Fortinet (NASDAQ: FTNT) soared in after-hours trading, with gains of almost 13% following its fourth-quarter earnings results. While the Sunnyvale-based cybersecurity firm recorded a modest beat on earnings ($0.44 vs. $0.39 consensus) and a slight miss on revenue ($1.28B vs. $1.30B consensus), it was the company's stronger-than-expected guidance for Q1 2023 that appears to have ignited investor excitement.

However, it's worth considering the reasons behind the magnitude of the market's reaction to the earnings report. While the results beat expectations, it was by no means a standout performance warranting a 13% move. Yet, the rally raises the question of whether the stock's response resulted from deeper market forces.

The sentiment seems to be that crucial market force here. Cybersecurity stocks were among the most hated in 2022, which lowered expectations, making a merely decent earnings report seem like a huge success.

But here's the rub: can Fortinet and other cybersecurity firms seize the current momentum and run with it, or will it be another "fake-out?"

The Gift of Low Expectations

Cybersecurity stocks are getting a boost by outpacing previous basement-level growth expectations from the market.

The key to note here is that analyst and trader expectations are different beasts. You can reverse engineer trader expectations by analyzing price action and getting analyst expectations straight from MarketBeat.

High-growth cybersecurity stocks like Fortinet were Wall Street darlings from the COVID lows throughout 2021, with Fortinet returning almost 150% by the end of the year. However, following the global economic slowdown in 2022, growth stocks went out of favor. And when growth stocks go out of fashion, they tend to make a big exit as investors hurry for the door at the first sign of a busted growth story.

Investors replaced them with "real economy" stocks with tangible assets on their balance sheets.

This effect was compounded when executives at Fortinet and other cybersecurity firms began to signal in conference calls that they, too, were affected by the global economic slowdown, despite what many business analysts may have thought about their resilience. So not only was Fortinet taking a hit on a macro level but an industry level.

As a result, the sector saw significant losses last year. As a result, cybersecurity stocks were prime candidates for tax-loss selling by investors who wanted to offset some of the gains they saw in energy and other outperforming sectors, leading to indiscriminate selling of cybersecurity stocks going into the end of 2022.

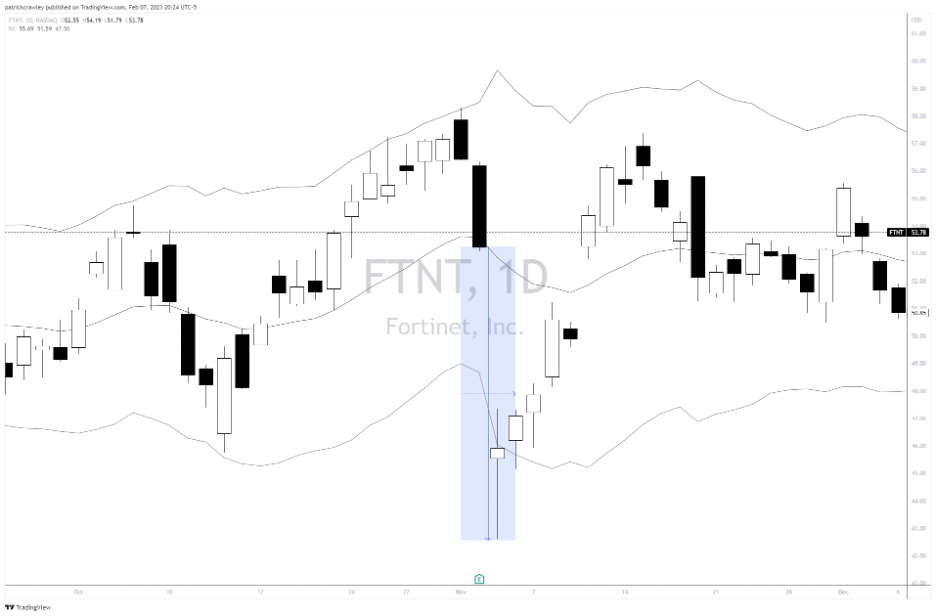

And the best demonstration of this is the market reaction to Fortinet's Q3 2022 earnings report, published in November. It had many of the same hallmarks of the Q4 report, which is a pretty decent report that was slightly better than consensus expectations.

But the market reaction was the polar opposite of this report. Fortinet (FTNT) stock tanked almost 20% as a result:

So what changed? In a word, sentiment.

In November, investors were selling growth stocks if they didn't report home-run earnings. Now? Tech and growth stocks are back in favor, evidenced by tech's outperformance throughout the new year.

The hyper-bearish sentiment makes a decent report look like a great report. In turn, investors are willing to buy again.

A Potential Trend Change?

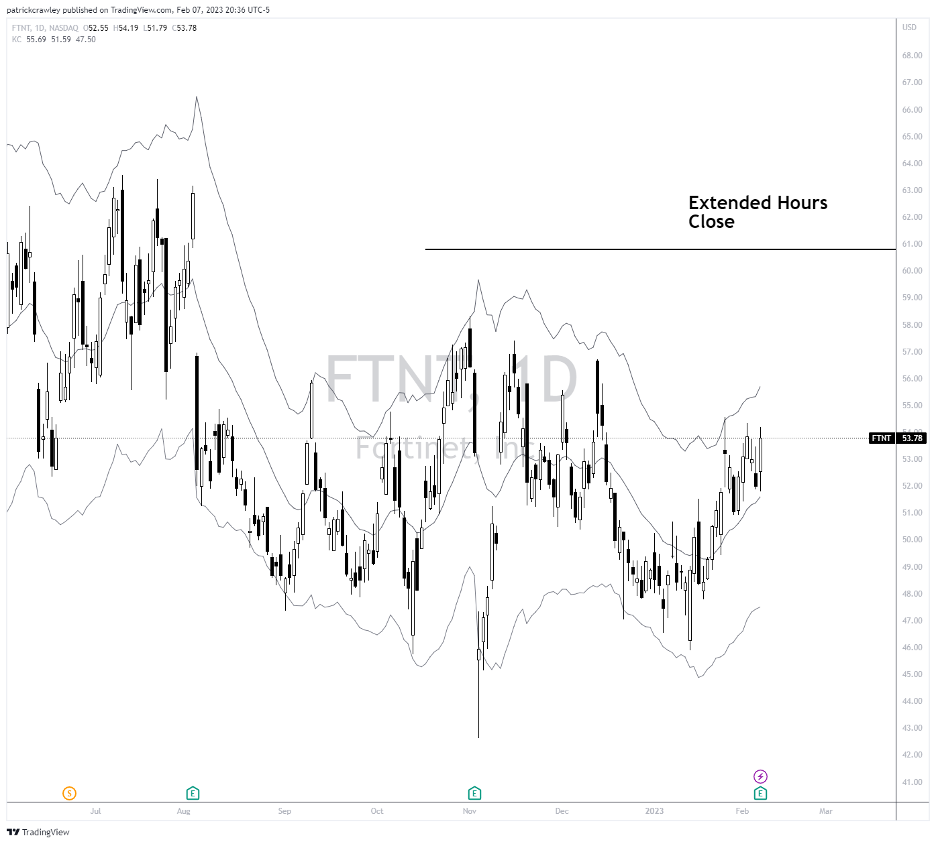

Coming into today's earnings report, Fortinet (FTNT) is in a year-long downtrend. But in the minutes following the publication of the Q4 2022 results, FTNT broke out of a 6+ month price range and currently sits above its $58 resistance level.

Playing the breakout was only possible if you were willing to hold through earnings. But the bigger play here is the potential for a trend reversal to the upside.

Sudden and significant counter-trend momentum often indicates a potential trend reversal. But we have to watch for the stock to prove itself first.

After all, FTNT's daily chart over the last six months (see above) is full of significant moves both to the upside and downside, ending with the stock settling back into its price range.

Critically, the stock needs to stabilize above the $58 resistance level. The market needs to "accept" these marked-up prices after volatility has subsided. It's common for stocks to reverse their earnings moves the following day, which is worth watching out for.

We'll know that the trend reversal pattern is successful when FTNT makes a series of higher highs and lows. But, as of now, we're just staring at one higher high.

Bottom Line

The market response to Fortinet's latest earnings report is a testament to the critical role expectations play in the stock market. Because markets are constantly discounting the future, any piece of news needs to be viewed relative to what you think the market expects to happen.

And the rally in FTNT is a perfect showcase of this phenomenon. Even a modest earnings beat can be perceived as a triumph when investor expectations for a sector are so bearish.

It remains to be seen whether or not this after-hours surge will bear fruit in the way of a trend reversal or sustained momentum, but the lesson is of key importance.