Drones have made headlines for their key roles in headline events like the Ukraine War. According to Grandview Research, the global drone industry is estimated to grow at a compound annual growth rate (CAGR) of 13.9% in the next seven years, and 9.1% in the U.S. Applications continue to broaden, ranging from security and surveillance at the borders, inspections of buildings, properties and crops, aerial photography, search and rescue, tactical warfare and delivery of products. As drone sales for the military, industrial, commercial and personal segments expand, the investment opportunity becomes more inviting. If you're looking for exposure in this growing industry, then look at these three drone stocks that can potentially elevate your portfolio.

Kratos Defense & Security Systems Inc. (NASDAQ: KTOS)

The defense industry identifies drones as unmanned aerial systems (UAS). Kratos is a technology company serving the aerospace and defense industry and commercial markets. Its Unmanned Systems designs and produces UAS, unmanned maritime systems (UMS) and unmanned ground vehicles (UGV). In addition to drones, the company provides missile defense systems, rocket support, engine propulsion technologies, combat and intelligence products and services in its Government Solutions division. Cathie Wood's Ark Invest owns 5.7% or $104.3 million of KTOS shares.

3,500 Mile Range Combat Drone

Its experimental XQ-58A Valkyrie combat drone is a potential game-changer with its versatility, economical, stealthy and artificial intelligence (AI) powered platform. The drone can be used for reconnaissance, surveillance, targeting and attack missions with a range of 3,500 miles, making it one of the world's longest-range drones.

Solid Growth

Kratos had 14.6% YoY revenue growth to $256.9 million, beating consensus analyst estimates for $235.9 million in its second quarter of 2023. It beat analyst estimates by 3 cents, earning 9 cents per share in the quarter. The company guided in line for Q3 with revenues of $240 million to $260 million versus $253.03 analyst estimates. Full-year 2023 revenues are expected between $980 million to $1 billion versus $994.13 million estimates.

Tactical Drone Spending Falls as Margins Rise

In its Q2 2023 earnings report, the Kratos Unmanned Aerial Systems (KUAS) segment saw revenues dip to $52.1 million from $56.4 million in the year-ago period. This was primarily due to reduced tactical drone activity. However, its operating income was $1.2 million compared to an operating loss of $5 million in the year-ago period due to a $5.5 million litigation settlement charge. Adjusted EBITDA for the segment was $3.6 million, up from $2.9 million. The book-to-bill ratio for Q2 2023 was 1.2 to 1.0, with $64.7 million in bookings. The total backlog was $256.7 million at the end of Q2.

Kratos Defense & Security Solutions analyst ratings and price targets are at MarketBeat.

Kratos Defense & Security Solutions peers and competitor stocks can be found with the MarketBeat stock screener.

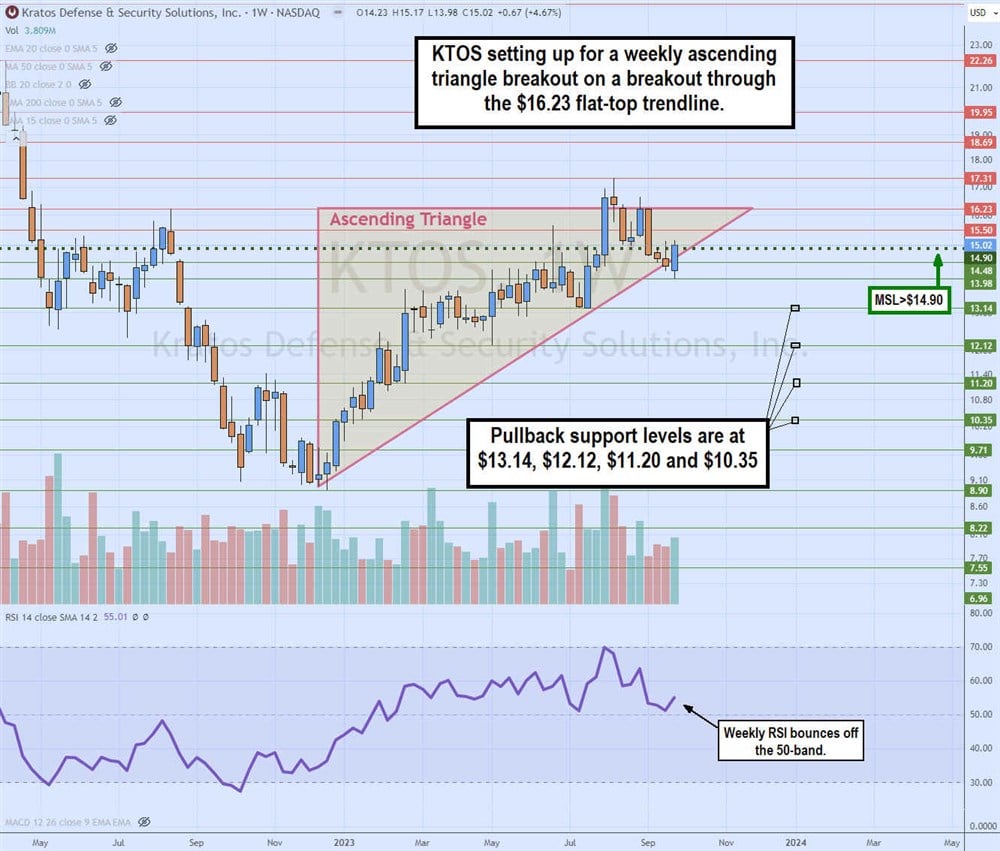

Weekly Ascending Triangle Pattern

The weekly candlestick chart illustrates an ascending triangle pattern. This is formed from the flat-top highs around $16.23 pitted against the higher lows represented by the ascending trendline. KTOS is nearing the apex point, so a resolution is inevitable. This will be a breakout of the weekly market structure low (MSL) trigger through $14.90 through the flat-top resistance or a breakdown through the ascending trendline. The weekly relative strength index (RSI) attempts to bounce off the 50-band. Pullback support levels are at $13.14, $12.12, $11.20 and $10.35.

Ambarella Inc. (NASDAQ: AMBA)

Ambarella is a fabless semiconductor company producing system-on-a-chip designs integrating ultra-high-definition compression, image processing, deep neural network processing and audio processing capabilities. Its chips are well suited for drones due to their artificial intelligence (AI) powered computer vision capabilities, which enable them to track and avoid objects. Its high-performance image processing capabilities enable drones to capture high-definition video and images. Its chips are designed for efficiency with low power consumption since drones can operate for long periods.

Other Applications for Ambarella Chips

Beyond drones, ambarella chips are also used in HD, ultra-HD, and surveillance cameras. They are used in GoPro Inc. (NASDAQ: GPRO) cameras. They are used in advanced driver assistance systems (ADAS) that enable adaptive cruise control, automatic emergency brakes and lane departure warning systems. Ambarella chips are also suitable for autonomous driving and robotic applications. The company is also expanding its internet-of-things (IoT) footprint with smart city and smart home partnerships.

Surprise Guidance Cut

Ambarella stock has been weakening as the company continues to lose money. Its Q2 2023 earnings report spooked investors, with revenues falling 23% YoY to $62.1 million and a loss of 15 cents per share. The gut punch was delivered out of the blue with its guidance drop, with Q3 2023 revenues guided to $48 million to $52 million versus $67.88 million consensus analyst estimates. The IoT market is seeing softening demand, notably in China, impacting Q3 and possibly Q4. However, they expect growth to resume in fiscal Q1 2024.

Analyst Reactions

The analysts were mixed. On August 30, 2023, TD Cowen cut its rating to Market Perform from Outperform and dropped its price target to $65 from $90. Needham reiterated their Buy rating but cut its price target to $90 from $100. On September 18, 2023, Northland Capital initiated AMBA with an Outperform rating and a $70 price target.

Ambarella analyst ratings and price targets are at MarketBeat.

Weekly Descending Triangle Pattern

The weekly candlestick chart on AMBA illustrates the weekly descending triangle of lower highs against a flat bottom. It commenced in November 2021 at $227.59, making lower highs on bounces to form the descending trendline. It hit lows of $49.02 in October 2022 to form the flat-bottom horizontal trendline support. The weekly MSL triggers above $67.51. The pullback support levels are $49.02, $43.76, $39.80 and $36.02.

AeroVironment Inc. (NASDAQ: AVAV)

As a leading provider of AI-powered drones or unmanned aerial systems (UAS), AeroVironment dominates the small drone segment with clients in over 50 countries. It also offers aerial weapons called loitering munitions systems (LMS) that can wait patiently in the air around a target until it is instructed to engage and attack. These are seeing demand in allied nationals thanks to their activity in the Ukraine war. The company is experiencing higher demand across all its business segments as it manages inventory levels targeting 60 days of forward supply.

Explosive Quarter

The company beats its Q2 2023 earnings handily by 74 cents, reaching $1.00 per share versus 26 cents per share analyst estimates. Revenues jumped 40% YoY to $152.35 million, beating the $128.5 million analyst estimates. AeroVironment reaffirmed its full-year 2023 EPS guidance of $2.30 to $2.60 versus $2.60 analyst estimates but raised its full-year 2023 revenue guidance to $645 to $675 million versus $655.8 million consensus analyst estimates.

AeroVironment analyst ratings and price targets are at MarketBeat.