With the actions of governments and central banks during the Covid-19 pandemic to slow the viral spread and keep the economy in check, several stimulus measures were put into place. These certainly had a short-term effect on the global economy and likely saved it from becoming a disaster, especially after the March 2020 collapse of stock markets worldwide. Since the downturn, the world has seen tremendous growth in the equity markets and commodities like lumber and oil, and even cryptos have climbed. These price run-ups, combined with the printing of money that happened after the pandemic took hold, have caused the fears of inflation to form.

Why the inflation talk?

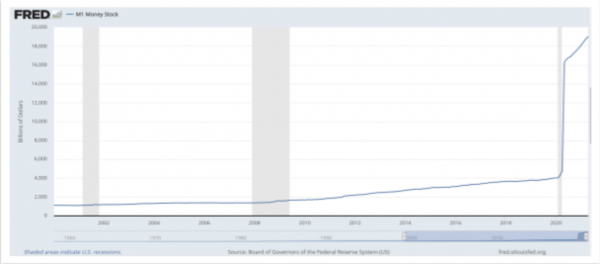

Looking at the USD supply chart, there is quite a significant and unprecedented jump.

With this increase in supply, the USD's value should be diluted with standard economic supply and demand curves; however, heavy inflation has not yet taken hold. It is likely to occur.

These same inflation issues are likely to be stronger in the UK, seeing an expected inflation rate of 3.95% in early 2022, nearly double the Bank of England's 2% target.

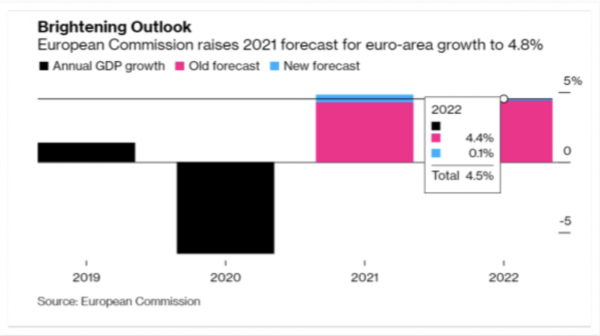

Even the EU is not immune to such inflation increases. Though 1%-1.25% inflation is the norm for the EU, there are already revised numbers expected. In July, Valdis Dombrovskis, the European Commission Vice President, said in a statement. "We will have to keep a close eye on rising inflation, which is due not least to stronger domestic and foreign demand." In July, the ECB raised its inflation outlook for the region and now expects in 2021 a rate of 1.9%, compared to 1.7% previously, stating that rising energy and commodity prices combined with supply-chain bottlenecks are contributing to price increases this year. Though EPB predictions are notoriously optimistic, they do predict inflation should slow again in 2022.

Not all bad news

While the inflation talks are a bit of a worry for some, it is not all bad news. The reason for the inflation discussions is partly due to positive economic aspects. The European Commission's growth forecast increased for the currency block up a half percent from 4.3% to 4.8%, as well as predicting improved 2022 performance. The ECB stated that the economy already did better than initial projections of the first quarter, and recent data suggests a robust private consumption rebound is already underway.

Across the channel, the UK looks even more promising than Europe. After suffering its most significant economic slump in over 300 years due to the coronavirus pandemic, 2021 has seen Britain's economy recovering rapidly. The National Institute of Economic and Social Research (NIESR), a leading British economic think tank, has revised its UK growth forecast for 2021, up 1.1 percentage points to 6.8%, which is in line with the BoE predictions as well as projections of the IMF. The NIESR also stated that the UK's inflation rates should fall back to 2% by 2023 if the BoE begins to raise interest rates as expected.

Mitigating Inflation

While inflation can be considered harmful to a currency, it also brings higher rates of return for investors. These returns are an arbitrage opportunity for a global investor to take advantage of the high returns on one country and then convert back to their local currency with lower returns.

The high expected growth of the UK on a global scale, with initially high but lessening inflation, makes investment there a great opportunity. Seeing high returns but with a well-controlled British pound's inflation makes it a unique situation.

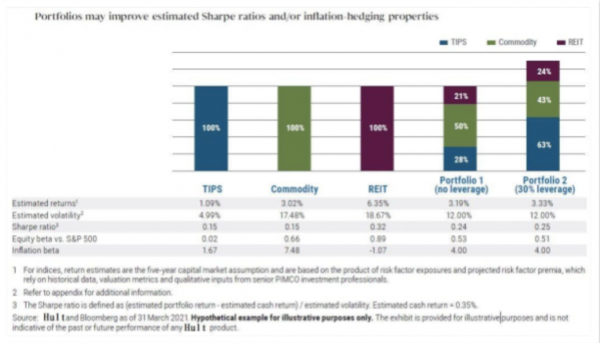

Additionally, like diversification of investments lowers the risk (beta) of a portfolio, the same type of diversification into a portfolio of specific assets can further lessen inflation's effects. This portfolio method combined with investment in the UK is where HULT Private Capital can best help an investor.

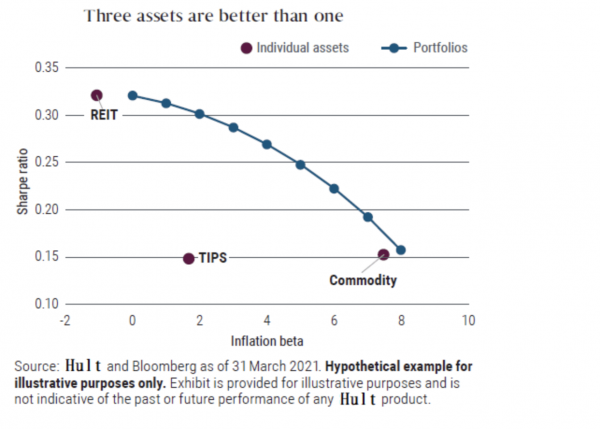

When looking at three general inflation resistant assets, real estate investment trusts (REITs) similar to HULT's Direct Property Investments, Treasury Inflation-Protected Securities (TIPS) similar to the Fixed Return Investments offered by HULT and commodities, one can plot inflation beta versus the Sharpe ratio for optimal portfolios using various inflation beta targets, and the three inflation resistant assets. The results show that an optimised portfolio has the potential to deliver better returns with better hedging benefits than any of the individual asset classes.

HULT Private Capital is precisely positioned to serve the needs of high net worth individuals and accredited investors to develop a personalised portfolio intended to continue the growth of a family's or personal wealth for generations to come. Developing a portfolio of Private Equity, Property, and Fixed Return Assets will produce an optimal return that maximises the Sharpe ratio.

Hult can use assumptions about the characteristics of the various inflation beneficial asset classes and how they can be combined into a diversified portfolio that provides greater estimated returns while lowering portfolio volatility. These returns can be further expanded by using leverage. The above image shows two portfolios (unleveraged and leveraged) that have positive inflation betas and can achieve higher estimated returns above the Sharpe ratios of the individual asset class constituents, except for REITs, which benefit from a negative inflation beta.

Summery

By combining the benefits of the UK's current unique investing environment, which has a higher potential than other locations, with the portfolio allocation strategy that Hult Private Capital has developed to reduce the effects of inflation and increase returns over those of individual inflation resistant investments, Hult Private Capital is in a position to provide a unique opportunity for wealth accumulation to high net worth individuals and families. While some are fearful of inflation, Hult has found a way to embrace inflation and maximize returns for its investors. As John Hudson of HULT recently stated, "Hult's advantage is its ability to find opportunities where others either worry or pass them by."

For additional information about how HULT private capital can develop a personalised portfolio of inflation resistant investments, click HERE

Media Contact

Company Name: HULT Private Capital

Contact Person: Claire Bashir

Email: Send Email

Phone: +44 20 8123 5164

Address:1 Cornhill London City of London

City: London EC3V 3ND

State: England

Country: United Kingdom

Website: http://www.hultprivatecapital.com