Payroll and human resources software provider, Paylocity (NASDAQ:PCTY) announced better-than-expected revenue in Q3 CY2024, with sales up 14.3% year on year to $363 million. Guidance for next quarter’s revenue was also optimistic at $366.5 million at the midpoint, 2.4% above analysts’ estimates. Its non-GAAP profit of $1.66 per share was also 17.5% above analysts’ consensus estimates.

Is now the time to buy Paylocity? Find out by accessing our full research report, it’s free.

Paylocity (PCTY) Q3 CY2024 Highlights:

- Revenue: $363 million vs analyst estimates of $356.2 million (1.9% beat)

- Adjusted EPS: $1.66 vs analyst estimates of $1.41 (17.5% beat)

- EBITDA: $129 million vs analyst estimates of $118.3 million (9% beat)

- The company lifted its revenue guidance for the full year to $1.54 billion at the midpoint from $1.52 billion, a 1.5% increase

- EBITDA guidance for the full year is $535 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 68.3%, in line with the same quarter last year

- Operating Margin: 17.7%, up from 13% in the same quarter last year

- EBITDA Margin: 35.5%, up from 33% in the same quarter last year

- Free Cash Flow Margin: 20.4%, up from 16.1% in the previous quarter

- Annual Recurring Revenue: $333.1 million at quarter end, up 14.2% year on year

- Market Capitalization: $9.81 billion

“Fiscal 25 is off to a strong start, with recurring & other revenue and total revenue growth of 14% in the first quarter, combined with a significant year-over-year increase in profitability, as our differentiated value proposition of providing the most modern software in the industry continues to resonate in the marketplace,” said Toby Williams, President and Chief Executive Officer of Paylocity.

Company Overview

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

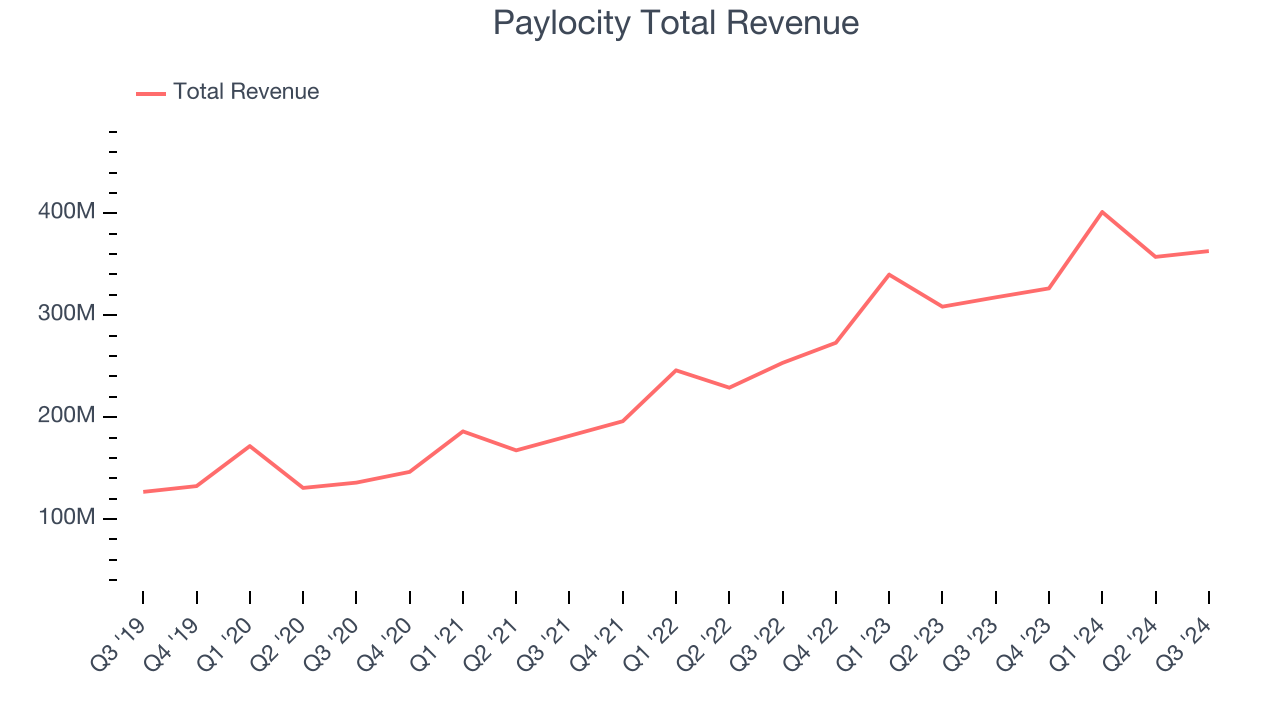

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Paylocity’s sales grew at an impressive 28.6% compounded annual growth rate over the last three years. This is a useful starting point for our analysis.

This quarter, Paylocity reported year-on-year revenue growth of 14.3%, and its $363 million of revenue exceeded Wall Street’s estimates by 1.9%. Management is currently guiding for a 12.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates the market thinks its products and services will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

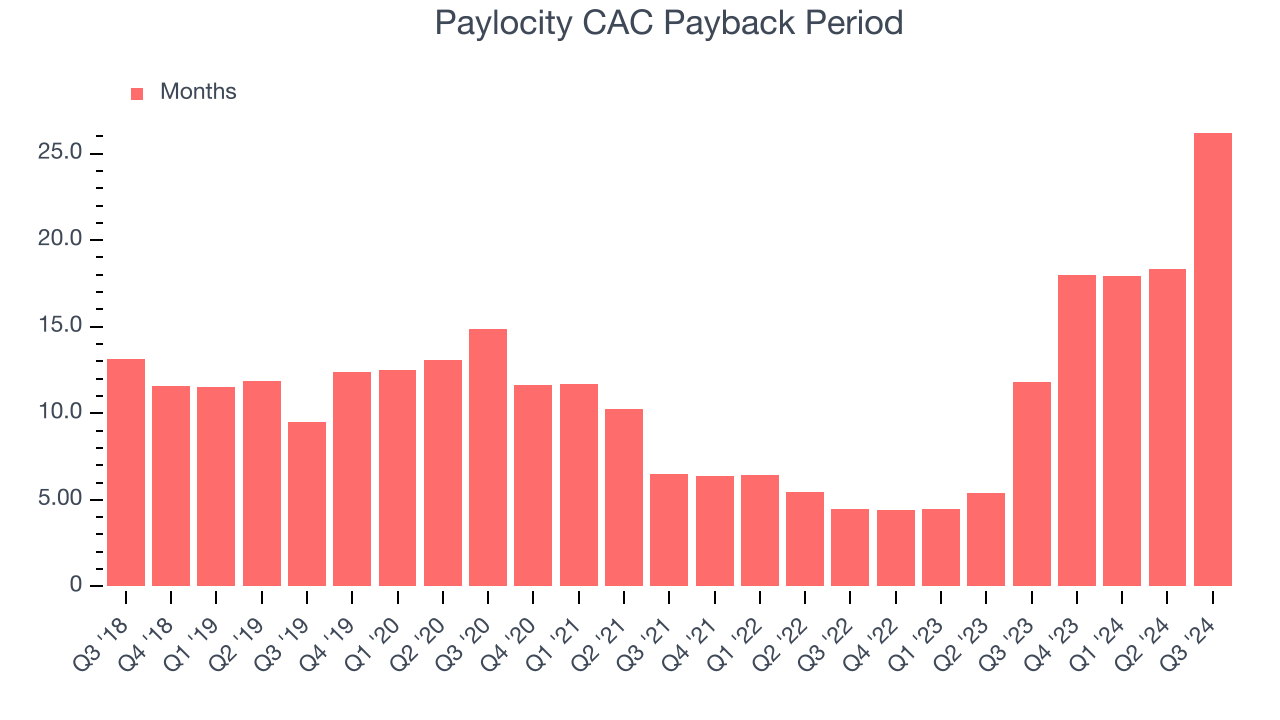

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Paylocity is very efficient at acquiring new customers, and its CAC payback period checked in at 26.2 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Paylocity’s Q3 Results

We were impressed by how significantly Paylocity blew past analysts’ EBITDA expectations this quarter. We were also glad next quarter’s revenue guidance came in higher than Wall Street’s estimates. On the other hand, its EBITDA forecast for next quarter was underwhelming. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.5% to $183 immediately following the results.

Sure, Paylocity had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.