Employee Retention Credit (ERC) Payroll Tax Refund news – the IRS new filing deadline criteria for recovery startup businesses (RSB), religious organization, churches and schools may delay tax refunds if 941X amended return is not submitted by 12/31/23. Leading ERC services provider and trusted experts in CARES Act lending and ERC payroll tax refund eligibility requirements release information videos, provide free consultation and offer no cost ERC tax refund assessment within 24 hours.

HOUSTON - Sept. 11, 2023 - PRLog -- The IRS has issued Employee Retention Credit (ERC) payroll tax refund filing instructions that clarifies and extends the previous filing deadlines. The clarification of the IRS three-year period of limitations for amended 941X filings for ERC payroll tax refund claims is April 15 of the year following the original 941 filing. Therefore, the newly clarified deadline for any new 2020 CARES Act Payroll Tax Refund claim is April 15, 2024 and the deadline for 2021 CARES Act Payroll Tax Refund claims is April 15, 2025.

However, the IRS has added another layer of complexity by requiring that any ERC payroll tax refund filed within 90 days of the above dates will have an additional step to take in qualifying for their tax refund. This means the most important new deadline for 2020 ERC payroll tax refund claims refund to avoid the additional step is December 31, 2023.

After December 31, 2023, the IRS requires a new 2020 ERC filing step called the "claim process", instead of using the current 941X adjustment process of prior payroll filings. We have researched this requirement and believe it will further delay IRS processing of client ERC payroll tax refunds filed after December 31, 2023.

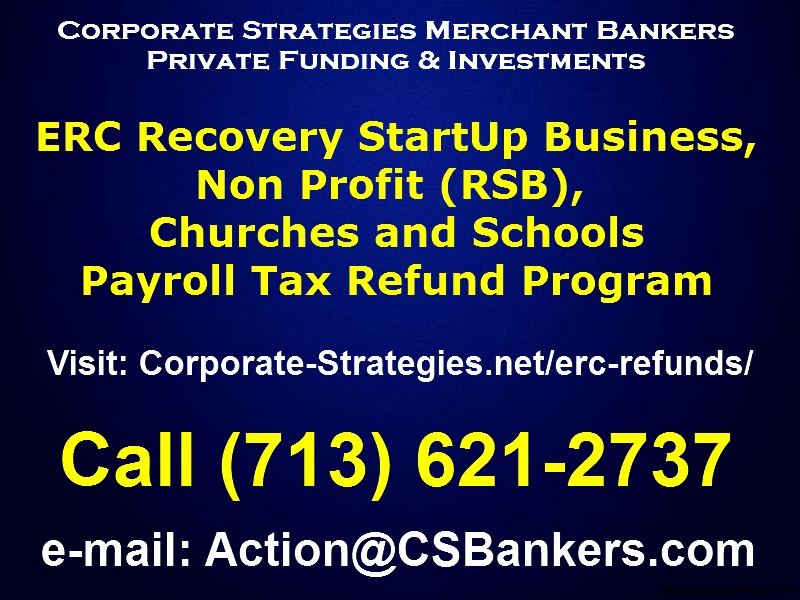

To receive a no cost ERC tax refund assessment within 24 hours, all new, current or pending clients of Corporate Strategies Merchant Bankers, including churches, schools, non-profits and recovery startup businesses who have not completed their Employee Retention Credit payroll tax refund applications are urged to call:

(713) 621-2737 (24x7) or

E-mail: Action@CSBankers.com

Visit: https://corporate-strategies.net/erc-refunds/

for more information on meeting these new deadlines.

See the ERC Payroll Tax Credit Specialist information video at:

https://youtu.be/XxBvb5SnScE

About Corporate Strategies Merchant Bankers

Founded in the 1980's by CEO Tim Connolly, the Corporate Strategies team (http://www.CSBankers.com) is a family office engaged in Private Lending and Real Estate Investments. Our team is comprised of private banking professionals, ERC qualification experts, former tax auditors, practicing tax lawyers/CPAs/ex IRS agents and dedicated staff.

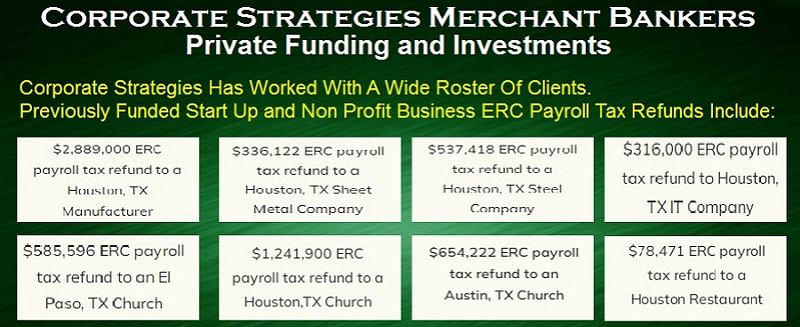

We are trusted experts in CARES Act lending and ERC payroll tax refund eligibility requirements---since 2020 our clients have received millions in PPP loans and received ERC Payroll Tax Refunds averaging $300,000+ and up to $2.9 MM.

We focus our efforts on ERC tax refund qualification for churches, schools, recovery startup businesses & nonprofits. Our ERC qualification work is done on a contingency basis, so if a client company does not qualify for an ERC tax refund, nothing is owed.

Photos: (Click photo to enlarge)

Source: Corporate Strategies, LLC

Read Full Story - ERC Tax Refund News - IRS Clarifies New Employee Retention Credit (ERC) Payroll Tax Refund Filing Deadlines For Businesses, Churches And Schools | More news from this source

Press release distribution by PRLog