GitLab’s (NASDAQ: GTLB) post-release plunge was not as large as it could have been, but the weaknesses were already priced in. The stock price fell 15% the week before after results from MongoDB (NASDAQ: MDB) and UiPath (NYSE: PATH) undercut the outlook for AI and IT spending this year. The takeaways, however, are that the tech sector is growing, albeit at a less robust pace than prior forecasts, and AI is leading the technology industry, setting these businesses up for long-term success.

GitLab Had a Solid Quarter, Guides for Growth

GitLab had a solid quarter with revenue of $169.2 million, growing more than 33% YoY and outpacing the consensus by 180 basis points. The strength is driven by increasing customer count and penetration, with clients contributing more than $5,000 in ARR up 21% and clients contributing more than $100K in ARR up 35%. Net retention rate, a measure of revenue growth from existing clients, came in at 129%, indicating nearly 30% comp-client growth compared to last year. RPO, a leading indicator of future business, is strong and up 48%.

The margin news is good. The company continues to post GAAP losses but has significantly improved its operating and adjusted operating margin over the last year. The takeaway is that cash flow and adjusted free cash flow are positive in Q1 for the first time, and the adjusted earnings came in well above forecasts. The $0.03 is $0.07 better than forecast and suggests the guidance may be weak.

Guidance is good but fell short of the consensus, leading to some weakness in the stock price in premarket trading. The company expects Q2 revenue from $176 to $177 million for roughly 5% sequential growth and 26% compared to last year. As good as 26% growth is, it is shy of the consensus and slowing compared to last year and the first quarter, which is a problem for highly-valued tech growth stocks. This stock trades over 100X earnings for this year and next, providing a substantial headwind for the market.

Analysts Reset the Outlook for GitLab

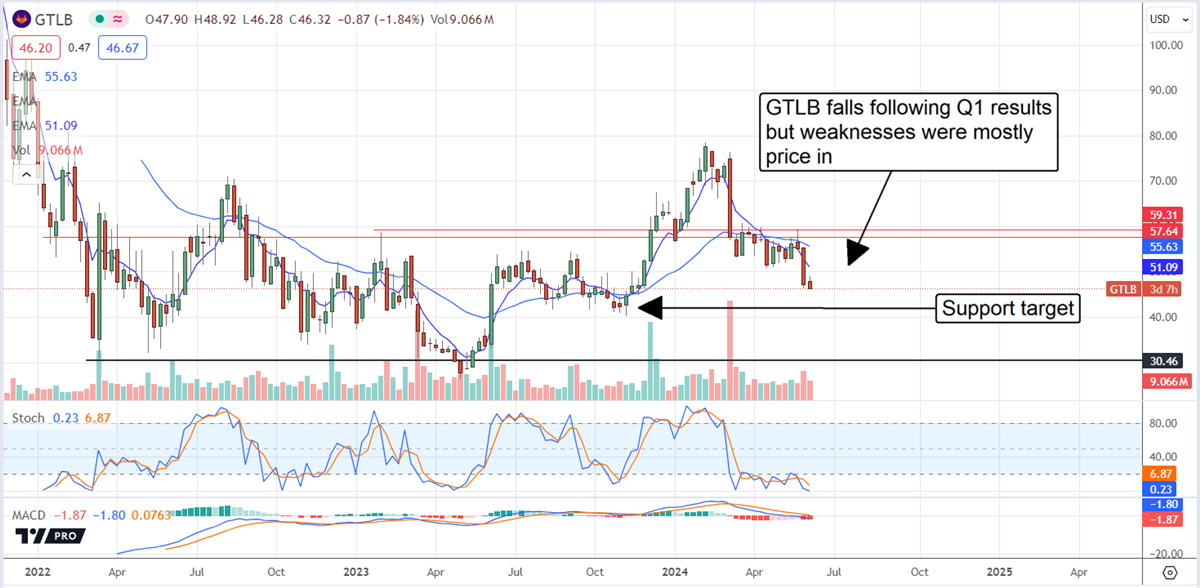

The analysts are resetting the outlook for GitLab stock following the release. MarketBeat.com tracked nearly a dozen revisions within the first 12 hours, including a price target reduction. The new targets include a fresh low target of $50, and most are below the consensus, but all assume some value remains for investors. The $50 low price target is still $3 or about 6% above the current action, suggesting a floor for the market. Assuming the market follows through on the indication, this stock should move sideways soon and may even begin to rebound over the summer.

Despite the price target revisions, GitLab remains one of the top-rated stocks tracked by MarketBeat. The top-rated stocks are the 150 stocks with the highest average analyst rating over the past 12 months, with a minimum of five reports. GitLab has a strong following, with 25 analysts rating it as a Moderate Buy and about 35% upside at the new consensus, which is near $65.

GitLab Heading for Lower Prices

GitLab’s weak guidance was expected by the market and priced into the stock, but that doesn’t mean it can’t move lower now. The high valuation alone is enough to keep the stock price capped, and the analysts aren’t helping with downward revisions to the price target. Investors might expect this stock to move down to critical support near $40, if not the bottom of the trading range, before finding solid support.

A move to $40 may trigger a strong market response because of institutional interest. For over a year, the institutions have bought this stock at a 2:1 pace compared to sellers and own more than 90% of the shares. That is a robust vote of confidence in the company, and the largest shareholder is Google (NASDAQ: GOOGL).