If you're like most traditional investors, you were probably first exposed to meme stocks during the great GameStop bull run of January 2021.

While GameStop showcased the power of social media sentiment to influence the market, it isn't the only investment that users are meme-ing — including a few options to include these investments as diversified ETFs. Read on to learn about meme stock ETF options, some examples of meme stocks and some of the benefits that adding these often-volatile investments to your portfolio might have.

Overview of Meme ETFs

Before discussing the meme economy and the specifics of meme ETF stock prices, it's important to define ETFs and understand how they vary from individual stocks. "ETF" stands for "exchange-traded fund," a grouping of stocks that trade together as a single unit. When you purchase shares of a fund, you pool your money under the fund's management team, which divides investor funds among the holdings laid out on its website.

Tools like MarketBeat's ETF screener can help you narrow down funds by holdings, helping you identify assets that meet your goals.

Investing in an ETF provides many benefits over picking and choosing individual stocks. When you buy into an ETF, you gain exposure to all the assets listed as part of the ETF. Your losses won't be as concentrated should a particular stock fail to perform as you expect. In other words, ETFs provide access to investments across a sector, diversifying your holdings.

As you might suspect, given the name, meme ETFs are exchange-traded funds centered around meme stocks. Meme ETF holdings are primarily composed of "meme stocks," an affectionate nickname for stocks that experience rapid and often unpredictable price movements driven by online communities. While the most famous meme stocks are retail stocks, a meme stock can pop up in any sector in which online communities collectively see potential.

Meme stocks can be risky for long-term investors due to their inherently volatile nature. The popularity and price movement of meme stocks are not necessarily based on the company's fundamental financial performance but rather on the fuel of social media and online communities to influence market sentiment and trading behavior. These social media websites may have dubious fact-checking information and resources, causing misinformation to spread quickly.

Despite this, meme stocks are popular, especially among tech-savvy short-term traders. Meme ETFs can offer exposure to various meme stocks without the versatile market research skills required to determine which stocks are trending and which meme ETF stocks are priced for a rebound. While there are currently limited ETFs for meme stocks that explicitly call themselves "meme-oriented," tech-forward ETFs can help you stay on the cutting edge of consumer preferences.

Examples of Meme Stocks

Before investing in a meme ETF, it's important to understand which assets qualify as meme stocks. While the definition of a meme stock might change depending on the context, most are lower-cost, highly publicized consumer goods shares. Recent meme stock picks have also centered around tech and cryptocurrency, including EV stocks and stocks that support the EV charging infrastructure. Actively managed meme ETFs may integrate data from online forums like WallStreetBets when selecting assets for inclusion.

Some examples of meme stocks include the following:

- GameStop: Perhaps the first and the most well-known meme stock, GameStop (NYSE: GME) became a public name in January 2021 when investors banked on a short squeeze on the stock. GameStop quickly saw an extraordinary price surge fueled by Reddit users, calling national attention to the influence social media could have on share prices for the first time.

- AMC Entertainment: AMC Entertainment (NYSE: AMC) is a chain of movie theaters hit particularly hard by the effects of the COVID-19 pandemic. Shortly after GameStop became a meme stock, investors began to look for opportunities to challenge short sellers in other areas. AMC became the next target, reaching a peak price of about $35 in June 2021.

- Palantir Industries: While not a meme stock in the same sense as GameStop or AMC, Palantir Industries (NYSE: PLTR) is another favorite of online investors. Since its initial public offering, Palantir received attention from retail investors, particularly due to its association with prominent figures like Peter Thiel, who co-founded the company. It saw a price surge that benefitted early investors who connected via social media and is now a major component of the Roundhill Meme ETF.

- SoFi Technologies: SoFi Technologies (NASDAQ: SOFI) is a financial technology company that offers various products and services, including personal loans, student loan refinancing, mortgages and investment services. SoFi's claim to fame is its ease of use, combining a simple online application process with a lack of in-person representatives, which allows the company to offer lower rates. After stirring up attention on social media, SOFI's IPO and subsequent success led it to be another significant inclusion in most meme-oriented ETFs.

Remember that by definition, meme stocks will come into and fade out of popularity. Maintaining an active portfolio management strategy can help you better capitalize on these often-unpredictable price movements.

Why Invest in Meme ETFs?

While meme stocks and ETFs can be volatile assets, this volatility can benefit investors in some circumstances:

- High short-term returns: Meme stocks have the potential for rapid and significant price surges in a short period, resulting in corresponding rises in ETF prices. Investors who can time their entry and exit points correctly can make substantial gains in a short time frame.

- Chance of higher returns for smaller investors: Meme stocks often attract individual retail investors with limited resources compared to institutional investors. Participating in meme stock investing allows smaller investors to engage in the stock market and potentially access significant returns.

- New education opportunities: Meme stock investing can be an educational experience for some investors, especially those new to the stock market. It can provide a chance to learn about market dynamics, trading strategies and the impact of social media on stock prices while also utilizing your favorite social media sites. If investing seemed too intimidating, meme stocks could be a great place to start learning.

3 Best Meme ETFs to Buy Now

Now that you understand what meme stocks are and how they come together to form meme ETFs, let's look at some of the top meme stock-containing ETFs on the market. Investing in multiple ETFs can give you broader exposure to the "meme market" and limit losses if the market turns negative.

1. Roundhill MEME ETF

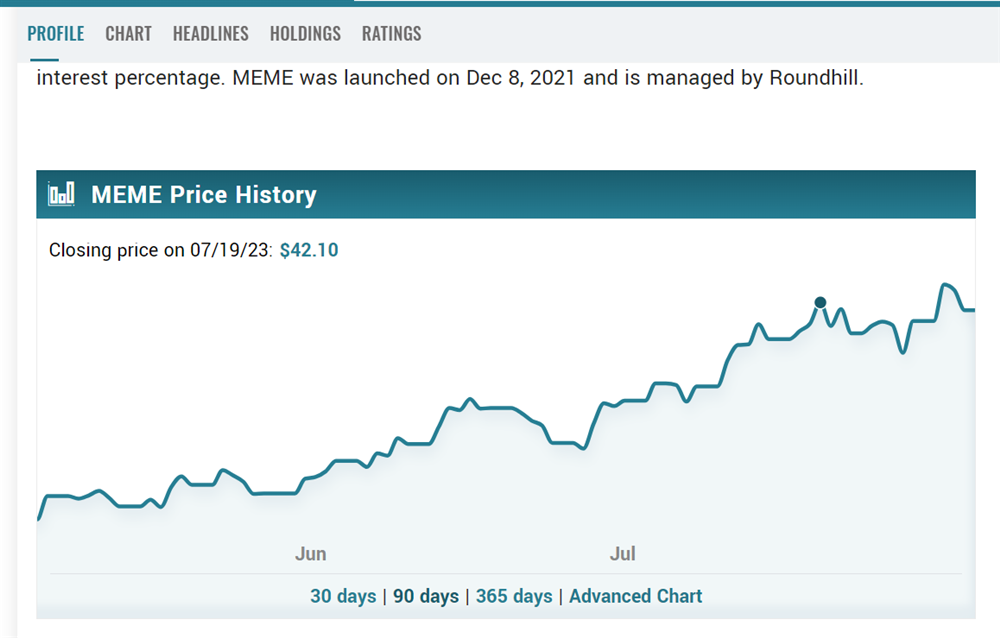

The Roundhill MEME ETF (NYSE: MEME) is a one-of-a-kind ETF investment and the first to use social sentiment to calculate its holdings. MEME tracks the Solactive Roundhill Meme Stock Index, which consists of 25 equal-weighted U.S.-listed equity securities that exhibit a combination of elevated social media activity and high short interest. This combination capitalizes on the same price movements that propelled GameStop and AMC to price discoveries in January 2021.

Image text: Despite its reliance on of-the-moment meme stocks, Roundhill's meme ETF price has remained on an upward trajectory for the past three months.

The underlying index rebalances every two weeks, meaning that the fund is also actively rebalanced regularly. This makes MEME a particularly dynamic option, which can be a strong choice if you want to add a layer of high-risk, high-reward assets to your portfolio. The expense ratio of 0.69% is also affordable compared to other actively managed options, meaning you'll lose less of your dividends.

2. Roundhill Ball Metaverse ETF

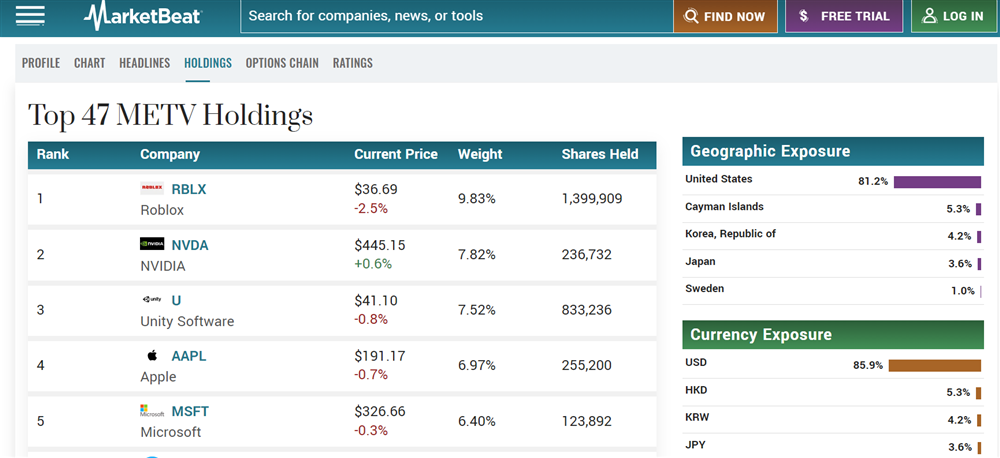

Another top meme stock, some investors believe that Meta Platforms (NASDAQ: META) will bring about a new wave of internet companies that will change the current online landscape. The Roundhill Ball Metaverse ETF (NYSE: METV) tracks the performance of Roundhill's proprietary Ball Metaverse Index, a tiered weight portfolio of globally-listed companies actively involved in the Metaverse. Some of the fund's top holdings include Roblox Corporation (NYSE: RBLX), NVIDIA Corporation (NASDAQ: NVDA) and Unity Software Inc. (NYSE: U).

This fund's makeup can make it a beneficial portfolio inclusion for anyone looking to invest in the Metaverse beyond the company formerly known as Facebook. While Meta makes up a major percentage of METV, it also contains 46 additional companies, providing more diverse integration for investors.

3. Fidelity Crypto Industry and Digital Payments ETF

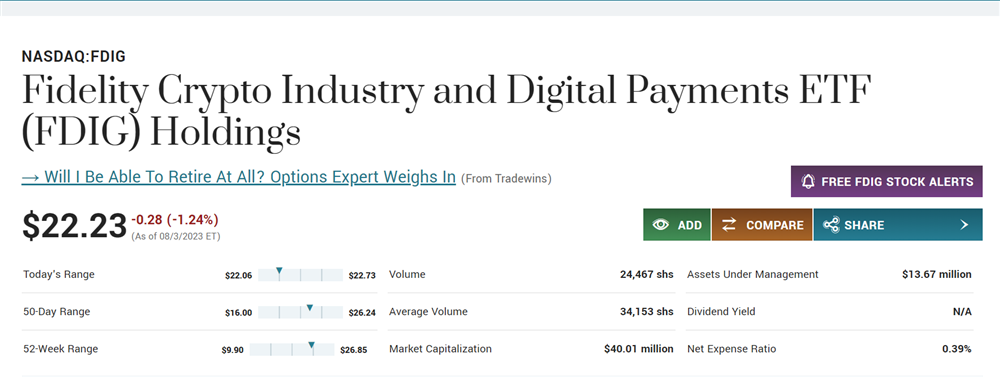

In addition to stocks, members of finance-oriented social media forums also regularly discuss crypto projects. While the Fidelity Crypto Industry and Digital Payments ETF (NASDAQ: FDIG) isn't quite a meme stocks ETF, it does help you take advantage of the social media sentiment surrounding hot cryptocurrency projects. For example, one of the fund's top holdings is in Coinbase Global (NASDAQ: COIN), a top cryptocurrency brokerage that tracks social media sentiment when considering which assets to offer to its buying platform.

If you're more interested in cryptocurrency memes but not in the volatility of crypto tokens, an ETF like FDIG can offer an excellent learning experience. The fund's total market capitalization of more than $40 million in August 2023 also makes it a more stable choice for sometimes-volatile meme assets.

Memes or Dreams?

While it can be easy to focus on meme stock success stories, it's important to remember that financial misinformation can often spread more quickly than info on genuine opportunities. For example, investors who quickly jumped in on a cryptocurrency themed around the hit South Korean drama Squid Game found themselves victims of a rug pull scam. You can limit your risk when investing in meme stocks by limiting investments to individual shares rather than options contracts and purchasing only assets listed on major exchanges like the New York Stock Exchange. As with any unique asset, invest only what you can afford to lose.

FAQs

Before investing, you might have the following last-minute questions about meme stocks and meme ETFs.

What is a meme fund?

A "meme fund" is usually a meme ETF like the Roundhill MEME ETF. This ETF incorporates social media sentiments (like those expressed on meme forums like WallStreetBets) into its index weighting. This dynamic rebalancing strategy aims to provide short-term returns.

What is the meme stock index?

The Roundhill Meme Stock Index is an index that weights companies based on factors like short interest and social media sentiment. It favors meme stocks that showcase elevated social media activity and high short interest.

What are the four phases of the meme stock cycle?

The four main phases of the meme stock cycle are the early adopter, middle, FOMO and profit-taking phases. Early adopters are the trendsetters in the meme stock cycle and identify an opportunity before the bulk of adopters (the middle) popularizes it. FOMO stage investors may lose money as the profit-taking stage arrives and early adopters take their returns.