NEW YORK, Aug. 05, 2024 (GLOBE NEWSWIRE) -- A new financial analysis by Siebert Williams Shank (SWS) finds that the projected infrastructure cost of the clean energy transition, while substantial, will be a worthwhile investment that could yield enormous economic benefits in the United States.

The 112-page study estimates that while the electric infrastructure costs of the transition are about $10 trillion over the next 30-50 years, the net financial benefits to the U.S. economy could ultimately exceed $2.3 trillion annually.

“The clean energy transition translates into an opportunity for a step change in job creation and broader prosperity in the U.S. and globally,” the SWS report states.

Analysts behind the report echoed that sentiment in a recent “In Conversation with SWS” podcast, in which they dive deeper into the findings’ underlying mechanics.

According to the report, the $10 trillion transition cost estimate for just U.S. electricity infrastructure equates to an average of about $331 billion annually for the prospective 30 years. That level of electricity infrastructure investment for the industry reflects only about 0.8% of 2023 annual GDP with a declining proportion to about a 0.4% share as the economy presumably grows about a modest 2.1% annually through 2053.

“Certainly an average of about 0.5% of annual GDP over a number decades is not too big of an ask for such an important economic transformation,” the report says.

SWS’s clean energy transition report is relatively unique in two ways. First, while most such reports focus on the aggregate costs for all sectors in the transition, the SWS analysis breaks down the transition’s implications for the electricity industries more specifically. The report examines two sectors: utilities and transportation, which collectively represent about 65% of U.S. carbon emissions.

Second, the report focuses on economics rather than climate change. Discussion in the media typically frames the clean energy transition as a debate about its effectiveness in combating global warming. Rarely is there deliberation over the full economic consequences of the proposed transition other than a potential reduction in carbon emissions for the environment.

“Our analysis tells us that the clean energy transition is a worthy economic endeavor. No climate or government ideology is required,” the report says.

It continues, “While the transition began as a solution to the climate change problem, we believe that it now stands on its own as an economic revolution that will lead to a great flourishing of the nation that all of America can support.”

SWS analysts assert that the clean energy transition can largely be achieved without massive government incentive programs, carbon limits/taxes, or even a Green New Deal.

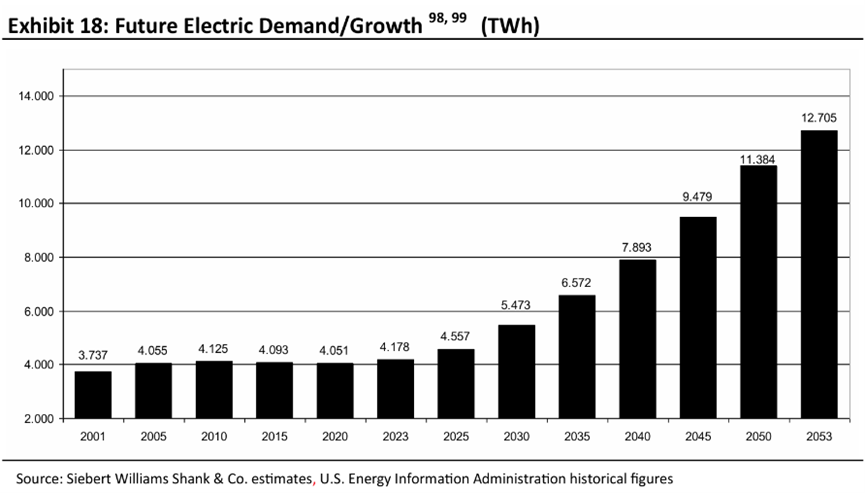

The economic transformation should be effectively self-funding in the aggregate due to the 200% electricity demand/usage growth expected over the next few decades with a few specific transition technology exceptions, in the analysts’ opinion.

According to the report, the increase in U.S. electricity demand is potentially a staggering amount over the next 30 years due to EV adoption, general industry electrification, AI, digital growth, and general economic growth trends.

Most utilities today report that the significant growth is coming from large new data centers, new semiconductor manufacturing, and associated business activity. EV adoption will prove to be an even larger contributor to electricity usage/demand growth in the coming decades.

The report’s estimates suggest a net annual savings in the trillions of dollars to the U.S. economy from just a transition in the electricity and transportation industries alone. Moreover, the transition could yield per capita net savings of $5,000-$7,000 annually, owing largely to avoided fossil fuel costs in daily driving, electricity production, and delivering household goods.

Further less tangible externality costs are avoided in substantially lower health care costs, reduced water pollution and its costs, reduced wear-and-tear on more complex equipment, and from corrosion, vehicle and home paint, etc.

SWS analysts believe the phased clean energy transition will take multiple decades to fully achieve. In their view, focusing excessively on the 2050 date — the Intergovernmental Panel on Climate Change’s target to reach zero net emissions — is counterproductive not just because it is unrealistic, but also because it leads skeptics to disregard carbon reduction efforts that are urgently needed.

To accelerate the transition, the U.S. needs more constructive discourse, better consumer education, and revised legal, legislative, and regulatory policies that will remove challenges to the transition, enable the transition, and develop further support from the general public.

“We believe that government subsidies are not essential,” the report says. “Most of what we need is procedural and policy reform that is essentially free.”

Dually headquartered in New York, NY and Oakland, CA, SWS is an independent non-bank financial services firm that offers investment banking, sales and trading, research, and advisory services. Its mission is to exceed expectations through value-added results and leave a lasting impact on the sectors, corporations, and communities it serves. SWS counts 74 Fortune 100 companies among its clients.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1ac4da71-31a8-4e82-afc6-714b139fad74

Media Contact: Thomas Butler – tbutler@butlerpr.com – 646-213-1802 Nick Eilerson – neilerson@butlerpr.com – 646-205-7627