Payment Gateway Market worth over $60 BN by 2027

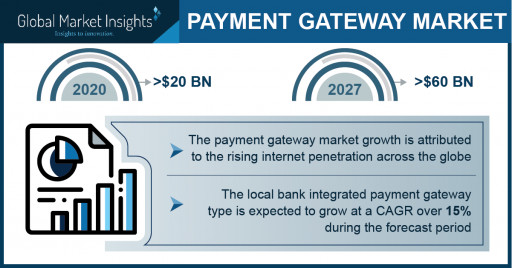

Payment Gateway Market size is set to surpass USD 60 billion by 2027, according to a new research report by Global Market Insights Inc.

Global Market Insights Inc. has recently added a new report on the payment gateway market, which estimates the market valuation for payment gateway will cross US $60 billion by 2027 due to increasing demand for secure digital payments and mobile payment technology.

Rising internet penetration across the globe is boosting the payment gateway market demand. The increasing internet penetration is enabling customers to use various digital payment methods such as net banking and mobile wallets. The security of online transactions is the major challenge faced by both customers and businesses. The payment gateway helps businesses to perform online transactions in a more secure way. The growing demand for various smartphone-based digital payment apps is also supporting the payment gateway market growth.

Request a sample of this research report at https://www.gminsights.com/request-sample/detail/5077

The local bank integrated payment gateway type is expected to grow at a 15% CAGR till 2027 due to growing digitalization across banks. The local bank integrated payment gateway directs customers to banks during the financial transaction, where users can add their financial credentials. This type of payment gateway is quick and easy to set up, making it ideal for SMEs.

The SMEs held the market share over 60% in 2020 due to the growing adoption of digital payment solutions across SMEs. SMEs are using digital payment solutions to avoid long queues of customers. The digital payment is also faster than traditional manual payment methods, helping SMEs to improve their customer experience. Digital payments also enable SMEs to reduce the risks, such as thefts, arising due to physical security breaches at their premises.

The media & entertainment industry is expected to grow significantly over the forecast period in the payment gateway market. This market growth is attributed to the increasing adoption of advanced technologies, such as IoT and AI, across the media & entertainment industry. The entertainment industry is emphasizing improving the customer experience by providing digital payment services at movie theatres, amusement parks, and plays.

Europe's payment gateway market size is projected to generate revenue of over USD 15 billion by 2027. The growth is attributed to increasing digitalization across the financial sector in the region. The major banks are deploying various digital solutions to improve their customers' banking experience. The increasing number of internet banking users in the region is another factor fueling the market.

The companies operating in the market are focused on partnering with digital payment solution providers to expand their payment gateway capabilities. For instance, in March 2021, PayPal partnered with Cashfree, an India-based payment and banking technology company, to enable international payments for merchants across 200 countries. This partnership helped the company to strengthen its position in the payment gateway market.

Some major findings of the payment gateway market report include:

- Growing smartphone penetration is supporting the demand for online banking apps and digital payments.

- Rising shift of consumers toward online shopping is also fueling the payment gateway market.

- Europe is anticipated to hold a significant market share for the payment gateway market due to increasing digitalization across the financial sector in the region.

- The companies operating in the market are focusing on development of secure payment gateways to support secure digital transactions.

Request for customization of this research report at https://www.gminsights.com/roc/5077

Partial chapters of report table of contents (TOC):

Chapter 3. Payment Gateway Industry Insights

3.1. Introduction

3.2. Industry segmentation

3.3. Impact of COVID-19 outbreak

3.3.1. Global outlook

3.3.2. By region

3.3.2.1. North America

3.3.2.2. Europe

3.3.2.3. Asia Pacific

3.3.2.4. Latin America

3.3.2.5. Middle East & Africa

3.3.3. Industry value chain

3.3.3.1. Suppliers

3.3.3.2. Payment gateway technology providers

3.3.3.3. Marketing & distribution channels

3.3.4. Competitive landscape

3.3.4.1. Strategy

3.3.4.2. Distribution network

3.3.4.3. Business growth

3.4. Payment gateway ecosystem analysis

3.4.1. Issuers

3.4.2. Acquirers

3.4.3. Credit card networks

3.4.4. Payment processors

3.4.5. Payment gateways

3.4.6. Independent Sales Organizations (ISOs)

3.4.7. Payment facilitators

3.4.8. Payment processing hardware providers

3.4.9. Shareholder profit margin analysis

3.4.10. Vendor matrix

3.5. Payment gateway evolution

3.6. Regulatory landscape

3.6.1. Alternative Investment Fund Managers Directive (AIFMD)

3.6.2. Anti-Money Laundering Directive 2015/849/EU (AMLD)

3.6.3. Dodd-Frank Wall Street Reform and Consumer Protection Act

3.6.4. European Market Infrastructure Regulation (EMIR)

3.6.5. Federal Information Security Management Act (FISMA)

3.6.6. Foreign Account Tax Compliance Act (FATCA)

3.6.7. General Data Protection Regulation (GDPR)

3.6.8. Health Insurance Portability and Accountability Act (HIPAA)

3.6.9. Markets in Financial Instruments Directive (MiFID)

3.6.10. North American Electric Reliability Corp. (NERC) standards

3.6.11. Payment Card Industry Data Security Standard (PCI DSS)

3.6.12. The Gramm-Leach-Bliley Act (GLB) Act of 1999

3.6.13. The Sarbanes-Oxley Act of 2022

3.7. Technology and innovation landscape

3.7.1. Application Processing Interface (API)

3.7.2. Blockchain

3.7.3. AI and machine learning

3.7.4. Biometrics

3.8. Digital payment statistics

3.9. Patent analysis

3.10. Investment portfolio

3.11. Industry impact forces

3.11.1. Growth drivers

3.11.1.1. Increasing e-commerce sales along with growing internet penetration

3.11.1.2. Changing consumer preferences towards digital payments

3.11.1.3. Supportive government initiatives

3.11.1.4. Increasing financial literacy across developing nations

3.11.1.5. Catalyzed investments in the fintech industry

3.11.2. Industry pitfalls & challenges

3.11.2.1. Rising cybersecurity issues

3.11.2.2. Absence of a global standard for cross-border transactions

3.12. Porter's analysis

3.13. PESTEL analysis

About Global Market Insights

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision-making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Press Release Service by Newswire.com

Original Source: Payment Gateway Market Revenue to Hit $60 Bn by 2027; Global Market Insights Inc.