Three industries have historically proven recession-proof: government, education and healthcare. People still need education and healthcare during the good and bad times. Nations need a government to operate in any economic condition. Government intelligence, national security and military are primary functions that remain a high priority during economic cycles. While recession fears have been ongoing since 2022, these are two companies utilizing artificial intelligence (AI) technology that thrive during this period of economic uncertainty and can continue to thrive in the event of a recession.

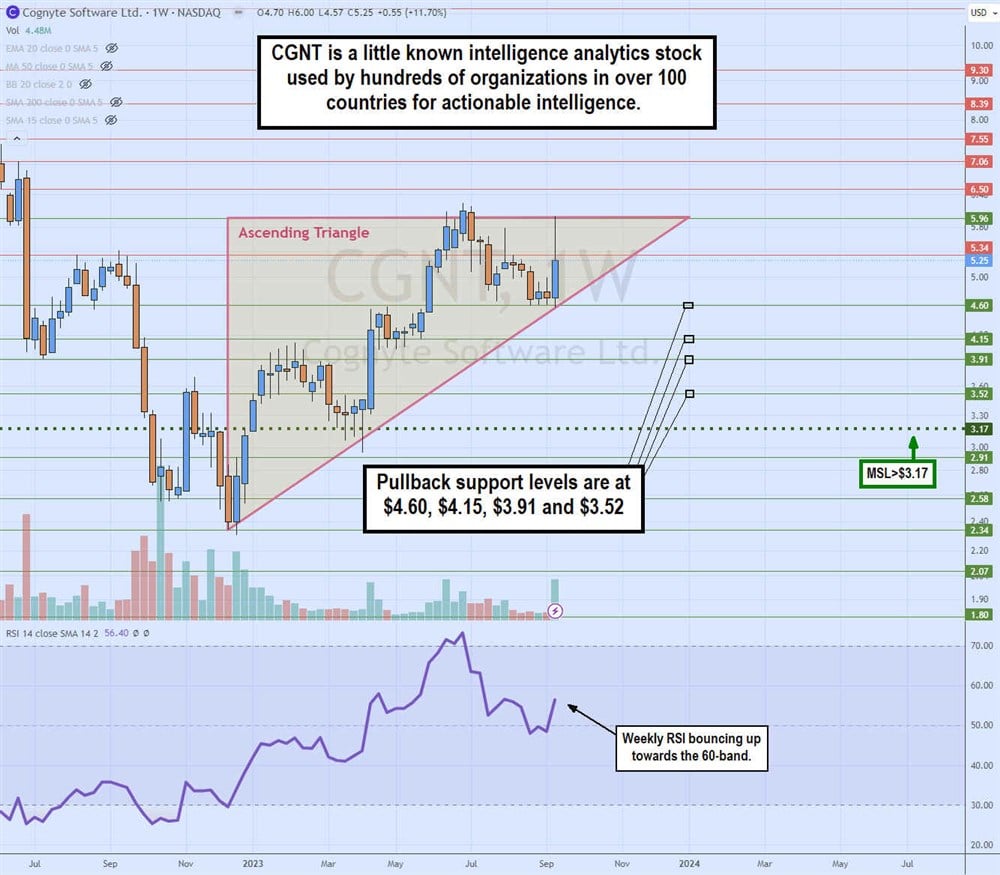

Cognyte Software Ltd. (NASDAQ: CGNT)

Cognyte provides investigative AI-powered analytics software to governments and enterprises worldwide. From governments, intelligence, and law enforcement to financial institutions and organizations responsible for public safety, Cognyte provides "Actionable Intelligence for a Safer World." Its platform collects, fuses and displays disparate data sets to help agencies and security departments detect and investigate safety, security and fraud crimes more quickly and efficiently. Clients use the platform in more than 100 countries.

Earnings Beat

Cognyte reported a fiscal second-quarter 2024 earnings-per-share (EPS) loss of 9 cents versus analyst expectation for a loss of 21 cents, a 12-cent beat. Revenues fell 4.9% YoY to 73.87 million, still beating the $73.87 consensus analyst estimates. Shares soared by 20% as the company laid a bullish picture ahead, driving higher guidance estimates.

Cognyte CEO Elad Sharon commented, "We won deals with existing and new strategic customers who recognize the strength of our innovative technology and its value. Given the Q2 results, we are raising our outlook for the year for non-GAAP revenue, gross margin and EPS,"

Raising the Bar

Cognyte raised guidance for the fiscal full-year 2024 to $307 million with a midpoint range of +/- 1% to 2% and 8.5% growth from the previous year's SIS-adjusted non-GAAP revenue. Diluted non-GAAP EPS loss is expected to be 33 cents, the midpoint of its revenue outlook. Stock-based compensation is expected between $11 million to $13 million.

Cognyte Software analyst ratings and price targets are at MarketBeat.

Cognyte Software peers and competitor stocks can be found with the MarketBeat stock screener.

Weekly Ascending Triangle

CGNT formed an ascending triangle pattern after bottoming at $2.34 in December 2022. Shares continued to rally towards the flat-top resistance upon triggering the weekly market structure low (MSL) breakout through the $3.17 trigger. Each bounce and pullback was met with higher lows until reaching the $5.96 flat-top horizontal trendline resistance, which continues to elude a breakout. The weekly relative strength index (RSI) attempts to bounce back towards the 60-band as shares test the ascending diagonal trendline. Pullback support levels are at $4.60, $4.15m, $3.91 and $3.52.

Palantir Technologies Inc. (NASDAQ: PLTR)

Palantir provides AI-powered big data analytics software to governments, intelligence agencies and commercial clients. Its platform lets clients visualize and analyze large data sets to spot trends and patterns that can assist in actionable decisions. It's been riding the AI trend and benefiting from geopolitical uncertainty as allied nations sign on to its platform. Palantir AI has been credited for many of the tactical successes of Ukraine's forces in its conflict with Russia.

This has caused other nations to board for security, terrorism and other national security threats. Palantir has been focusing on growing its commercial customers to grow its business mix while securing government contracts. Financial institutions have come on board to detect and prevent fraud and financial crimes, while corporations are adopting the platform for their business decision-improvement capabilities. The company has technically reached profitability after 16 years in business.

Earnings Beat and Raise

On August 7, 2023, Palantir reported Q2 2023 EPS of 5 cents, meeting consensus analyst estimates for 5 cents. It recorded GAAP earnings for 1 cent per share or $28 million net income. GAAP income from operations was $10 million, representing a 2% margin. Revenues grew 12.7% YoY to $533.32 million versus $533.38 million analyst estimates. The Board authorized a stock buyback program of up to $1 billion.

Revenue Growth by Segment

Commercial revenues rose 10% YoY to $232 million, with U.S. commercial revenues increasing 15% to $103 million. Government revenues rose 15% YoY to $302 million. International revenues grew 31% YoY to $76 million. Palantir grew its customer count by 35% YoY to 161 customers. The company closed the quarter with $3.1 billion in cash and cash equivalents.

Palantir CEO Alex Karp commented, "We see a market, especially in the U.S., which is hungry for an ability to apply AI, both large language models and algorithms, to transform our businesses. I believe this transformation will change the GDP of America and that Palantir will participate in that -- in the delta between where the GDP is now and where it will get to be powered by unique technologies that are almost exclusively being built in the United States and are being adopted more rapidly and more efficiently with more vigor."

Palantir Technologies analyst ratings and price targets are at MarketBeat.

Palantir Technologies peers and competitor stocks can be found with the MarketBeat stock screener.

Weekly Cup and Handle Pattern

The weekly candlestick chart illustrates the cup and handle pattern attempt. The $20.24 cup lip line formed in December 2021 as PLTR proceeded to sell off to the low of $5.92 in December 2022. Shares formed a rounding bottom and continued to rally back to the $20.24 lip line in July 2023. PLTR sold off to $13.68 before forming the market structure low (MSL) breakout trigger above $16.35. The weekly RSI is attempting to coil back to the 60-band. Pullback support levels are at $13.68, $12.52, $11.62 and $10.61.