The offshore drilling industry was destroyed by the COVID crisis, with many companies like Valaris (NYSE: VAL) going bankrupt due to low oil prices. But the industry is rebounding, and drilling companies are receiving top dollar to rent their rigs.

But it's not the same old cycle. While ramp-ups in oil and gas are typically met by swift new supply, resulting in a boom and bust cycle, that isn't happening this time. A decade of underinvestment in capital expenditures across the industry leaves the supply of drilling rigs low, even as it becomes profitable to operate them with little prospect of new supply on the horizon.

As a result, offshore drilling stocks have been on a tear since 2021, with the VanEck Oil Services ETF (NYSE: OIH) rising about 65% in 2022.

This article will look at two well-positioned stocks to benefit from this trend.

The Rundown on Offshore Drilling

Let's dive into the offshore drilling industry to understand how it works.

At the bottom of the ocean lie oil wells that oil companies desperately want to tap into. But extracting the oil requires expensive and sophisticated drilling rigs designed for the job, and that’s where offshore drillers come in.

Drilling companies rent out these rigs to oil producers for a negotiated rate over a specific period, ranging from a few months to several years. This rate is constantly changing and is heavily impacted by oil prices and other relative oil drilling opportunities.

For instance, Brazilian oil giant Petrobras (NYSE: PBR) recently inked a $500 million contract with driller Valaris (NYSE: VAL) to lease one of its large drillships, which is used to drill in the deeper parts of the ocean.

To compare this contract with smaller ones, investors use a crucial metric called the "day rate," calculated by dividing the total contract value by the number of days in the contract. In this case, the day rate for this contract is $456,000 per day. Tracking day rates across the industry is crucial for understanding how it's faring.

Fleet utilization is another critical factor, representing the percentage of rigs under contract and generating revenue. When utilization is low, drillers must accept lower day rates as many boats compete for a smaller pool of buyers. But when utilization gets high, the supply of available ships is low, giving drillers much more leverage in contract negotiations.

The Supply and Demand Story

Wall Street swore off the energy industry after the shale boom busted in 2014. The sector became starved for capital because investors didn't trust oil and gas management teams with their money.

As a result, the industry has underinvested over the last decade, and companies didn't make the necessary investments to deal with a quick uptick in demand.

The COVID crisis only made things worse, as the downward price shocks in oil forced many firms into bankruptcy, which led to industry consolidation. Even after getting a footing when oil prices started to rise in late 2020, investors demanded profits to be distributed back to them. Meanwhile, geopolitical events like Russia's invasion of Ukraine added tremors to the market, exacerbating the supply-demand imbalance.

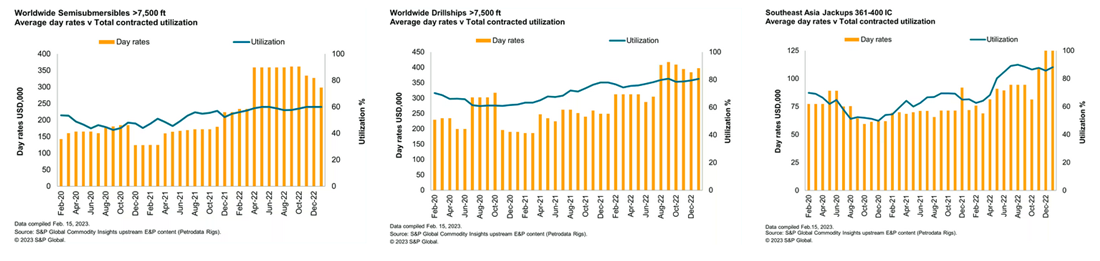

The second half of 2022 might serve as a signpost, as critical metrics like day rates and utilization are starting to tick up and fast. This all comes while significant demand catalysts like China's reopening are on the horizon. This backdrop looks like a recipe for increased profits for the drilling industry to many investors.

Industry-wide data from S&P Global shows a significant rise in day rates in the second half of 2022, continuing into the beginning of this year.

Valaris

Let's take a closer look at Valaris (NYSE: VAL), one of the biggest offshore drilling companies in the world, with a whopping 51 rigs in its fleet, divided between 36 jack-ups and 16 floaters. With major customers like ExxonMobil, BP, and Chevron, the company has a strong presence in key oil-producing regions like the Gulf Coast, West Africa, and the Middle East.

But Valaris struggled like many in the industry during the pandemic-induced crash in the oil and gas business, ultimately going bankrupt in 2020 due to overwhelming debt. However, the company emerged from bankruptcy in May 2021 as a reorganized entity with a significantly cleaner balance sheet and no net debt.

This puts them in a much stronger position than heavily leveraged peers like Transocean (NYSE: RIG), which has $6.3 billion in net debt. As a result, Valaris' stock has risen over 200% since emerging from bankruptcy, significantly outperforming the oilfield services sector, which rose 75% over the same period.

Based on management guidance, the company is trading at 16 times 2023 EV/EBIDTAR, which doesn't scream "bargain,", especially for such a cyclical industry. However, things are just beginning to roll for the industry.

However, the company recently signed a 3-year contract with Petrobras worth $500 million, with a day rate of $456,000, more than double its average floater day rate in the fourth quarter of 2022.

If the Petrobras contract is a sign of things to come, Valaris has a very bright few years ahead of it.

Tidewater

Tidewater (NYSE: TDW) primarily supports the offshore drilling industry. Rather than owning and operating its own rigs, the company operates a vessel fleet that provides services to drilling companies and oil producers. These boats do things like:

- Transport supplies like fuel, drilling materials, water, etc.

- Move things around for rigs.

- Transport rig personnel to and from rigs.

What's interesting about Tidewater is they're one of the only US-based publicly traded "OSV" (offshore support vessel) companies today. They're a niche player compared to the global oil and gas sector. So why are OSVs interesting right now? Because nobody is building them. The shipyards that typically build them are booked up, building other oil and gas vessels that are more profitable with customers they trust more.

So the current supply of OSVs is somewhat frozen. The existing boats are essentially what the industry has to work with for the next couple of years. So if offshore drilling activity significantly picks up, companies like Tidewater will hold all the cards and can set higher day rates.

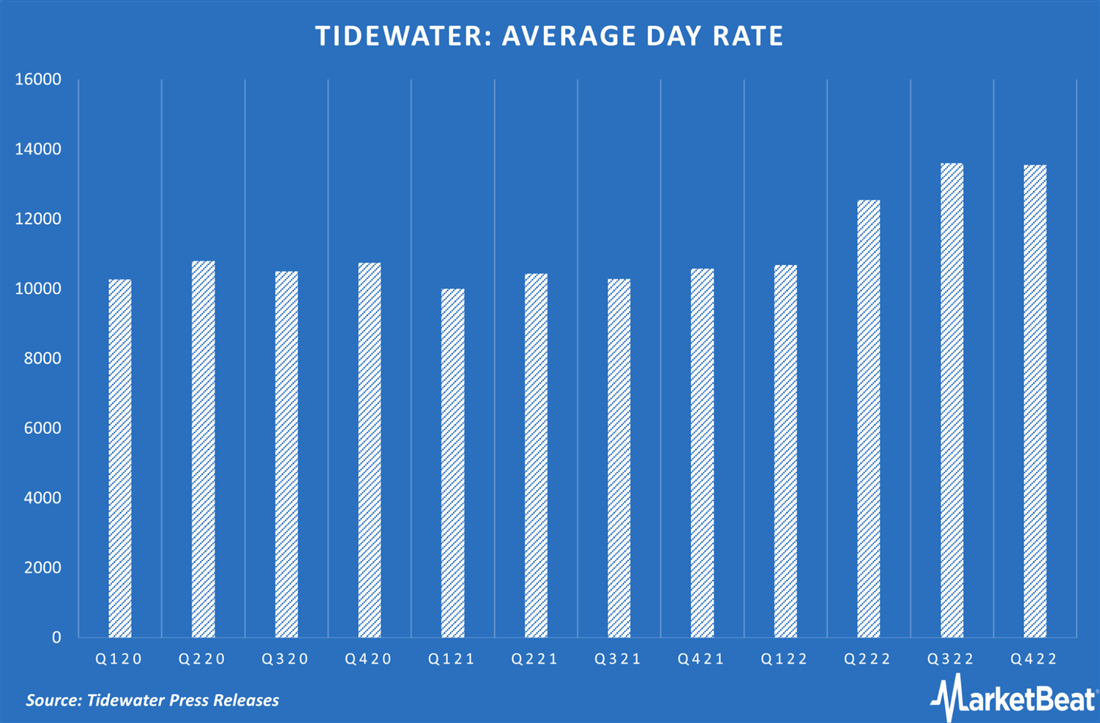

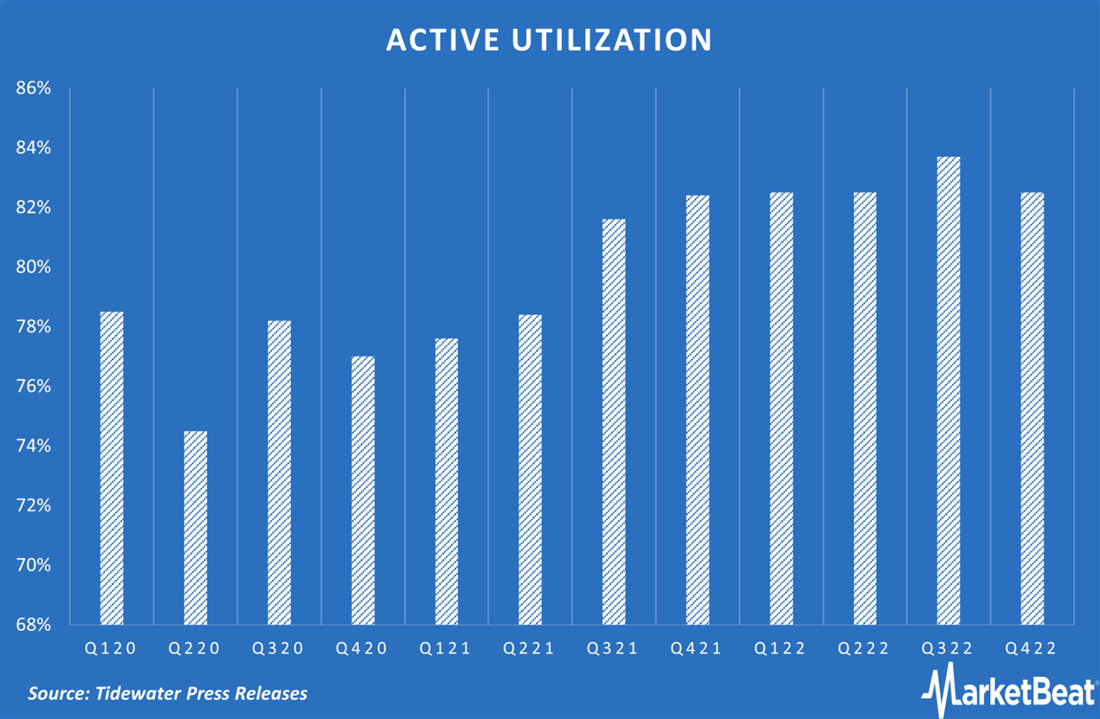

To date, this thesis has worked out. Tidewater stock is up over 200% year-over-year, and revenue significantly ramped up in the second half of 2022. The company continues to demand higher day rates and boosts its utilization.

Notice the stability in rates until the second half of 2022:

Utilization followed a similar trajectory:

Bottom Line

While the backdrop for the offshore drilling industry looks favorable, most of this analysis is out the window of the price of oil crashes. These stocks rely on elevated oil prices to generate outsized cash flows.

Keep the vicious cyclicality of the oil and gas industry in mind when considering trading or investing in stocks like Valaris and Tidewater.

Most value investors see them as quick turnaround plays when things get hot rather than stocks you can put under your mattress. Management at these companies is famous for screwing over shareholders, making it even more prudent to be cautious.