In 2021, the term SPAC became part of the investor’s dictionary. SPAC stands for special purpose acquisition company, and it was a way many companies went public in 2020 and 2021. Many of those companies were in the electric vehicle (EV) industry. And not just car manufacturers but any company that impacted the EV supply chain, including battery production.

Two of these companies were Microvast Holdings Inc. (NASDAQ: MVST) and FREYR Battery SA (NYSE: FREY). Both Microvast and FREYR Battery are considered business services stocks. But they are not just penny stocks; they’re micro penny stocks. The combined market capitalization of the two companies is around $266 million. And, like many SPAC companies, Microvast and FREYR Battery have significantly underperformed the S&P 500 since 2021.

But if you’re a speculative investor who has the capital to set aside for a company that could deliver transformational technology, what do you need to know about each of these stocks?

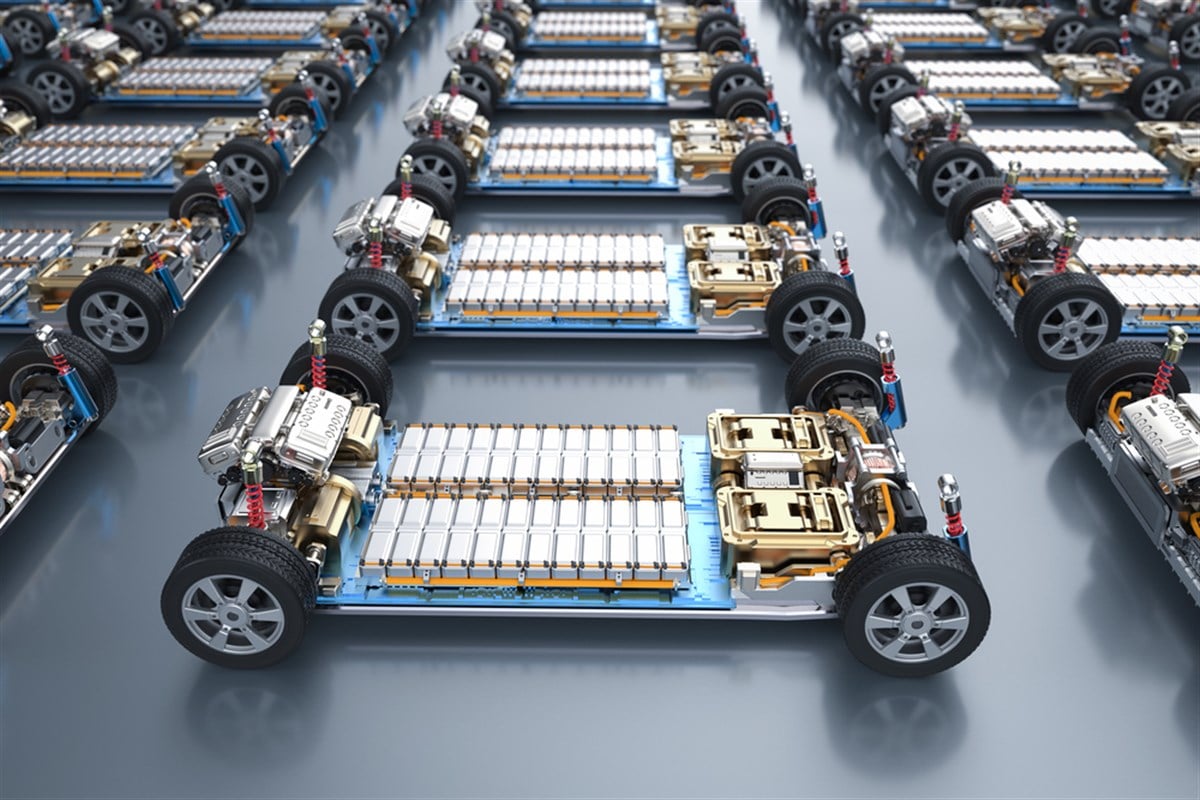

Microvast: Producing the Next Generation of Lithium-Ion Batteries

Microvast designs, develops, and manufactures lithium-ion battery solutions. The vertically integrated company is a recognized innovator in the sector, and its products cover commercial transportation, heavy equipment, and energy storage solutions.

On the positive side, Microvast has over 630 patents and controls every aspect of its development process starting with research & development through to manufacturing.

In its second-quarter 2024 earnings report, delivered on August 9, the company announced a record $84 million in revenue. This was 12% higher YoY, but it missed analysts’ expectations of $87.5 million. The company also reported negative earnings per share of 21 cents, which was significantly worse than the negative one-cent EPS analysts expected.

In a separate regulatory filing since the earnings report, the company announced it was suspending construction of its factory in Clarksville, Tennessee. Like many small companies, the construction is being held up due to financing. Once up and running the plant is expected to bring 290 jobs.

MVST stock was already heading lower after the earnings report. The news about the construction delay has pushed it to a 52-week low of around 31 cents.

FREYR: Addressing the Dirty Secret of Many Clean Energy Solutions

FREYR Battery is a Norwegian company that is working to create industrial-scale clean energy battery solutions for energy storage, EV, and marine applications. In doing so, the company is highlighting one of the concerns in the global shift to electric vehicles – particularly those that use lithium-ion batteries. That is, they’re not truly clean energy.

While that sounds good on paper, turning this vision into reality will take time. Not only is FREYR Battery unprofitable it is generating little to no revenue. Adding to the puzzle for investors, the company has yet to build its first gigafactory in its home country. And while it has plans to build a factory in the United States, that seems to be years away.

However, in the company’s most recent earnings presentation, it reported having $222 million in cash and no debt. FREYR believes it has a cash runway into 2026 with the company forecasting first revenue in 2025.

After initially falling after the report, FREY stock has recovered slightly, but it’s still down about 35% in 2024 and is also trading near its 52-week low.

If You Had to Pick One...

The global lithium-ion battery market faces an issue of oversupply. That is likely to work itself out over the next year regardless of the result of the November election. The renewable energy transition may be slowing, but it’s not stopping. And both of these companies could be looking at solutions for the next wave of growth.

That said, both companies represent a significant risk to investors. But if I had to pick one, I’m choosing Microvast. The company is heavily focused on energy storage solutions which are going to be in high demand if for no other reason than the continued expansion of data centers. The company also has a solid backlog of projects which supports its own guidance for revenue growth between 6% and 12% in the coming quarter.

Small-cap companies, particularly unprofitable ones, don’t generally receive a lot of analyst coverage. That’s true of both Microvast and FREYR Battery. However, the four analysts that have issued a price target on MVST stock give it a consensus price target of $4.50. That's over 1,350% above its August 16, 2024 price.