- Consumer Stress continues a year-long upward trend based on an average of 150,000 monthly requests from American consumers for legal help

- Lingering elevated interest rates drive uptick in loan modification calls

- Housing: A decline in new home construction and home purchase inquiries suggest a real estate holding pattern for consumers

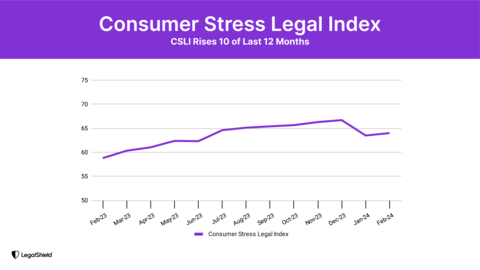

LegalShield’s February Consumer Stress Legal Index (CSLI) highlights an uptick in financial stress among U.S. consumers. This finding adds to a year-long trend of rising economic stress with the February headline number landing at 64, an 8.8% gain year over year.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240319099667/en/

LegalShield’s February Consumer Stress Legal Index (CSLI) highlights an uptick in financial stress among U.S. consumers. This finding adds to a year-long trend of rising economic stress with the February headline number landing at 64, an 8.8% gain year over year. (Graphic: Business Wire)

This increase aligns with the drop in The Conference Board’s Consumer Confidence Index and mirrors the decline in Consumer Sentiment as reported by the University of Michigan, indicating a continued sense of unease among consumers. The latest results from The Conference Board and University of Michigan were foretold by LegalShield’s December 2023 CSLI report.

Since its inception, the CSLI has been a 60-90 day leading indicator of the closely watched Consumer Confidence Index with a correlation level of -0.85.

A deeper look into the findings, based on more than 150,000 calls for legal assistance from LegalShield members in February, showed spikes in questions about billing disputes and loan modifications.

“Millennials and Gen Xers are particularly affected, hitting the heart of the workforce and the electorate,” said Matt Layton, LegalShield senior vice president of consumer analytics. “The continued rise in stress indicates people are taking action to protect every penny.”

The rise in stress continues as macroeconomic indicators show a mixed picture. The Consumer Price Index reports a slightly higher than expected 3.2% inflation in February. And, while the U.S. economy added more jobs than expected at 275,000 in February, unemployment sits at a two-year high of 3.9%.

LegalShield’s CSLI was launched in 2018 and is based on a dataset of more than 35 million consumer requests for legal assistance since 2002. The index is built on three sub-indices tracking calls for legal assistance for issues related to Consumer Finance, Bankruptcy and Foreclosure.

On average, LegalShield receives approximately 150,000 contacts each month from consumers seeking legal help in more than 90 areas of law, including key consumer issues.

Consumer Finance Index Ticks Up; Interest Rate Effect Ripples

The Consumer Finance Index experienced a marginal rise, up by 0.6 points to 100.9, and bucks a seasonal trend: The index has declined in February 7 out of the last 10 years.

Of note, billing disputes are on the rise by 3.8% over January, with an even greater increase for Millennials and Gen X. at 8.1% over last month, marking the highest levels on record for these demographics.

Gen X and Millennial cohorts are behind a 353% year-over-year jump in inquiries about loan modifications, at an all-time high in February. Requests to modify loans have risen steadily since the Federal Reserve raised rates in February 2023.

Consumer actions observed by LegalShield provider attorneys include loan modifications, adding names to existing loans, and requests for new terms.

“People are changing who is on an existing mortgage instead of refinancing or taking out new loans in their own names due to high interest rates,” said Heidi McGee, a LegalShield provider attorney in Connecticut. “Typically, a life change like divorce or aging parent drives the change, but folks can’t afford to assume a property under new terms, so they are adding someone new to an existing loan.”

In other cases, borrowers are unable to make mortgage payments and are seeking new terms.

“Banks don’t want to foreclose right now, so they are offering either longer terms or interest-only balloon loans to keep the borrower in their house,” said Ben Farrow, LegalShield provider attorney in Alabama. “Balloon loans are particularly concerning, as the entire balance will come due in three to five years, likely triggering another issue. We help people understand those terms so they can make the best choice for themselves and their families.”

Housing Trends:

Elevated interest rates appear to continue to take their toll on housing construction and sales as well. In addition to the CSLI, LegalShield tracks its own Housing Construction Index and Housing Sales Index.

The Housing Construction Index fell to its lowest reading since February 2019, 110.9 in February down from 114.0 in January. This index tends to lead U.S. Census data on housing starts (a key economic indicator) by 1-2 months, providing timely intelligence about near-term housing market health.

The Housing Sales Index reveals a similar picture falling 2.1 points to 90.2 in February, its lowest level since May 2011.

“Our housing data indicates that consumers are losing patience with elevated interest rates intended to fend off inflation,” observed Layton. “We’ve seen a drop in calls to our provider attorneys about new house construction or purchases, suggesting people are holding off building or buying…they’re waiting to see what rates do.”

Foreclosure Index Rises

LegalShield’s Foreclosure Index inched up 1.7 points, from 38.4 in January to 40.1 in February. While that marks a 27.3% year-over-year increase, the Foreclosure Index continues to hold steady, with February just slightly above the two-year average of 39.6.

Bankruptcy Index Improves Slightly

The Bankruptcy Index eased, moving from 32.7 in January to 31.9 in February.

“Despite a slight reduction in calls about bankruptcies, February's figure remains notably high, marking the second-highest reading since March 2020. As we stated in January, we still expect to see an increase in Bankruptcy filings through the second quarter of this year,” said Layton.

The Bankruptcy Index is up 26.6% year over year and historically leads actual bankruptcy filings as reported by the U.S. court system by two quarters, with a .98 correlation.

About the LegalShield Consumer Stress Legal Index:

As part of LegalShield’s mission to ensure every person has equal access to justice, we mine our data for insights policymakers can use to make a real, positive impact in their decision making. Released monthly, the LegalShield Consumer Stress Legal Index is comprised of three sub-indices which reflect the demand for various legal services. LegalShield’s dataset includes more than 35 million consumer requests for legal assistance since 2002, averaging approximately 150,000 calls received monthly. The CSLI uncovers the daily challenges people are facing and provides actionable intelligence to help policymakers and industry leaders bridge those gaps.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to thousands of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240319099667/en/

Contacts

LegalShield Media Contact:

Hollon Kohtz, Director of Communications

hollonkohtz@pplsi.com