-- Continued Increase in Customer Activity and Improved Cost Structure Leads to Material Improvement in Sequential Quarterly Results --

APRIL 29, 2021 – VANCOUVER, BC, CANADA – Select Sands Corp. (“Select Sands” or the “Company”) (TSXV: SNS, OTC: SLSDF) announces operational and financial results for Q4 and full year 2020, and the filing of its audited financial statements and associated management’s discussion and analysis on www.sedar.com. All dollar references in this release are in U.S. dollars.

FOURTH QUARTER AND FULL YEAR 2020 HIGHLIGHTS

-

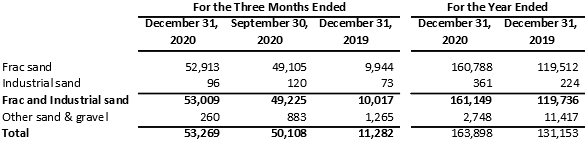

•.Sold 53,009 tons of frac and industrial sand during Q4 2020, compared to 49,225 tons in Q3 2020. For the full year 2020, the Company sold 161,149 tons of frac and industrial sand versus 119,736 tons for the full year 2019.

-

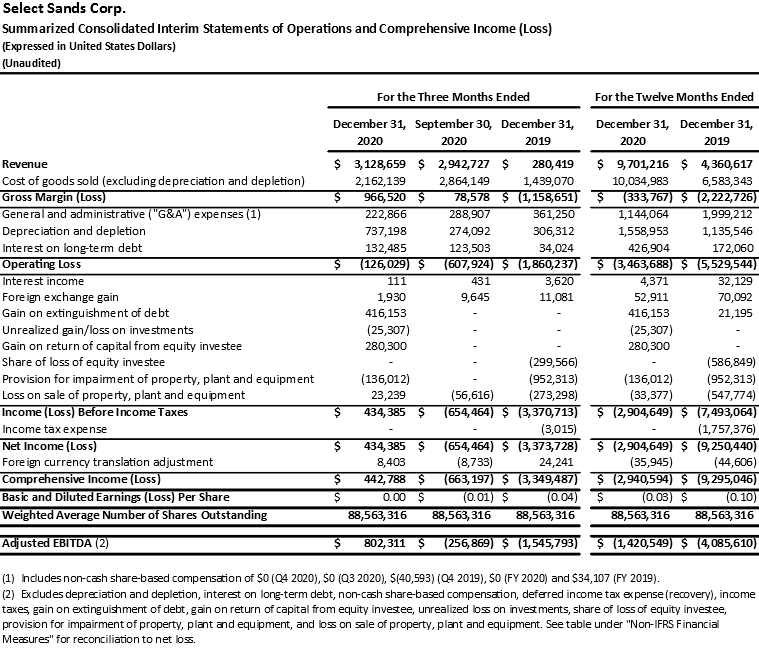

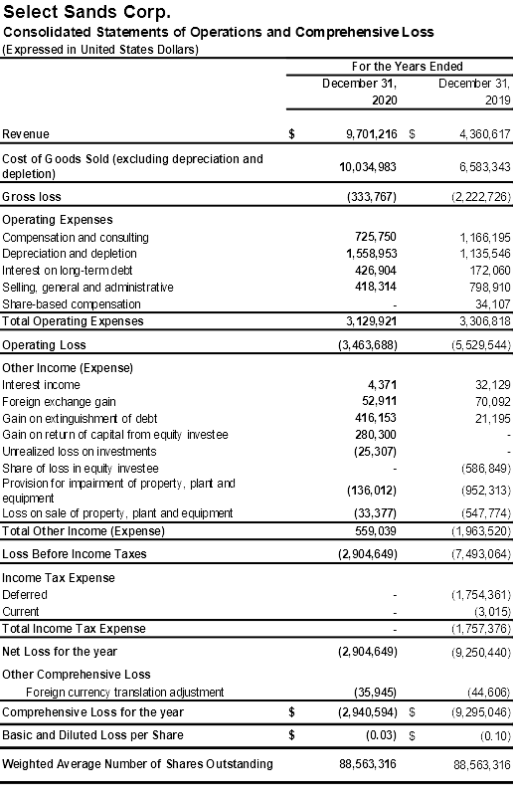

•.Recorded revenue of $3.1 million and a gross margin of $1.0 million in Q4 2020, versus $2.9 million of revenue and a gross margin of $0.1 million in Q3 2020. For the full year 2020, Select Sands recorded revenue of $9.7 million and a gross loss of $0.3 million, compared to revenue of $4.4 million and a gross loss of $2.2 million for the full year 2019.

-

•.Reported net income of $0.4 million, or $0.00 per diluted share in Q4 2020, compared to a net loss of $0.7 million, or $0.01 loss per diluted share, in Q3 2020. For the full year 2020, the Company reported a net loss of $2.9 million, or $0.03 loss per diluted share, versus a net loss of $9.3 million, or $0.10 loss per diluted share, for the full year 2019.

-

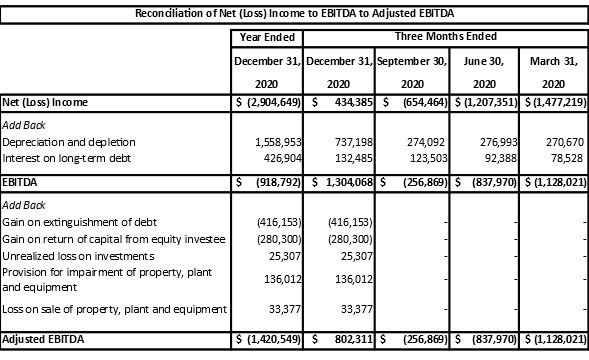

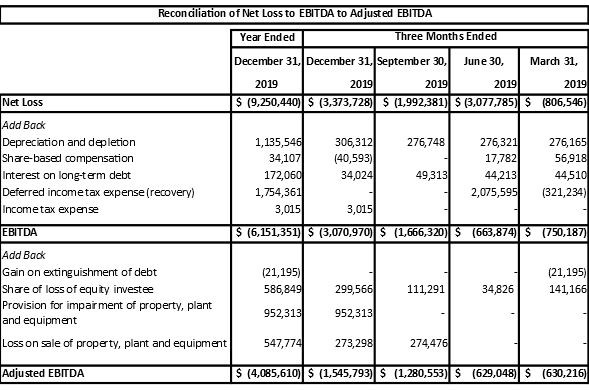

•.Generated adjusted EBITDA(1) of $0.8 million for Q4 2020, versus an adjusted EBITDA loss of $0.3 million in Q3 2020. For the full year 2020, Select Sands posted an adjusted EBITDA loss of $1.4 million versus an adjusted EBITDA loss of $4.1 million for the full year 2019.

-

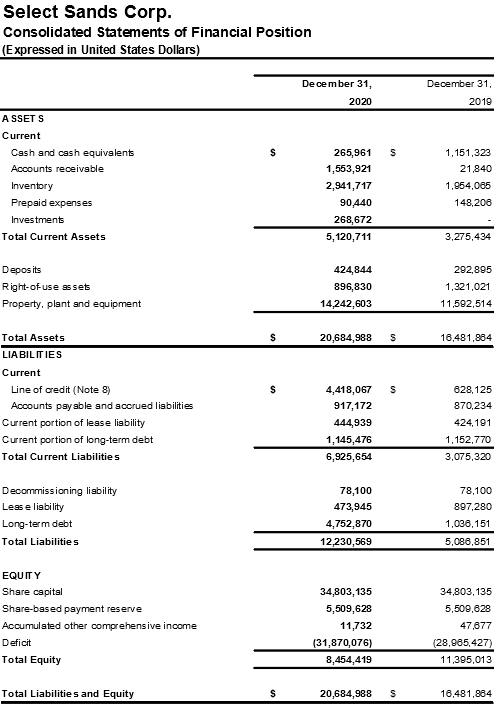

•.As of December 31, 2020, cash and cash equivalents were $0.3 million, accounts receivable was $1.6 million, and inventory was $2.9 million.

-

•.During 2020, the Company started a project to optimize and consolidate processing assets to improve its cost structure (the “Plant Reconfiguration Project”) that was substantially completed by year end. The wet plant and 100 mesh dry plant operated during Q4 2020. The 40/70 line started operation in early January 2021 in preparation for upcoming sales. Select Sands also completed the purchase of the Diaz Rail Loading Facility, located in Diaz, Arkansas (the “Diaz Rail Facility”). The Plant Reconfiguration Project included installation of dry-process equipment at the Diaz Rail Facility, which improved process efficiency by reducing inter-plant transportation costs.

-

•.Select Sands began transload operations at an established facility in the Eagle Ford shale basin located in George West, Texas in December 2019 and started delivering in January 2020 under a long-term agreement to a large E&P operating in the region. In late March to early April 2020, the customer curtailed frac operations and halted receipt of sand shipments due to declining oil prices primarily as a result of supply and demand imbalances associated with the COVID-19 global pandemic. Supported by a higher oil pricing environment, the customer restarted frac operations and the Company resumed shipping product to the customer at the end of the second quarter, with the level of shipments trending higher through the remainder of the year and into 2021.

-

1.(1)Adjusted EBITDA is a non-IFRS financial measure and is described and reconciled to net loss in the table under “Non-IFRS Financial Measures”.

Zig Vitols, President and Chief Executive Officer, commented, “We were pleased with our fourth quarter of 2020 financial performance, which was highlighted by a substantial improvement in earnings and adjusted EBITDA from the third quarter. Contributing to our sequential quarterly results were higher sales volumes and a lower cost of goods sold per ton as a direct result of our successful Plant Reconfiguration Project. We look forward to benefitting from higher margins in 2021 as sales volumes are expected to increase through the remainder of 2021. Our improved fourth quarter 2020 and full year 2020 results were also driven by the ongoing efforts of our employees and contractors. Their ability to perform at a consistent high-level throughout the year despite the many challenges faced as a result of the COVID-19 pandemic was extremely impressive, and I appreciate their continued hard work and dedication.”

FINANCIAL SUMMARY

The following table includes summarized financial results for the three month periods ended December 31, 2020, September 30, 2020 and December 31, 2019, as well as the twelve month period ended December 31, 2020 and December 31, 2019:

For Q1 2021, the Company had sales volumes of frac and industrial sand of approximately 60,000 tons. Sales volumes for Q1 2021 were impacted by the widespread harsh winter storm in February, during which Select Sands was unable to receive natural gas supply as the regional physical gas and power infrastructure was severely impaired. The combined impact of well-head freeze-offs and the failure of gas processing plants and pipelines resulted in more than a week of downtime for the Company’s Arkansas production facilities.

OPERATIONS UPDATE

Select Sands substantially completed its Plant Reconfiguration Project in Arkansas during the fourth quarter of 2020, with the new wet plant located at the Sandtown Quarry remaining fully operational for the entire period. The new dry plant at the Diaz Rail Facility is currently producing 100 mesh product and the 40/70 mesh product line was brought online in early January 2021 in preparation for future sales.

The Plant Reconfiguration Project has materially improved the efficiency of Select Sands’ mining, processing and shipping operations by reducing the number of interplant sites from four to two and allowing for all truck transport between facilities in open top dump trailers while discontinuing the necessity of interplant transport in closed hopper trailers. In addition, Select Sands has increased the level of its own truck fleet capacity to help lower transportation costs.

Supporting the increasing needs of the Company’s largest customer in the Eagle Ford shale basin in South Texas, the George West facility is continuing to operate 24 hours per day and seven days per week.

OUTLOOK

Mr. Vitols concluded, “We are seeing an increase in global oil demand the COVID pandemic in the U.S. has been easing and the level of COVID-19 vaccinations continues to grow in the U.S. We expect the economy to continue to recover and oil demand continue to improve in 2021. We have seen oilfield development activity increase steadily in the U.S. since the beginning of 2021. Based on conversations with our current and prospective customers, we expect this trend to continue. With Select Sands’ premium Northern White Sand product that is strategically located much closer to key oil and gas basins in the Southern U.S. as compared to traditional sources in the Upper Midwest, we believe we are in a solid position for continued growth and success. Combined with our recently announced renewal of our line of credit, we continue to pursue additional opportunities for the benefit of our shareholders.”

Elliott A. Mallard, PG of Kleinfelder is the qualified person as per the NI-43-101 and has reviewed and approved the technical contents of this news release.

ADDITIONAL MANAGEMENT COMMENTARY

An audio recording of management’s additional comments related to its results and outlook will be posted to the Company’s website (https://www.selectsands.com/) under the Investors section prior to market open on Friday, April 30, 2021. Investors interested in having a follow-up discussion with management are encouraged to arrange a specific time for a call by contacting Arlen Hansen at Kin Communications at (604) 684-6730.

Select Sands Corporation is an industrial silica product company, which wholly owns a Tier-1 (Northern White), silica sands property and related production facilities located near Sandtown, Arkansas. Select Sands’ goal is to become a key supplier of premium industrial silica sand and frac sand to North American markets. Select Sands’ Arkansas properties have a significant logistical advantage of being significantly closer to oil and gas markets located in Oklahoma, Texas, Louisiana, and New Mexico than sources of similar sands from the Wisconsin area. Select Sands also operates a transload facility in George West, Texas in Live Oak County that serves customers operating in the Eagle Ford Shale Basin. The facility has a capacity for 180 rail cars and is equipped with two offload/loading stations with dedicated silos for a high throughput capacity.

The Tier-1 reference above is a classification of frac sand developed by PropTester, Inc., an independent laboratory specializing in the research and testing of products utilized in hydraulic fracturing and cement operations, following ISO 13503-2:2006/API RP19C:2008 standards. Select Sands’ Sandtown project has NI 43-101 compliant Indicated Mineral Resources of 42.0MM tons (TetraTech Report; February, 2016). The Sandtown deposit is considered Northern White finer-grade sand deposits of 40-70 Mesh and 100 Mesh.

This news release includes forward-looking information and statements, which may include, but are not limited to, information and statements regarding or inferring the future business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs of the Company. Information and statements which are not purely historical fact are forward-looking statements. The forward-looking statements in this press release relate to comments that include, but are not limited to, statements related to expected current and future state of operations, sales volumes for 2021, the impact of the February 2021 winter storm and the benefits afforded by the Company’s recent renewal of its line of credit. Forward-looking information and statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking information and statements herein. Although the Company believes that any forward-looking information and statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such information and statements, there can be no assurance that any such forward-looking information and statements will prove to be accurate, and accordingly readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward-looking information and statements. Any forward-looking information and statements herein are made as of the date hereof, and except as required by applicable laws, the Company assumes no obligation and disclaims any intention to update or revise any forward-looking information and statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking information and statements herein, whether as a result of new information, future events or results, or otherwise, except as required by applicable laws.

COMPANY CONTACT

Please visit www.selectsandscorp.com or call:

Zigurds Vitols

President & CEO

Phone: (844) 806-7313

INVESTOR RELATIONS CONTACT

Arlen Hansen

Phone: (604) 684-6730

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

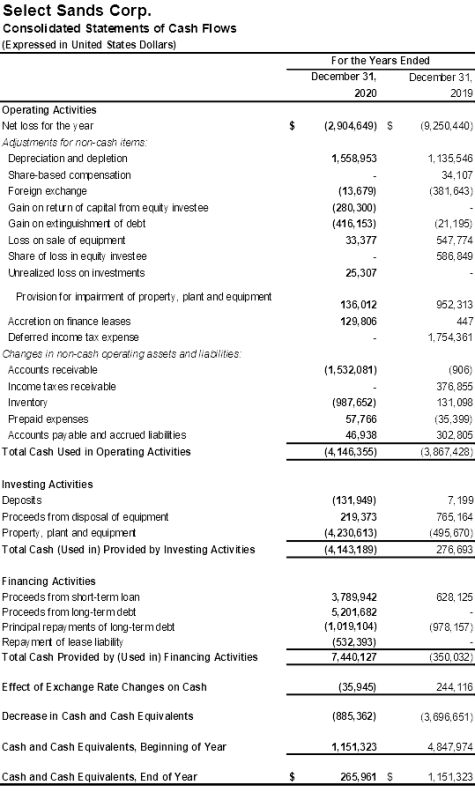

NON-IFRS FINANCIAL MEASURES

The following information is included for convenience only. Generally, a non-IFRS financial measure is a numerical measure of a company’s performance, cash flows or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS. Adjusted EBITDA is not a measure of financial performance (nor does it have a standardized meanings) under IFRS. In evaluating non-IFRS financial measures, investors should consider that the methodology applied in calculating such measures may differ among companies and analysts.

The Company uses both IFRS and certain non-IFRS measures to assess operational performance and as a component of employee remuneration. Management believes certain non-IFRS measures provide useful supplemental information to investors in order that they may evaluate Select Sands' financial performance using the same measures as management. Management believes that, as a result, the investor is afforded greater transparency in assessing the financial performance of the Company. These non-IFRS financial measures should not be considered as a substitute for, nor superior to, measures of financial performance prepared in accordance with IFRS.

As reflected in the above table for the periods presented, the Company defines EBITDA as net loss before depreciation and depletion, interest on long-term debt, non-cash share-based compensation, deferred income tax expense (recovery) and income taxes. The Company defines Adjusted EBITDA as net loss before depreciation and depletion, interest on long-term debt, non-cash share-based compensation, deferred income tax expense (recovery), income taxes, gain on extinguishment of debt, gain on return of capital from equity investee, unrealized loss on investments, share of loss of equity investee, provision for impairment of property, plant and equipment, and loss on sale of property, plant and equipment. Select Sands uses Adjusted EBITDA as a supplemental financial measure of its operational performance. Management believes Adjusted EBITDA to be an important measure as they exclude the effects of items that primarily reflect the impact of long-term investment and financing decisions, rather than the performance of the Company’s day-to-day operations. As compared to net income (loss) according to IFRS, this measure is limited in that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in the Company's business, the charges associated with impairments, termination costs, transaction costs or other items management views as unusual or one-time in nature. Management evaluates such items through other financial measures such as capital expenditures and cash flow provided by operating activities. The Company believes that these measurements are useful to measure a company’s ability to service debt and to meet other payment obligations or as a valuation measurement.

INDICATED RESOURCES DISCLOSURE

The Company advises that the production decision on the Sandtown deposit (the Company’s current “Sand Operations”) was not based on a Feasibility Study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that production will occur as anticipated or that anticipated production costs will be achieved.

Copyright (c) 2021 TheNewswire - All rights reserved.