Every so often, a move occurs in the stock market that can best be described as a 'black swan.' That is to say, a move that occurs in an individual stock that is exceedingly rare from a probabilistic standpoint.

This week, many will agree that a black swan event occurred when small-cap and micro float medical-technology company Vivos Therapeutics (NASDAQ: VVOS) surged more than 1000% in a single day after announcing breaking news.

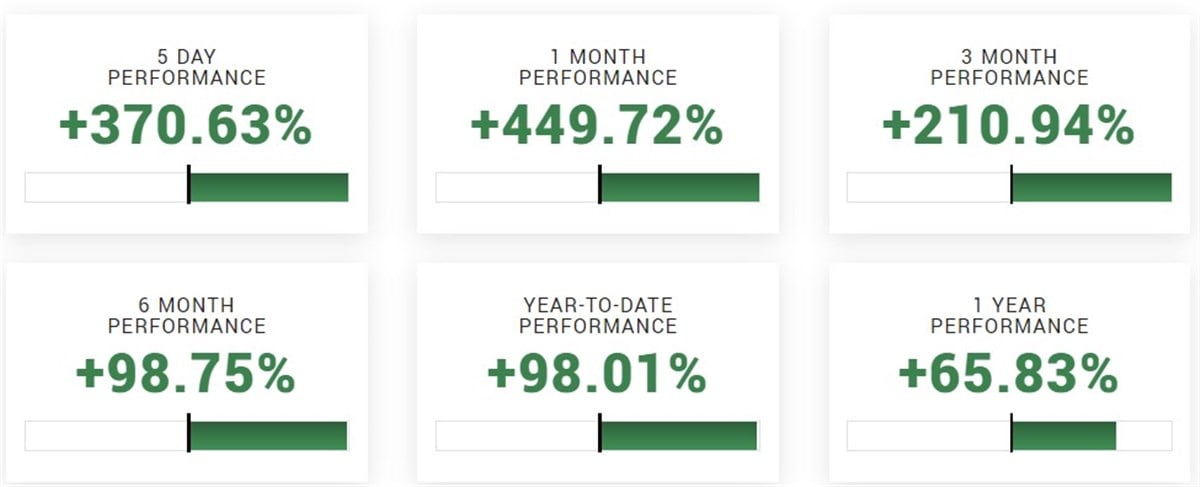

In the two days following the initial higher surge, the stock retraced from the highs by over 50% but still closed the week up a staggering 370%.

While the fresh news is potentially fundamentally changing for the company, other factors might have led to this stock's euphoric one-day rocket higher. So, let's look at the catalyst and critical factors that led to the surge higher.

What is Vivos Therapeutics?

Vivos Therapeutics is a medical technology company specializing in developing and marketing non-invasive treatments for dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults. Their primary offering, The Vivos Method, is a non-surgical, non-pharmaceutical treatment approach that involves multiple disciplines. They also provide the VivoScore Program, which includes screening and home sleep tests for adults and children. Their products and services are sold to licensed professionals, mainly general dentists in the United States and Canada.

Its stock, VVOS, has a public free float of just one million shares, placing it in the dangerous category of micro-floats concerning supply and demand. Similarly, the company has a micro-cap, even after last week's staggering rise, of just $23 million. These figures and technicals, combined with street-wide availability of locations to short the stock on day one, resulted in the excessive rise intraday.

However, this is not to discount the breaking news and catalyst as they are fundamentally changing for the company.

The catalyst: VVOS receives FDA clearance

On Wednesday morning, November 29, the company announced it had recently received FDA clearance for its CARE oral appliances to treat severe obstructive sleep apnea (OSA) in adults. This clearance marks the first-ever approval for an oral appliance addressing moderate to severe OSA alongside positive airway pressure (PAP) and myofunctional therapy. Renowned experts hail this decision as a game-changer, recognizing the importance of oral vault functionality in OSA treatment.

Data from 73 severe OSA patients showed promising results, with 80% experiencing improved conditions and a short average treatment time of 9.7 months. Another study highlighted that one in four Vivos patients experienced complete resolution of OSA symptoms, demonstrating a groundbreaking resolution within a limited treatment time compared to continuous interventions needed with CPAP or surgical implants.

What's next for the stock?

This milestone signifies a breakthrough for Vivos and sets a new standard for non-invasive severe OSA treatment, potentially reshaping the landscape of sleep medicine and providing hope for millions suffering from this condition.

Nevertheless, investors should exercise caution given the considerably small float size, known for adding an extra layer of volatility and uncertainty. However, the float is anticipated to increase as the company considers raising more capital to cover operational costs and fuel its growth trajectory.