Confident Xperi Stockholders See Through the Company’s Falsified Version of Performance

Emphasizes that Xperi’s Latest Attempt to Cover Up Dilution is Highly Disingenuous

Urges Stockholders to Vote FOR Rubric’s Nominees Thomas A. Lacey and Deborah S. Conrad on the WHITE Proxy Card

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today issued the following statement in response to Xperi’s recently updated investor presentation in connection with its 2024 Annual Meeting of Stockholders.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240503119075/en/

Rubric Analysis of Dilution (Source: Regulatory filings of Xperi and its predecessor)

As longtime stockholders of Xperi (and its predecessor company led by the same directors), we have tolerated many things. Years of underperformance. Poor transparency. Excessive compensation. Wanton spending on ‘science projects.’ But we cannot tolerate the twisting of financial realities to present falsified versions of share performance and dilution to investors. That is a bridge too far.

Fairytale Performance

In Xperi’s latest investor materials, the Company and its Board of Directors (the “Board”) present a version of share performance which would be utterly alien to any long-term Xperi stockholder. Instead of cutting the data in creative ways, let Rubric lay the TSR analysis out plainly for all investors to judge:

| Since Joining Board | 3 Year TSR | ||||||||

| Predecessor | SpinCo | Combined | Predecessor | SpinCo | Combined | ||||

| XPER | XPER | TSR | XPER | XPER | TSR | ||||

| A | B | A + B | A | B | A + B | ||||

| Darcy Antonellis | -10.6% |

-33.5% |

-40.6% |

-33.7% |

-33.5% |

-56.0% |

|||

| Underperformance vs Russell 3000 | -58.3% |

-73.7% |

-153.0% |

-18.1% |

-73.7% |

-77.2% |

|||

| David Habiger | -57.4% |

-33.5% |

-71.7% |

-33.7% |

-33.5% |

-56.0% |

|||

| Underperformance vs Russell 3000 | -133.6% |

-73.7% |

-184.1% |

-18.1% |

-73.7% |

-77.2% |

|||

Source: Bloomberg. Calculated as of April 26, 2024. |

|||||||||

It is undeniable that the Board members Rubric is seeking to replace – Darcy Antonellis and David Habiger – have presided over staggering losses on behalf of Xperi stockholders, both as directors of Xperi and as directors of its predecessor company.

Shockingly, in an attempt to skirt accountability, the Company in its materials excluded a full quarter of trading to present a fairytale version of its share performance to investors. Better yet, the Company attempted to take credit for the post-spin performance of Adeia Inc. (Nasdaq: ADEA), Xperi’s former parent, despite the incumbent directors having no roles whatsoever in that company following the spin-off in October 2022. Investors in Xperi know the truth: performance of Xperi was poor before the spin-off while the incumbent directors were in fact stewards of stockholder capital, and performance of Xperi has remained poor since. We believe that voting for Rubric’s director nominees – Thomas A. Lacey and Deborah S. Conrad – is the only way to restore accountability in the boardroom and instill a true culture of performance at the Company.

Doubling Down on Dilution

Furthermore, Xperi, in its amended investor presentation, has doubled down on its claim that the Board is acting as careful stewards of stockholders’ capital by embracing the GAAP-based fallacy that stock-based compensation does not count as dilution for a poorly performing company like Xperi.

See “Xperi Presentation of Dilution” Slide

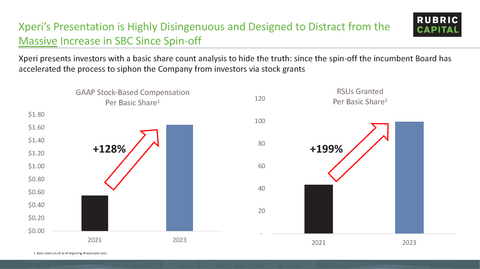

Allow us to present a different, more honest, analysis of Xperi’s dilution, which highlights the Board’s aggressive use of stock-based compensation at the expense of stockholders.

See “Rubric Analysis of Dilution” Slide

We focus on 2021, the last full year before Xperi’s spin-off, and 2023, the first full year following the spin-off, to present to you both GAAP stock-based compensation and RSU grants on a per share basis. Our doing so demonstrates just how dramatically the Xperi Board has accelerated dilution to stockholders. Due to the spin-off, Xperi’s share count today is 60% less than it was in 2021, but its stock-based compensation has increased on an absolute basis. Accordingly, stockholders lose and insiders reap the rewards, with almost 80% of those RSUs tied not to performance but to the passage of time. It is clear to us that Xperi is cultivating a culture of ‘rest and vest.’

Xperi doesn’t seem to understand why Rubric is seeking new representation on the Board. We are doing so because since the spin-off, it is apparent that the Xperi Board has set stockholders and insiders on two different paths. It is also clear to us that the path for stockholders is currently typified by investment losses and margin and growth disappointment, while the other path, for insiders, is one of personal enrichment based on tenure at the expense of stockholders.

Rubric wants the paths of stockholders and insiders to align so that both can share in the benefit of an improved Xperi, and we are confident that electing Thomas A. Lacey and Deborah S. Conrad can help achieve this. That’s what this proxy contest is about.

Vote the WHITE proxy card TODAY

If you have any questions, require assistance in voting your WHITE universal proxy card, or need additional copies of Rubric’s proxy materials, please contact our proxy solicitor Okapi Partners at (855) 305-0856 or via email at info@okapipartners.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240503119075/en/

Contacts

Media:

Jonathan Gasthalter/Sam Fisher

Gasthalter & Co.

(212) 257-4170

Investors:

Jason W. Alexander/Bruce H. Goldfarb

Okapi Partners LLC

(212) 297-0720