Zurn Elkay’s 19.4% return over the past six months has outpaced the S&P 500 by 8.7%, and its stock price has climbed to $38.91 per share. This run-up might have investors contemplating their next move.

Is now the time to buy Zurn Elkay, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Despite the momentum, we're swiping left on Zurn Elkay for now. Here are three reasons why we avoid ZWS and one stock we'd rather own.

Why Is Zurn Elkay Not Exciting?

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE:ZWS) provides water management solutions to various industries.

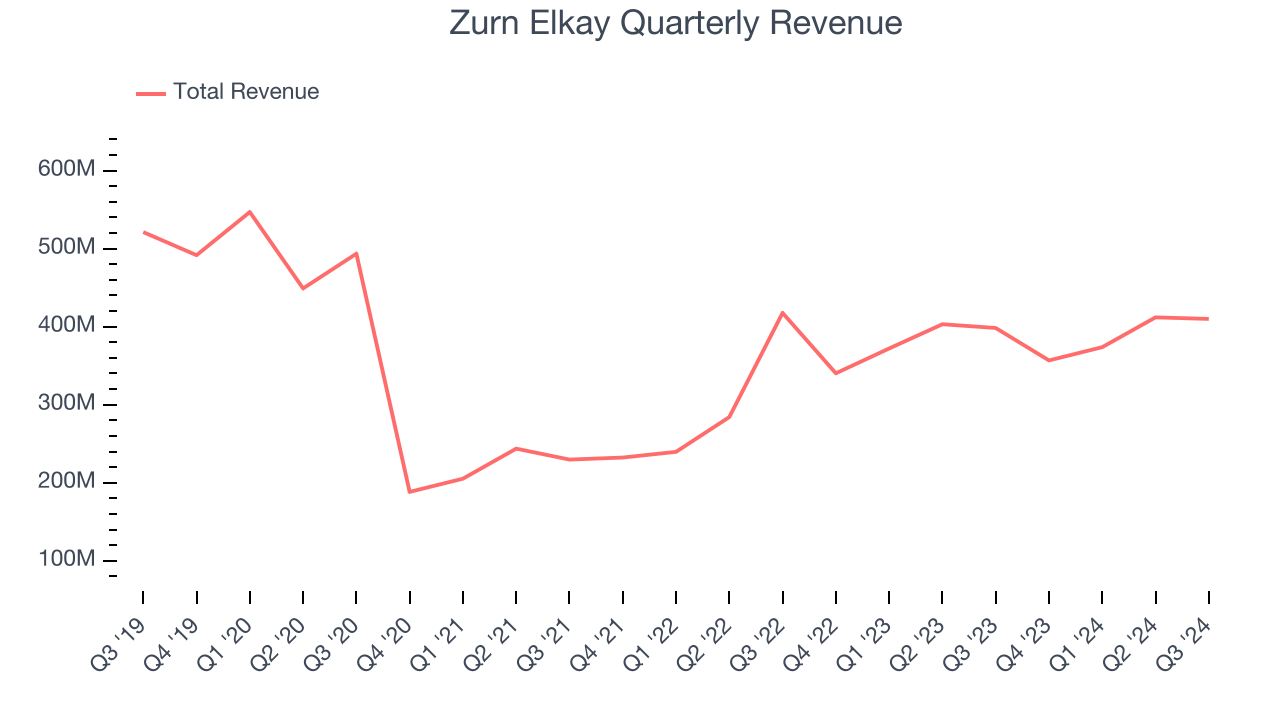

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Zurn Elkay’s demand was weak over the last five years as its sales fell by 5.4% annually.

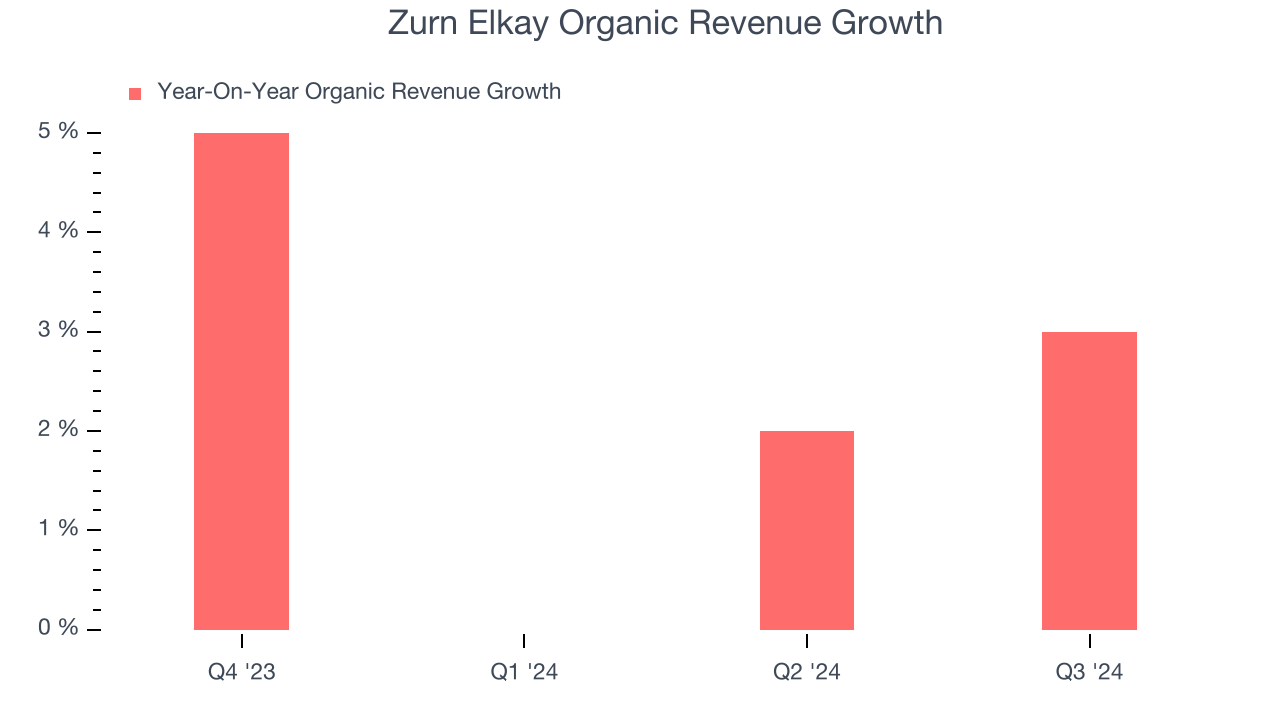

2. Slow Organic Growth Suggests Waning Demand In Core Business

Investors interested in HVAC and water systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into Zurn Elkay’s core business as it excludes one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Over the last year, Zurn Elkay’s organic revenue averaged 2.5% year-on-year growth. This performance was underwhelming and suggests it might have to lean into acquisitions to accelerate growth - this isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

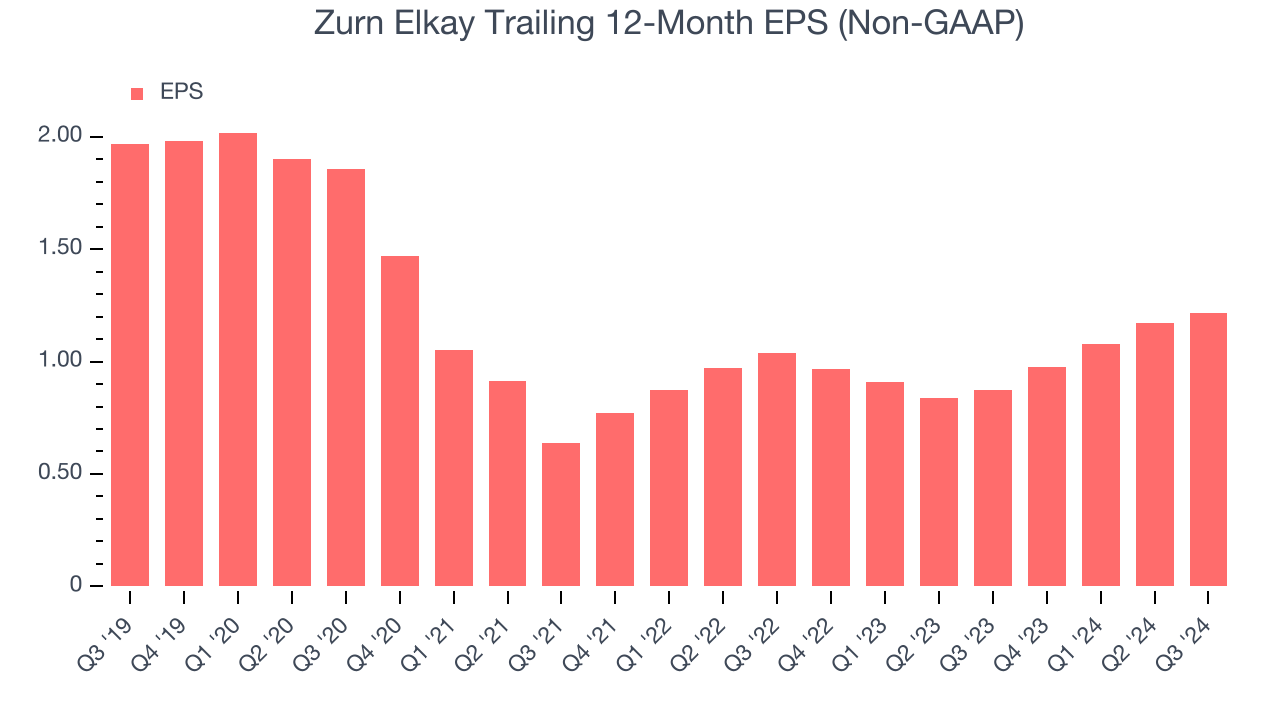

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) tells us whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Zurn Elkay, its EPS declined by more than its revenue over the last five years, dropping 9.2% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Zurn Elkay isn’t a terrible business, but it isn’t one of our top picks. With its shares beating the market recently, the stock trades at 30.2x forward price-to-earnings (or $38.91 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend taking a look at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Zurn Elkay

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.