Twilio (NYSE: TWLO) has become a forgotten name since coming off about 84% from its pandemic highs, set in February 2021. The communication technology company was a favorite amongst growth players. Still, since its sharp decline over the past two years, it has fallen off the radar of many. However, could shares of the company be set to stage a comeback now that the downtrend on a higher timeframe has broken? And do the changing fundamentals of the company point towards future success?

Twilio is a leader in the communication technology industry in the U.S. The company provides programmable communication tools through its web services APIs. The company'scompany's mission is to fuel the future of communications by providing developers and businesses with powerful tools to create innovative and engaging customer experiences. The company'scompany's products and services include messaging, voice, video, and email.

Where Have Shares of TWLO Come From?

Long-term shareholders will want to avoid being reminded of the stock's performance on a higher timeframe. However, it is not all bad news. Although shares of TWLO were stuck in a downtrend for over two years, this year'syear's action points towards a possible shift in momentum. Over the previous month, shares have gained by 43%, and YTD is up almost 39% as the price stabilizes.

The downtrend broke at the beginning of the year, and shares have since been able to consolidate and show signs of price stability and support while steadily climbing. More recently, TWLO has been trading in a tight consolidation between the 5d and 50d SMA, near resistance around $75 - $80. A break above this key area would confirm a bottom and momentum shift. The tides are turning for shares of Twilio.

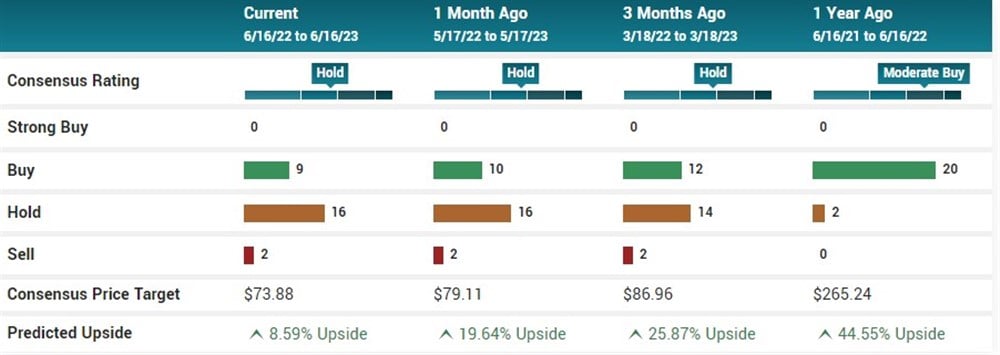

Analysts Are Mixed

Analysts are mixed on the name, with the consensus rating amongst 27 being Hold. The consensus price target is $73.88, predicting a mere 8.59% upside in the name. That price target has steadily decreased, with the PT at $79.11 one month ago and $86.96 three months ago. 16 of the 27 analysts have shares at Hold, while only 8 are at Buy.

Insider Selling Has Finally Slowed

Throughout the pandemic, as company shares soared to new heights, insiders appeared to take advantage as they consistently sold shares. The good news, however, is that since Q2 of 2022, insider selling has dried up, and net insider transactions have now swung positively. Over the past year, net insider transactions have been $3.42 million of stock purchases.

Recent Results and Outlook

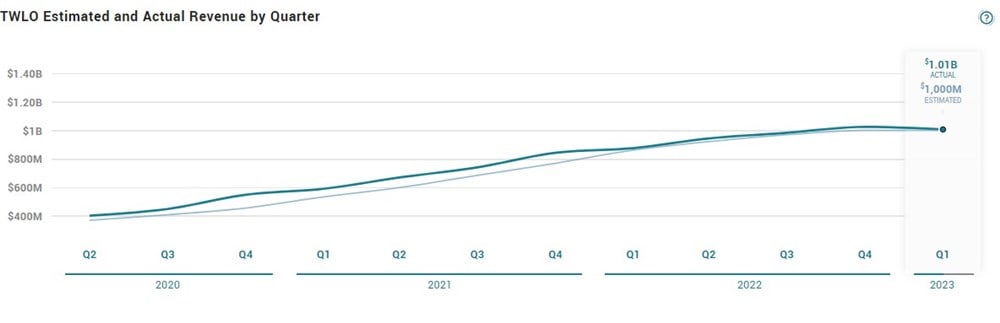

The company reported Q1 results in May, surpassing expectations. However, its guidance for Q2 fell short. Twilio reported $1.01 billion in revenue versus the $1 billion expected. Earnings came in at an adjusted 47 cents per share versus the expected 21 cents per share. The company gained 10,000 customer accounts during Q1, totaling over 300,000 active accounts.

Guidance was sluggish for Q2, as the company said adjusted earnings would be 27 cents to 31 cents per share on $980 million - $990 million revenue. Analysts estimated 29c per share earnings on $1.05 billion in revenue.

Historically, TWLO has consistently beaten analyst estimates for sales, and investors will be hopeful that the company can surprise for Q2 results. Declining revenue would break the 3-year trend of revenue growth topping estimates.

Should you invest?

Recent signs of price stabilization and a break in the downtrend indicate a potential comeback for the stock. While analysts hold mixed opinions, the insider selling slowdown and the company's ability to beat Q1 estimates provide hope for investors. In the short term, a break over key resistance could provide a momentum opportunity for traders and investors looking to capitalize on a reversal move, albeit short-lived. However, investors will need to focus heavily on the upcoming Q2 results, which will determine whether the company can reverse the trend on a higher time frame.