USAA Ranks Highest in Individual Annuity Satisfaction

Financial advisors and insurance agents offering individual annuity products are confronting a particularly challenging set of dynamics in the current marketplace. According to the J.D. Power 2024 U.S. Individual Annuity Study,SM released today, the majority (59%) of current annuity customers struggle with their financial health1 and many do not fully understand the products they are buying.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241017959942/en/

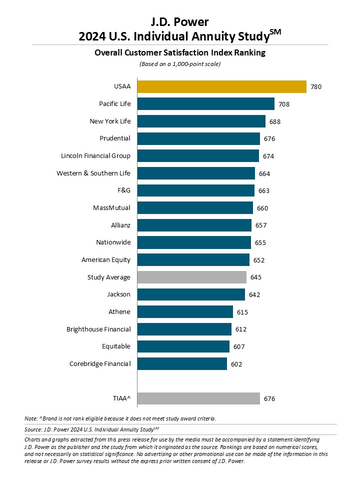

J.D. Power 2024 U.S. Individual Annuity Study (Graphic: Business Wire)

“Long-term customer satisfaction with individual annuity products is directly linked to customers’ understanding of a fairly complex financial product, which makes agent and advisor communication such an important part of the equation,” said Breanne Armstrong, director of insurance intelligence at J.D. Power. “It’s important to note, however, that true understanding goes deeper than just filling out forms and signing on the dotted line. In fact, 43% of individual annuity customers say their agent or advisor filled out the complete application for them and, not surprisingly, those people have lower overall satisfaction scores. Advisors and agents need to educate their customers and annuity customers need to make sure they understand the details of what they are getting.”

Annuity providers typically offer a variety of resources to help educate customers on a product. Agents and advisors can encourage engagement with these tools during the onboarding process, even if the agent or advisor completes the application for the customer. Understanding of the annuity contract and costs and fees is significantly higher when the agent or advisor provides the customer with information on navigating the provider’s website and/or mobile app or directs the customer to available educational videos about the annuity during onboarding.

Study Ranking

USAA ranks highest among individual annuity providers with a score of 780. Pacific Life (708) ranks second and New York Life (688) ranks third.

The U.S. Individual Annuity Study was redesigned for 2024. Scores are not comparable year over year with previous studies. The study measures the experiences of customers of the largest individual annuity companies in the United States across eight core dimensions (in order of importance): trust, value for price, ability to get service, ease of doing business, people, product offerings, digital channels, and problem resolution. The 2024 study is based on responses from 3,914 individual annuity customers and was fielded from April through July 2024.

For more information about the U.S. Individual Annuity Study, visit https://www.jdpower.com/business/insurance/us-annuity-study.

See the online press release at http://www.jdpower.com/pr-id/2024126.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness, and safety net items like insurance coverage.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241017959942/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com