Prosperity Home Mortgage Ranks Highest among Mortgage Originators

Despite a September interest rate cut by the Federal Reserve, the average 30-year mortgage rate in the United States has been on the rise during the fourth quarter, reaching 6.9%1 in November, its highest level since August. Persistently high rates, combined with steadily rising housing prices, have put a strain on mortgage customers, according to the J.D. Power 2024 U.S. Mortgage Origination Satisfaction Study,SM released today. Some lenders have managed to turn those challenges into an opportunity to play a more hands-on advisory role with customers, earning high marks for customer satisfaction along the way. Other lenders have struggled.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241112080063/en/

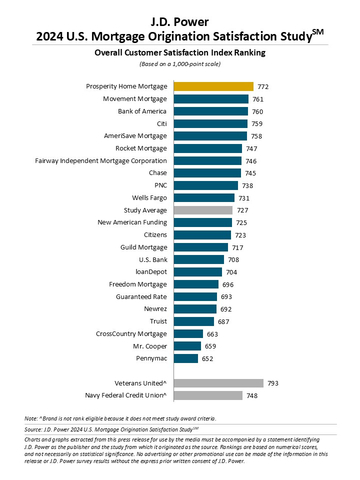

J.D. Power 2024 U.S. Mortgage Origination Satisfaction Study (Graphic: Business Wire)

“The variability in rates and higher costs for buyers increases the importance of understanding consumers’ individual situations,” said Bruce Gehrke, senior director of wealth and lending intelligence at J.D. Power. “Consistently, we’re seeing that lenders that play an active advisory role in helping their clients navigate the current market are earning significantly higher customer satisfaction, loyalty and advocacy scores than those that are treating mortgage lending as a transactional process.”

Following are some key findings of the 2024 study:

- Overall satisfaction declines following sharp increase in 2023: Overall customer satisfaction with mortgage lenders is 727 (on a 1,000-point scale), down 3 points from a year ago when mortgage customer satisfaction surged 14 points year over year. In the past year, mortgage lenders have noticeably trimmed their staffing levels, making it more challenging to deliver the same level of highly personalized customer service that drove the gains in customer satisfaction a year ago.

- Interpersonal relationships with local brand reps critical to satisfaction: The only factor showing gains in this year’s study is people, which has risen by a single point. The factors showing the biggest year-over-year declines in customer satisfaction are digital (-8 points); communication (-5); and loan offering met my needs (-5). In fact, when local brand representatives are directly involved in the mortgage origination process, overall satisfaction rises 40 points.

- Lender as advisor becomes key to navigating tough market: Lenders that actively advise clients throughout the lending process drive significantly higher customer satisfaction scores. The satisfaction score for trust among borrowers who strongly rely on the lender’s expertise to get through the borrowing process is 133 points higher than among those borrowers who do not strongly rely on the lender’s expertise.

- Timing is everything and earlier is better: Overall satisfaction is 41 points higher when lenders engage early with customers, connecting with them when they are first thinking about purchasing a home, compared with overall satisfaction when lenders get involved once customers are actively shopping. Satisfaction is 107 points lower when lenders get involved at the time customers are getting ready to apply for a mortgage.

Study Ranking

Prosperity Home Mortgage ranks highest in mortgage origination satisfaction, with a score of 772. Movement Mortgage (761) ranks second and Bank of America (760) ranks third.

The U.S. Mortgage Origination Satisfaction Study measures overall customer satisfaction based on performance in six factors (in alphabetical order): communication; digital channels; level of trust; loan offering meets my needs; made it easy to do business with; and people. The 2024 study was fielded from August 2023 through September 2024 and is based on responses from 7,534 customers who originated a new mortgage or refinanced within the past 12 months.

For more information about the U.S. Mortgage Origination Satisfaction Study, visit https://www.jdpower.com/business/financial-services/us-mortgage-origination-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2024147.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Source: Bankrate

View source version on businesswire.com: https://www.businesswire.com/news/home/20241112080063/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com