- Magna produces auto parts and systems to the 50 largest automobile brands worldwide

- Magna will begin production of its Fisker’s EVs in November

- Russia and a strong US dollar took a large bite out of Q2 2022 earnings

- The Company sees a second-half 2022 rebound from semiconductor supply and China stimulus

Worldwide vehicle parts manufacturer Magna International (NYSE: MGA) is not a household name yet is the largest automotive supplier in North America and fourth largest in the world. The Company is contracted with over 50 global customers including the largest automotive brands in the world like Ford (NYSE: F) and General Motors (NYSE: GM) as well as major European players like Volkswagen (OTCMKTS: VWAGY) and BMW. The Company manufactures everything from doors, seats, legacy and electric powertrains, and transmissions to manufacturing complete automobiles. Magna is a one-stop shop and the largest contract manufacturer for automobiles in the world with annual production capacity of over 200,000 vehicles.

Riding the Automotive Megatrends

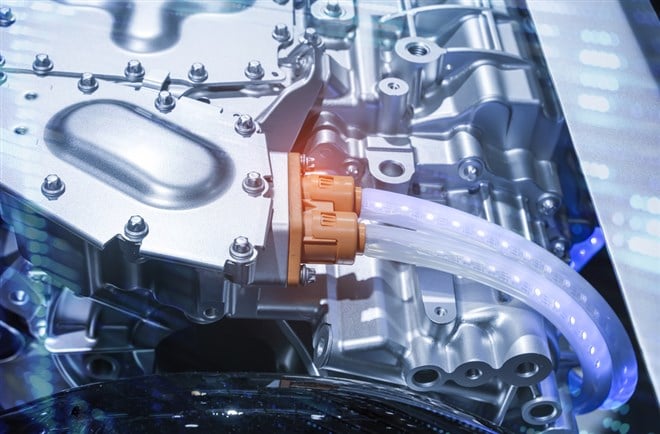

They are on the cutting edge of trends in the automotive industry like electrification, electric vehicles (EVs), energy storage systems, autonomous driving, mobility, and connectivity. While most of their nearly $39 billion of sales comes from legacy automobile business, it’s positioned to benefit from megatrends in the auto industry. The original Tesla (NASDAQ: TSLA) killer, Fisker (NYSE: FSR) will start production of its highly anticipated EVs in November. Magna is handling the complete manufacturing of the EVs. While they face the continuous headwinds of supply chain constraints, inflationary cost pressures, and a strong U.S. dollar, they are also reaping the tailwinds of strong auto demand and low dealer inventory levels. The stock is a one-stop shop for investors seeking a diversified major player riding the megatrends in the auto industry.

Attractive Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a comprehensive view of the price for MGA stock. The weekly rifle chart breakdown triggered on the rejection of the breakout attempt at the $65.24 Fibonacci (fib) level. The weekly downtrend has a falling 5-period moving average (MA) resistance at $53.39 followed by the weekly 15-period MA resistance falling at $57.69 as the weekly stochastic falls to the 20-band. The stock failed three separate attempts to stay above the weekly market structure low (MSL) buy trigger at $62.99 causing shares to plummet towards the weekly lower Bollinger Bands (BBs) at $46.55. The daily rifle chart has been in a downtrend led by the falling 5-period MA resistance at $49.54 followed by the 15-period MA at $53.18. The daily lower BBs sit at $45.35. The daily stochastic has crossed up but is stalling at the 10-band. It needs to crack the 20-band to gain upside momentum. Attractive pullback levels remain at the $46.26, $44.25 fib, $41.99 fib, $38.32 fib, $34.65 fib, and the $31.02 fib.

Second Half 2022 Recovery

On July 29, 2021, Magna released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) profit of $0.83 excluding non-recurring items versus consensus analyst estimates for $0.92, a (-$0.09) beat. Revenues rose 3.6% year-over-year (YoY) to $9.36 billion beating analyst estimates for $8.92 billion. The Company saw a 2% rise in light vehicle production, largely driven by a 14% jump in sales in North America. FX translations took a (-$629 million) bite out of earnings as well as lower sales in Russia. Higher input costs, Russia, and operating inefficiencies in Europe resulted in a (-41%) YoY drop in adjusted EPS from $1.40 to $0.83 and diluted EPS of (-$0.54) versus $1.40 in the year ago period. This was affected by a (-$1.24) non-cash impairment charge on its investment in Russia. However, the Company is optimistic for a second-half recovery. Magna raised its full-year 2022 revenues to come in between $37.6 billion to $39.2 billion, up from prior guidance of $37.2 billion to $38.9 billion versus $37.75 billion consensus analyst estimates.

Looming Headwinds

Magna CEO, Swamy Kotagiri expects supply chain problems to continue through 2022. These include semiconductor shortages to parts manufactured in China with COVID lockdowns. Input costs were and will remain elevated. He did remind analysts, “The stronger US dollar relative to other currencies, in which we operate, particularly the euro, is negatively impacting our reported results, and there is some risk going forward that high inflation and rising rates will impact auto consumers.”

Strong Tailwinds

The Company is experiencing strong auto demand with low dealer inventories and tight supply. Semiconductor supply constraints are expected to ease in the second half of 2022. The easing of China COVID lockdowns in addition to a government economic stimulus package should improve supply chains and bolster auto demand.