Pet food company Freshpet (NASDAQ:FRPT) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 26.3% year on year to $253.4 million. The company expects the full year’s revenue to be around $975 million, close to analysts’ estimates. Its GAAP profit of $0.24 per share was also 128% above analysts’ consensus estimates.

Is now the time to buy Freshpet? Find out by accessing our full research report, it’s free.

Freshpet (FRPT) Q3 CY2024 Highlights:

- Revenue: $253.4 million vs analyst estimates of $248.3 million (2% beat)

- EPS: $0.24 vs analyst estimates of $0.11 ($0.13 beat)

- EBITDA: $43.49 million vs analyst estimates of $35.46 million (22.6% beat)

- The company lifted its revenue guidance for the full year to $975 million at the midpoint from $965 million, a 1% increase

- EBITDA guidance for the full year is $155 million at the midpoint, above analyst estimates of $144 million

- Gross Margin (GAAP): 40.4%, up from 33% in the same quarter last year

- Operating Margin: 4.7%, up from -3.5% in the same quarter last year

- EBITDA Margin: 17.2%, up from 11.6% in the same quarter last year

- Free Cash Flow was $22.07 million, up from -$19.94 million in the same quarter last year

- Sales Volumes were up 26.1% year on year

- Market Capitalization: $6.48 billion

"Our third quarter results demonstrate the strength and consistency of both net sales and profitability growth we have been striving to deliver. We delivered our 25th consecutive quarter of >25% year on year net sales growth and matched that with a very strong operating performance. This further strengthens our confidence in our ability to meet or exceed our 2027 goals,” commented Billy Cyr, Freshpet’s Chief Executive Officer.

Company Overview

Contrasting itself with the typical processed pet foods found throughout the industry, Freshpet (NASDAQ:FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Freshpet is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

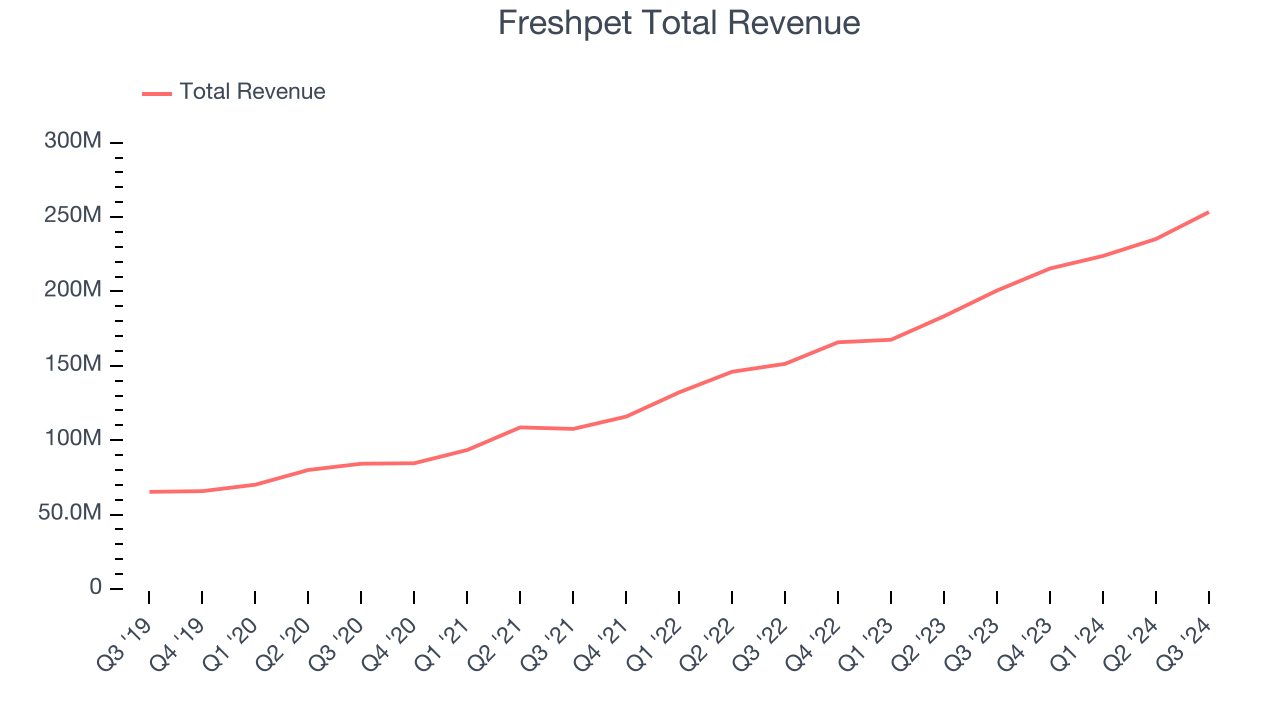

As you can see below, Freshpet’s 33% annualized revenue growth over the last three years was incredible as consumers bought more of its products.

This quarter, Freshpet reported robust year-on-year revenue growth of 26.3%, and its $253.4 million of revenue topped Wall Street estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 23.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is admirable and indicates the market is baking in success for its products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

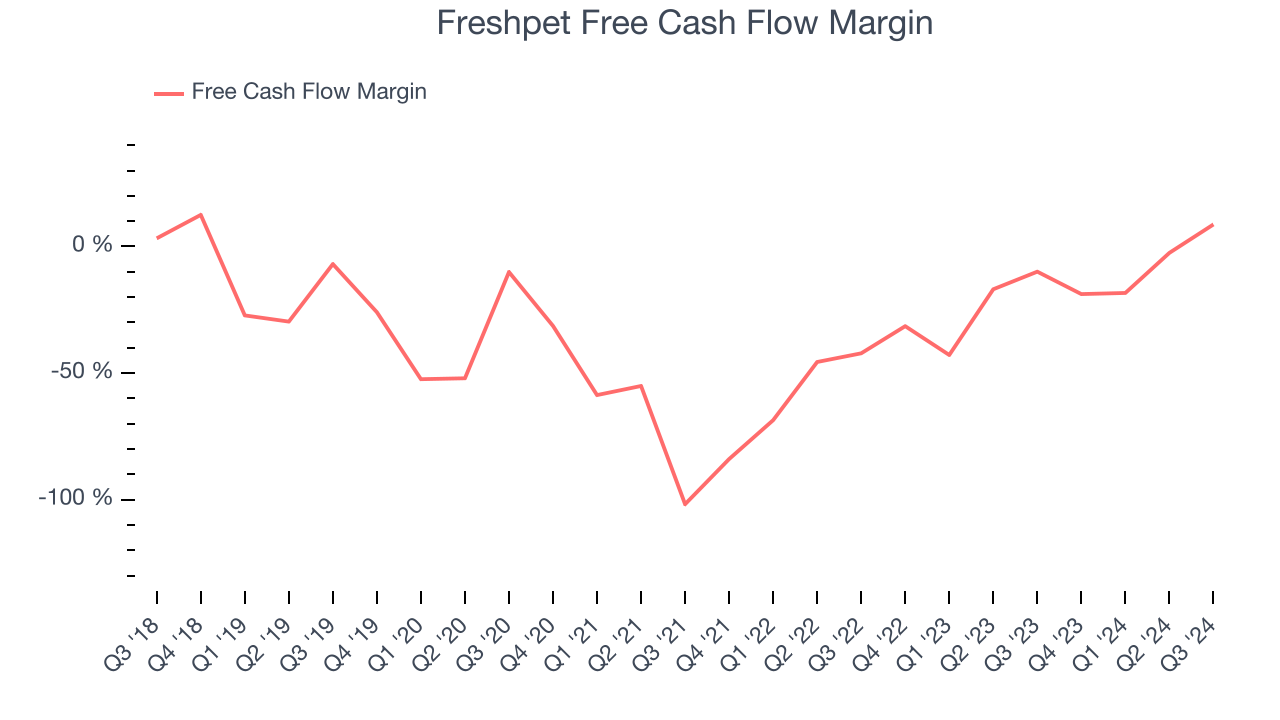

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Freshpet posted positive free cash flow this quarter, the broader story hasn’t been so clean. Freshpet’s demanding reinvestments have drained its resources over the last two years. Its free cash flow margin averaged negative 14.6%, meaning it lit $14.60 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Freshpet’s margin expanded by 17.3 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Freshpet’s free cash flow clocked in at $22.07 million in Q3, equivalent to a 8.7% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

Key Takeaways from Freshpet’s Q3 Results

We were impressed by how significantly Freshpet blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its gross margin missed analysts’ expectations. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2% to $136.53 immediately after reporting.

Freshpet had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.