MetLife's stock (NYSE: MET) has endured a rather forgettable year. Up to this point in the year, the stock has experienced a decline of nearly 14%, significantly lagging behind the broader market. Nevertheless, over the past few months, MET's shares have managed to mount a recovery, surging by almost 24% from their low point in June.

The current resurgence in MET's performance, combined with its bullish consolidation pattern and a higher low as several important moving averages converge, warrants attention as a potential signal for further upward movement.

MetLife is a global financial services company offering insurance, annuities, employee benefits, and asset management. It operates through five segments: U.S., Asia, Latin America, Europe, Middle East and Africa, and MetLife Holdings. MetLife has a long history since its founding in 1863 and is headquartered in New York.

The Opportunity In MET

With the stock trading confidently above its rising 5-day Simple Moving Average (SMA) and 50-day SMA, while consolidating in a tight range near the pivot-high, it is now showing a strong bullish trend. The recent uptrend and consolidation above two key moving averages is an evident change of character for the stock and signals a significant shift in momentum and direction.

Notably, an attractive setup has now formed, with a break of the consolidation resistance acting as confirmation of a breakout. If the stock can break over the consolidation resistance of $62 and hold above it with increasing volume, it might be gearing up for a move back above the 200-day SMA and potentially $66.

Recent Earnings and Dividends

On August 2nd, 2023, MetLife released its quarterly earnings. The company exceeded expectations with earnings per share (EPS) of $1.94, surpassing the estimated $1.85 by $0.09. The quarter's revenue was $16.62 billion, slightly below the anticipated $16.91 billion. This still marked a 7.4% increase compared to last year's period.

Over the past year, MetLife has achieved $2.57 in earnings per share over the past year and currently holds a price-to-earnings ratio of 24.2. The company anticipates an 18.89% earnings growth in the upcoming year, expecting earnings to rise from $7.78 to $9.25 per share.

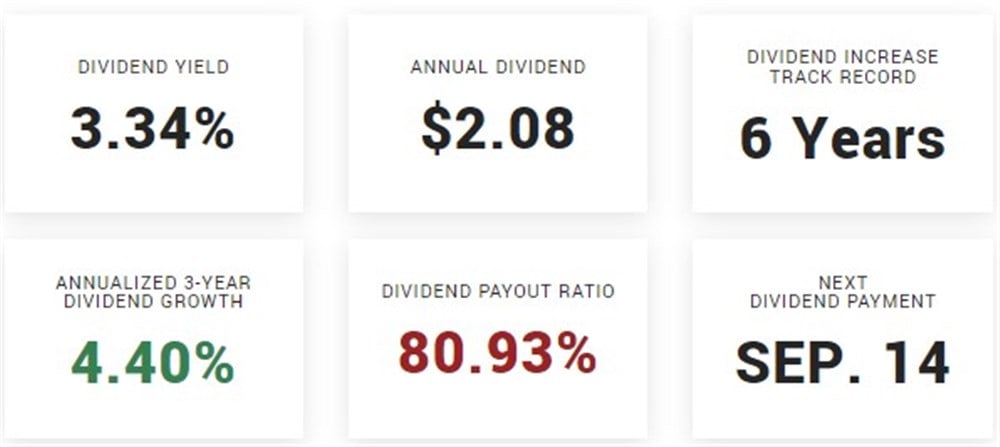

MetLife offers an attractive dividend yield of 3.34%. Over the last several years, MET’s dividend payments have modestly increased, from $0.46 in Q3 2020 to an expected $0.52 in Q3 2023. However, the company's annual dividend of $2.08 is less than the average annual dividend of relevant listed financial companies, $6.21, but greater than its competitors listed on the NYSE, $1.53.

Analysts See Upside For MET

Analysts are predicting a significant upside for shares of MET. Based on eleven analyst ratings, the consensus price target is $77.40, expecting an impressive 24.30% upside for the stock. MET has a consensus rating of Moderate Buy, with eight analysts placing the stock as a Buy and three as a Hold. The rating is above the consensus rating of finance companies, which currently stands at Hold.