploration expenditures of US$4.625 million over a five-year period. Orogen will retain a 2.5% net smelter return ("NSR") royalty on the Raven Project and a 3% NSR royalty on the Callaghan project, with a buy-down right up to 1.5% on each NSR for up to US$10 million.

Under the terms of the Alliance Agreement, generative exploration will be conducted within a 4,000 square kilometre area of interest ("AOI") in Nevada. Projects staked within the AOI and selected by Meridian will be subject to similar earn-in terms as the Option Agreement. Orogen will retain a 1% NSR royalty on ground acquired within the Alliance Agreement AOI.

"The Option and Alliance agreements are an evolution of a data alliance struck between Meridian and Orogen back in 2018," commented Orogen CEO, Paddy Nicol. "We will use that data alongside the work compiled by Orogen's generative team to explore the Austin-Lovelock gold trend, an exciting new frontier for Carlin gold exploration."

About the Raven and Callaghan Projects

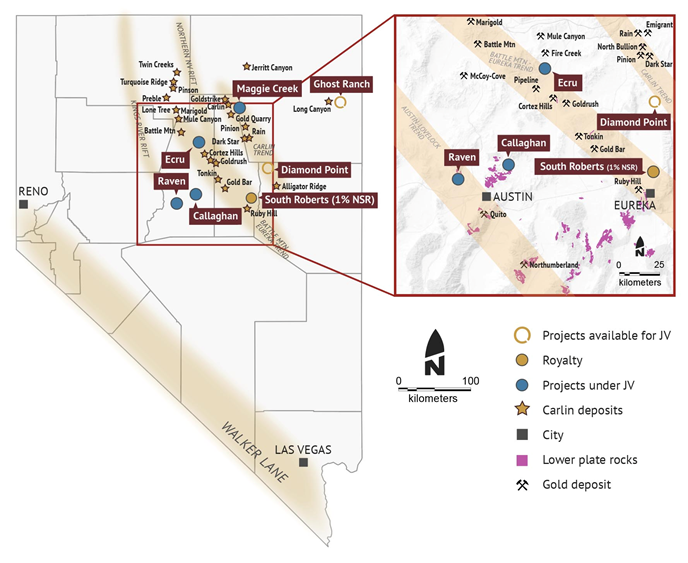

The Callaghan and Raven projects are Carlin-type gold targets covering multiple windows of prospective lower plate carbonate host rocks and Paleozoic normal faults, including extensions of the Roberts Mountain thrust. Both projects are within 25 kilometres of the town of Austin in Lander County, Nevada (Figure 1).

At the Raven Project, the southern claim block covers a mineralized body hosted by an upper-plate Ordovician calcareous siltstone. Thirty-six drill holes have tested this target with intercepts up to 9.96 grams per tonne ("g/t") gold over three metres. The lower plate target below this high-grade gold cell remains largely untested.

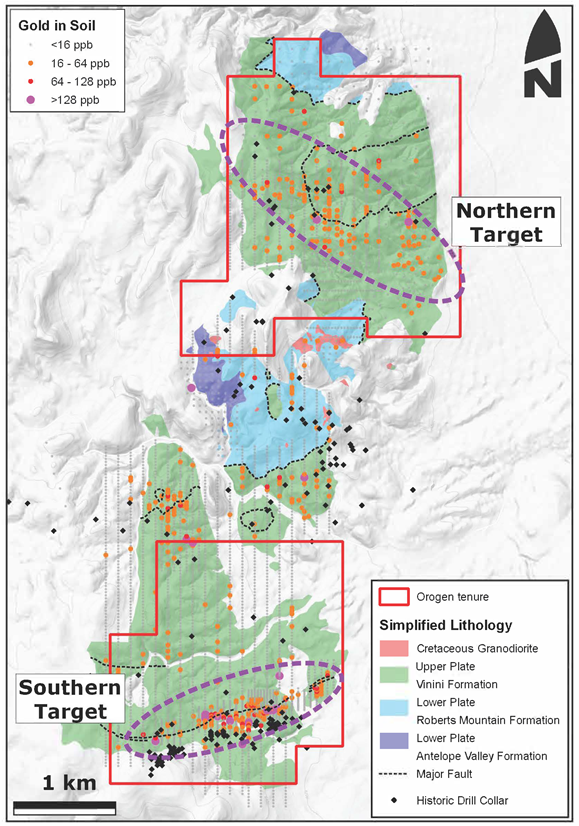

The northern claim block at Raven has seen limited exploration. Recent mapping by Orogen geologists combined with conodont ages have refined the stratigraphy and identified favorable lower plate horizons in multiple locations. Soil samples taken at Raven display a large arsenic, antimony and mercury anomaly across the area (Figure 2). Multiple shallow (30 to 180 metre) drill targets exist below these gold-in-soil anomalies.

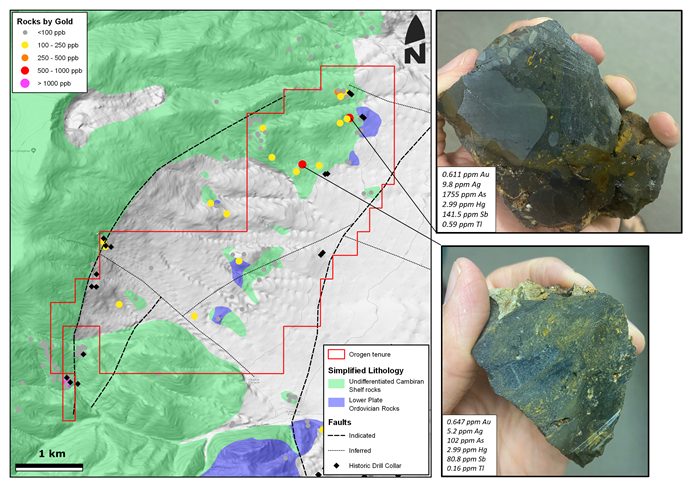

At the Callaghan Project, a window of lower plate carbonates and siltstones is exposed within an anticline. Anomalous gold values and elevated arsenic, antimony and mercury occur within decalcified sandstone, siltstones and jasperoid breccias that occur as outcropping islands along a 7.5 kilometre strike length (Figure 3). Historic drilling intercepted shallow Carlin-style mineralization associated with high angle structures and along the contact between upper and lower Cambrian rocks with drill intercepts up to 1.6 g/t gold over 10 metres. Similar targets exist immediately east and within the untested hinge of the anticline concealed under shallow pediment.

Drill targets will be developed at both projects following geological mapping, geochemical sampling and geophysical surveys in 2021.

About the Generative Exploration Alliance

The Alliance will focus on a 50 by 80 kilometre regional AOI within the Austin-Lovelock Gold Trend. The AOI covers a large region of lower plate rocks and Paleozoic normal faults, including extensions of the Roberts Mountain thrust, which are some of the principal controls on gold deposits found approximately 40 kilometres to the northeast in the Carlin and Battle-Mountain Trend. An increased understanding of the controls on Eocene magmatism in Nevada places the Alliance in an exciting frontier of Carlin gold exploration.

Figure 1: Location of Raven and Callaghan properties

Figure 2: Overview of the Raven Project

Figure 3: Overview of the Callaghan Project

Terms of the Option Agreement and Alliance Agreement

Under the terms of the Option Agreement, Meridian can earn a 100% interest in the Raven and Callaghan projects by making cash payments of US$300,000 and US$4.625 million in exploration expenditures subject the following schedule:

- $50,000 cash on the date of signing the Option Agreement;

- $50,000 cash and $375,000 in exploration with a minimum $100,000 spend on each project on or before the first anniversary;

- $50,000 cash and $500,000 in exploration on or before the second anniversary;

- $50,000 cash and $750,000 in exploration on or before the third anniversary;

- $50,000 cash and $1,000,000 in exploration on or before the fourth anniversary; and

- $50,000 cash and $2,000,000 in exploration on or before fifth anniversary.

Orogen will retain respective 3% and 2.5% NSR royalties on the Callaghan and Raven projects. In the case of each project, Meridian has a buy-down right of up to 1.5% which can be purchased for up to US$10 million.

Under the terms of the Alliance Agreement, Meridian, at its discretion, will fund generative exploration programs operated by Orogen within a 4,000 square kilometre AOI in Nevada, for a three -year period. Properties staked by Orogen and selected by Meridian will be subject to the same earn-in terms as described in the Option Agreement. Orogen will retain a 1% NSR royalty on all ground acquired within the Alliance AOI, with no buy-down.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. Orogen's royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR royalty) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Liliana Wong, Manager of Marketing and Investor Relations at 604-425-3400. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/659261/Orogen-Signs-Option-and-Generative-Alliance-Agreements-With-Yamana-Gold