Workday Inc. (NASDAQ: WDAY) is a leading cloud provider of human capital management (HCM) and finance applications for enterprises. Its artificial intelligence (AI) powered solutions enable companies to manage their workers and their money. The computer and technology sector leader is a newly minted Fortune 500 company and counts over 60% of the companies in the Fortune 500 as clients. It has over 70 million contracted customers throughout 175 countries.

Workday makes the distinction that its AI is embedded into, not bolted onto, its unified platform. The company has made 10 new AI investments since 2023 and announced its next-generation AI technology, Workday Illuminate.

Workday competes with HCM and finance platform providers like Automatic Data Processing Inc. (NASDAQ: ADP), Oracle Co. (NYSE: ORCL), and SAP SE (NYSE: SAP).

Human Capital and Finance Go Hand-in-Hand with Workday’s Solutions

Workday is a strong player in the HCM segment but is growing in the finance segment, which is more fractured. Its HCM solutions are used by human resource departments for entire employee lifecycle management, enabling them to recruit, hire, onboard, and pay talent. Its finance solutions help companies with accounting tasks, payroll management, budgeting, planning, and financial forecasting. The full suite of products is seamlessly integrated into its unified cloud platform preventing silos and configuration issues that develop using different platforms.

Workday Illuminate: AI-Powered Platform for Smarter Business Processes

Workday has been investing heavily in AI as it's embedded into its platform helping to automate, analyze and personalize tasks and workflows. It unveiled its next-generation technology, Workday Illuminate, which is designed to accelerate, assist and transform workflows.

Illuminate was developed using Workday’s own HCM and finance datasets comprised of over 800 billion transactions annually on its platform. In a nutshell, Illuminate was designed to enhance business process orchestration, task automation and generation of actionable AI-driven insights.

Illuminate understands the raw data, makes the connections determining the hows and whys of every task and develops personalized solutions that enable the employer to make better decisions in real-time and in human language using generative AI.

Workday Illuminate seeks to transform whole business processes, from writing job descriptions and contracts to generating content and detecting anomalies. Anticipating needs and streamlining workflows to minimize friction and maximize efficiency to complete tasks faster and smarter. Workday Assistant acts as an expert co-pilot, providing real-time and AI agents assistance in automating simple tasks and guiding users through more complex processes.

Workday Subscription Growth Slows From Last Year

Workday reported its fiscal second-quarter of 2025 EPS of $1.74, beating consensus analyst estimates by 10 cents. Revenue grew 16.5% YoY to $2.08 billion, which also beat consensus estimates of $2.07 billion. Subscription revenues rose 17.2% YoY, which was lower than the 18.8% growth last year. The company continues to see deal scrutiny and moderated headcount growth among its clients. However, that's being offset by full-suite wins in higher education like the University of Florida, the University of Mississippi, and Clemson University. Full suite wins in healthcare include Reid Health, Grady Health System, and Children's National Medical Center.

Subscription revenues rose 17.2% YoY to $1.903 billion. Its 12-month backlog grew 16%. The operating income margin was 5.3%, which was an improvement from 3% in the year-ago period. Adjusted operating margin improved to 24.9%, up from 23.6% a year ago. The company bought back 1.4 million shares and closed the quarter with $7.37 billion in cash. Workday also announced a new $1 billion stock buyback program.

Focusing on Profits and Keeping a Lid on Headcount

Workday CEO Carl Eschenbach reiterated the company’s tightening focus on profitability, improving efficiencies, and keeping a lid on its headcount. Operating margin is expected to improve to 30% by fiscal 2027, up from 25%.

Eschenbach noted, “And, we’ve identified opportunities to drive efficiencies across the business. In light of this, we’re making some adjustments to our medium-term plans, including a slightly moderated pace of subscription revenue growth balanced with accelerated margin expansion. Our revised medium-term outlook reflects the confidence we have to drive durable, profitable growth at scale.”

This meant the company lowered its annual subscription revenue to 15% for fiscal 2026 and 2027 as it became increasingly targeted on its investments and continued seeking accretive acquisitions to enhance ROI. The bottom line is despite the tough business climate as enterprises cut IT spending, Workday will focus on driving more efficiency, which includes more AI in its call centers, which should drive earnings and margin growth.

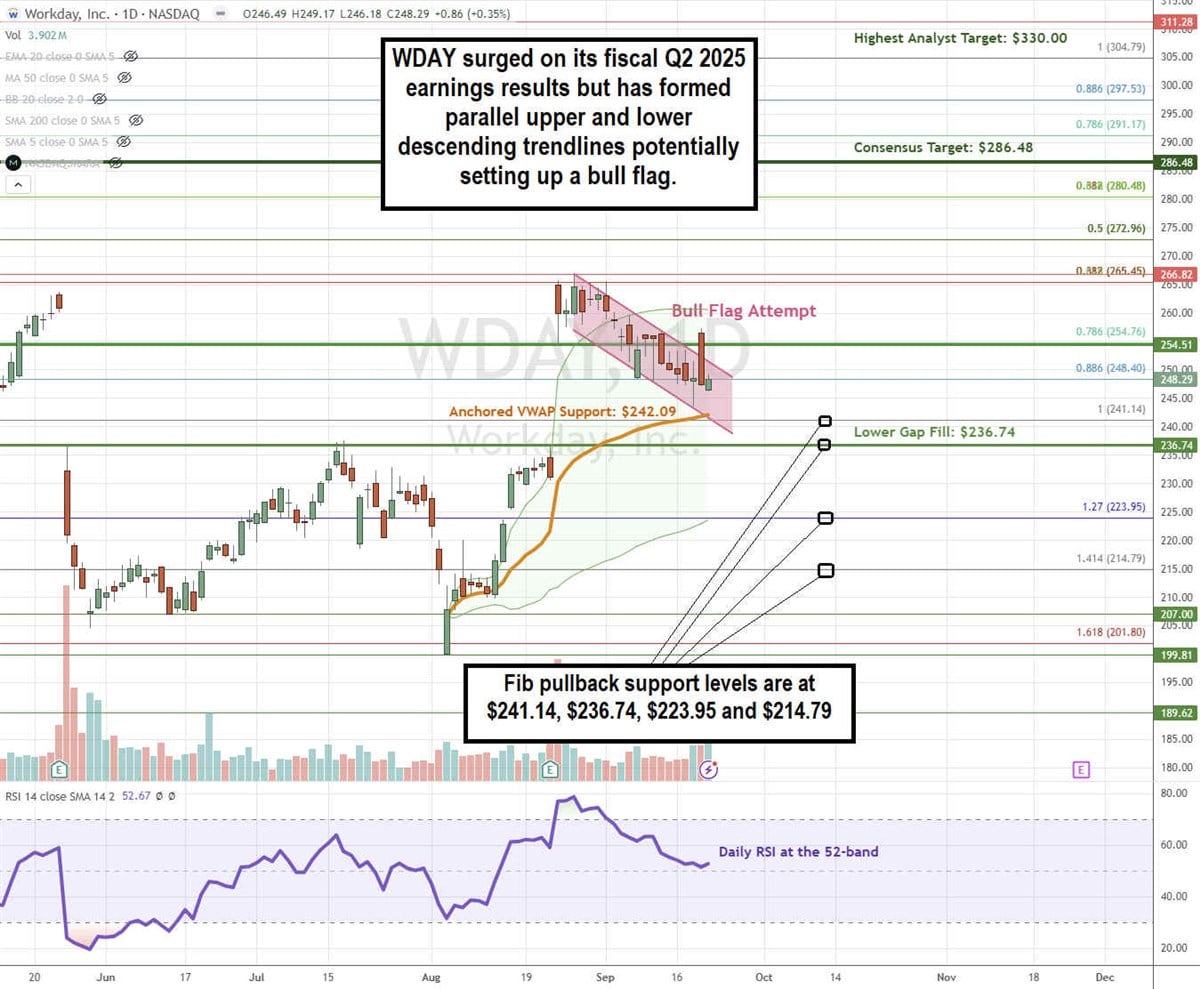

WDAY Stock Attempts a Bull Flag

A bull flag follows a sharp price rise followed by parallel descending upper and lower trendlines forming the flag—the bull flag breakout forms when the stock surges through the upper trendline resistance.

WDAY surged to peak its flagpole at $266.82 on the price gap following its earnings release. The flag formed on parallel descending upper and lower trendlines, indicating lower highs and lower lows. The attempt to trigger a bull flag breakout failed as it fell under the upper gap fill at $254.51. A breakout through the upper gap fill is needed to trigger the bull flag. The daily anchored VWAP support is at $242.09, and the lower gap fill is at $236.74. The daily relative strength index (RSI) is trying to round out a bottom at the 52-band. Fibonacci (Fib) pullback support levels are at $241.14, $236.74, $223.95 and $214.79.

Workday’s average consensus price target is $286.48, and its highest analyst price target is $330.00.

Bullish investors can buy on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls at fib extension levels to execute a wheel strategy for income.

Since Workday is an expensive stock, bullish options investors can limit maximum downside and profit from modest upside gains for less capital than owning the stock by implementing a bullish call debit spread.