Tilray Brands (NASDAQ: TLRY) reported a mixed quarter and a deal to acquire HEXO that sent the market moving lower. While the news is less than spectacular, there are some takeaways for investors to be aware of. Among them is the consolidation of the Canadian cannabis market, a bonus for businesses and consumers. The smaller players still struggle with profitability; the efficiencies of scale will allow them to make money, and Tilray is on the cusp of that. The company reiterated its expectation for positive free cash flow this fiscal year, which means the current quarter.

However, positive FCF may not be the catalyst for share prices it should be because US legalization is still such a far-off event, and that is the true catalyst for the cannabis market. Even so, investors should not expect a cannabis boom once legalization hits; people who want to use cannabis were doing so before legalization (as was seen in Canada), and that won’t change much afterward. What will change is that markets will come into the light and allow for cash flows that governments can tax and large corporations can use to pay dividends.

The question is if Federal Legalization will create an environment in which legal cannabis can flourish or if it will be so expensive the black market continues to thrive.

The real winners of US legalization are the major tobacco, alcohol and pharma companies. They have the land, the facilities, the money, the distribution networks and the retail relationships to get cannabis everywhere it needs to be. While the tobacco companies are not investing directly in cannabis, they are partnering with cannabis companies to gain toeholds on a cash cow that will get them off of tobacco.

As a leading, integrated cannabis company with partnerships including Charlotte’s Web (OTCMKTS: CWBHF), Novartis (NYSE: NVS) and Altria (NYSE: MO) (via the Aphria merger), Tilray is in a prime position to capitalize on US legalization.

Tilray Brands Has Mixed Quarter, Shares Fall

Tilray Brands had a mixed quarter with revenue of $145.59 million, falling 4.1% compared to last year. The revenue also missed the Marketbeat.com consensus estimate by 800 basis, but only some news is terrible. The company's distribution revenue grew by 5%(12% on an FX-neutral basis), and the margin was improved. The gross margin is still negative but up compared to last year, while the adjusted gross margin improved by 400 basis points on a 1400 basis point improvement in cannabis margin. The bottom line results are still negative on a GAAP and adjusted basis, but the adjusted EBITDA was positive and the adjusted EPS of -$0.04 beat by $0.02.

Another takeaway from the report is the balance sheet. The company is sitting on over $400 million in cash, with FCF expected this quarter. This should be ample capital for investment and consolidation while the company waits for US lawmakers.

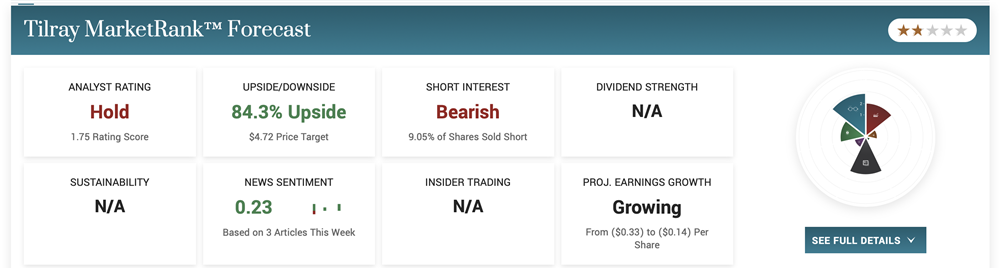

The Technical Outlook: Tilray Brands Is At A Bottom

The price action in Tilray Brands suggests the market is at another bottom. The operative word is another because this stock has been in a downtrend since the COVID-induced peak of 2021. The market may be able to move higher in the near to mid-term, but without profits, that move will be capped, possibly by the 150-day EMA. The market may reverse if the company produces positive FCF and profits next quarter. If it can sustain profits and whittle down debt, it could trend higher. Until then, this is another risky penny stock investors should be cautious with.