Metals Acquisition Limited (NYSE: MTAL):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240124060205/en/

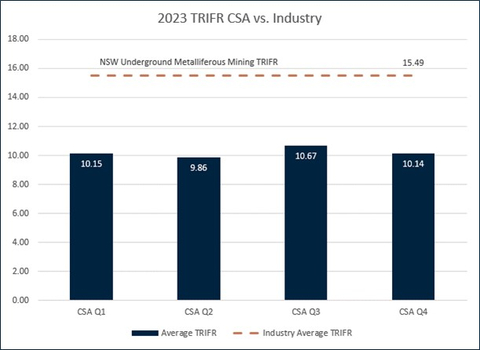

Figure 1 - CSA Copper Mine Recordable Injuries by Quarter (Graphic: Business Wire)

Metals Acquisition Limited (“MAC” or the “Company”) today provides an update on the operational performance of the CSA Copper Mine during the December quarter:

- Total Reportable Injury Frequency Rate (“TRIFR”) decreased slightly for the quarter to 10.1 per million hours from 10.7, with one Lost Time Injury (“LTI”)

- December quarter production of 9,832 tonnes of copper and 114,969 ounces of silver which is flat for both metals compared to the prior quarter

- December quarter C11 costs of US$1.99/lb*, up 7% on the prior quarter due to additional shipping and offtake charges incurred through shipping one additional vessel over the quarterly production (approximately US$0.11/lb produced for $1.88/lb sold) which is in line with the September quarter

- Underground capital development of 841m (up 40% on the September quarter) was the highest quarter for the 2023 calendar year, demonstrating the benefits of the Company’s investment, setting up the mine for a higher level of production in years to come

- Capital spend of US$10 million was down slightly on the prior quarter and well under estimated spend considering TSF works are under way and high capital development was achieved

- Cash on hand as of the date of this release of US$42 million and approximately US$10 million of outstanding Quotational Period receipts at current prices.

Mick McMullen, MAC’s CEO, commented “The results show that we continue to go after the low hanging opportunities which should be apparent in our ability to reduce costs, while also strategically investing in multiple opportunities to increase volumes. I could not be more excited about what the management team and all the members of CSA have accomplished in the first six months since taking ownership of the operations.

Drilling of the various deposits in and around the mine confirm the high-grade nature of the operation with most deposits open at depth and in some cases up dip as well (QTSC). The results from the QTSS Upper A deposit are highly encouraging so close to surface and we are excited to see what additional value we can create through the drill bit.

Our teams at site and in corporate have all worked very hard to turn this operation around, to achieve this safely and rapidly and we start 2024 in a strong position poised for growth.”

Unless stated otherwise all references to dollar or $ are in US$.

ESG

Safety

The TRIFR for the CSA Copper Mine decreased slightly for the quarter from 10.7 to 10.1 (refer Figure 1). This is below the NSW underground metalliferous TRIFR for 2022 of 15.5. Unfortunately, one LTI was incurred which, again, is below the NSW underground metalliferous LTI of 2.6 for 2022 but we still consider it to be one too many.

The slight improvement in TRIFR is an encouraging result as headcount continues to be reduced across the mine site. MAC believes that there is further potential to reduce this and continues to provide support and training to drive this TRIFR rate down.

Regulatory

After a busy September quarter securing the TSF approvals and Rehabilitation Cost Estimate (“RCE”) reduction the December quarter was relatively quiet on regulatory matters and very much a business-as-usual quarter.

Two Ancillary Mining Activity (“AMA”) permits were received in the quarter, with AMA-2023-2 enabling the Company to remove approximately 80,000 m3 of waste rock from the New South Wales government owned North TSF to be used for the Stage 10 TSF lift. This has saved considerable cost as this material would need to have been mined from a borrow pit for the TSF works, if not available for reclaim off the North TSF.

Work commenced late in the September quarter on the Stage 10 TSF lift upon receipt of approvals and mobilisation of the contractor. During the December quarter work fully ramped up on the Stage 9 buttressing works (see Figure 2) that forms the foundation of the Stage 10 TSF lift. Works are currently ahead of schedule and a detailed survey of the Stage 9 TSF has identified additional capacity to enable capital works to be pushed out marginally.

All approvals for all currently planned activities are in place putting the operation on a good footing to deliver on its operating plan without needing to acquire additional permits.

Following progressive rehabilitation of prior drilling activities, the RCE on EL5693 has been reduced from A$592,000 to A$164,000.

Production

The December quarter continued the strong operational performance from the September quarter and was relatively flat across most metrics quarter on quarter with a strong result from capital development and capital discipline. Table 1 contains a summary by quarter for the year.

Table 1- Quarterly Operational Performance of the CSA Copper Mine

|

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Ore Tonnes Milled |

240,698 |

254,381 |

300,328 |

266,105 |

Grade Milled |

3.7% |

3.1% |

3.4% |

3.8% |

Copper Recovery (%) |

98.1% |

98.1% |

97.3% |

97.6% |

Copper Produced (t) |

8,691 |

7,779 |

9,845 |

9,832 |

Silver Produced (oz) |

100,092 |

99,117 |

115,081 |

114,969 |

|

|

|

|

|

Mining Cost/t Ore Mined (US$) |

$102.8 |

$93.9 |

$84.8 |

$75.5 |

Processing Cost/t Milled (US$) |

$26.4 |

$28.0 |

$19.8 |

$25.5 |

G+A Cost/t Milled (US$) |

$23.6 |

$27.6 |

$24.2 |

$29.6 |

Total Operating Cost/t (US$) |

$152.8 |

$149.5 |

$128.7 |

$130.6 |

C1 (US$/lb) |

$2.90 |

$3.02 |

$1.86 |

$1.99* |

Development Cost/metre (US$) |

$18,677 |

$11,773 |

$10,225 |

$9,667 |

Total Capital Expenditure (US$m) |

$12.7 |

$13.2 |

$10.6 |

$10.0 |

Tonnes Milled/employee |

155 |

162 |

201 |

189 |

*Includes $0.11 per pound of costs relating to additional shipment made post Q3 cut-off. |

||||

Tonnes mined and milled were down slightly on the prior quarter however grade increased by 12% as mining moved into higher grade stopes and better mining practices improved mining dilution. Overall, copper production was flat quarter on quarter as seen in Figure 3.

The average received copper price before hedge settlements was up marginally quarter on quarter to US$3.85/lb compared to $3.81/lb in the prior period. The Australian dollar exchange rate was broadly flat compared to the prior quarter.

As seen in Figure 4, C1 cash costs increased marginally quarter on quarter. This was driven by an increase in G+A costs early in the quarter and an additional shipment in early October resulting in additional realization costs relative to produced copper.

MAC management believes that there are additional opportunities at the CSA Copper Mine to reduce costs with increased focus on productivity improvements and will continue to implement additional productivity measures to further reduce C1 costs. Figure 5 provides an illustration of the improvements in productivity at the mine with a reduction in tonnes milled per employee given the increase in milled grade.

Productivity has an inverse relationship to C1 as seen in Figure 4 and Figure 5.

In general, unit rates for mining, processing and G+A showed a reduction across the months of the December quarter with a strong finish to the year.

Apart from copper production, the largest driver of C1 costs is the mining unit rate as mining accounts for approximately 60% of total site operating costs. Figure 6 illustrates the improvement in the mining unit rate since MAC took ownership of the mine.

Mining unit rates reduced by 11% from the prior quarter. In addition to the 269,000 ore tonnes mined, an additional 77,500 tonnes of waste was mined for use in TSF construction activities. Unit rates have continued to trend in the right direction as the site team have focussed on improving productivity, right sizing the work force and idling fleet units that aren’t required.

The idling of fleet with very low utilization rates has led to significantly higher utilization rates in H2 compared to H1 under the prior owner. This fleet has been retained in preparation of mining at various satellite deposits in the future to facilitate production growth. In the meantime, the fleet isn’t incurring operating and maintenance costs and reducing mining operating costs until such time as volumes can be increased and can be rapidly redeployed.

The other significant component of the mining capital costs are development costs, which have been very high at CSA historically. This led to some historically poor decisions around mine layout with level spacings being increased to save on capital per ore tonne, rather than focussing on fixing the underlying issue of low development metres driving high unit rates. The larger level space in turn led to higher mining dilution.

Figure 7 demonstrates the improvements that have been achieved in the cost per metre of development over the course of the year, with another 5% reduction in the unit rate quarter on quarter. It should be noted that these are still high unit rates as compared to Australian peers and MAC believes that further opportunities for reductions exists as productivity is improved.

Figure 8 and Figure 9 shows the unit rates for processing and site G+A for the year. Both are heavily dependent on milled ore volumes due to their high fixed cost nature and given the 11% reduction in milled tonnages quarter in quarter both unit rates have increased.

Capital spend (including capitalized development) has trended down over the year as seen in Figure 10. This a strong result given the works on the Tailings Storage Facility (“TSF”) ramped up fully during October and the December quarter saw a 40% increase in capital development metres compared to the September quarter. This improved rate of capital development is critical to the future of the mine and was the highest capital development quarter for the 2023 year.

Mine Plan, Resource and Reserve

Since taking ownership the MAC team has been actively looking for ways to improve on the previous mine plan. Figure 11 illustrates the known mineralisation in the immediate mine environment.

The bulk of the current mining is in QTSN (circa 75% of production) and QTSC with additional minor production from the East and West deposits (not shown due to angle of section). The mine commenced production as a lead-zinc-silver mine near surface from the Upper Level Zone A mineralisation and then progressed into the current copper deposit from the Upper Level Zone B approximately 400m below surface. There is significant remnant mineralisation in both the Upper Zone A and Zone B areas and none of this is in the current mineral resource estimate as all the data is in hard copy. The program to digitize this material to bring it into the mineral resource estimate in the future has now been completed but this will not make it into the 2023 Resource and Reserve ("2023 R+R”) update due to the cut-off date for this.

Work on the 2023 R+R is well advanced and is expected to be completed in time for the Company’s 20-F Annual Filing.

Finance and Corporate

The Company continues to progress work and consideration of undertaking an additional listing on the Australian Securities Exchange (ASX). The Company is well progressed with this work stream and, subject to board approval and various factors out of the Company’s control (including market conditions), anticipates proceeding with the ASX listing in calendar Q1 2024. The timing and quantum of any associated equity raise would be market dependent and the Company cannot provide any certainty as to when or if an ASX listing or associated equity raise would occur.

At the time of this report the Company’s share capital is as shown below in Table 2.

Table 2 Company Share Capital

Pro Forma Ownership |

M Shares |

M Securities |

% of Capital Structure |

Shares on Issue |

50.24 |

50.24 |

72.5% |

Founder / Sponsor Warrants (6,535,304 at $11.50/sh strike) |

- |

6.54 |

9.5% |

Investor Warrants (8,838,260 at $11.50/sh strike) |

- |

8.84 |

13% |

Subordinated Debt Warrants (3,187,500 at $12.50/sh strike) |

- |

3.18 |

5% |

Total |

50.24 |

68.80 |

100% |

During the quarter, the Company delivered 3,375 tonnes of copper into the hedge book at an average price of US$3.72/lb.

At the end of December, the remaining copper hedge book consisted of the following:

Year |

Tonnes |

Price US$/lb |

2024 |

12,420 |

$3.72 |

2025 |

12,420 |

$3.72 |

2026 |

5,106 |

$3.72 |

During the quarter the Company paid a further US$7 million off the Senior Debt Facilities (US$14 million paid since acquiring CSA in June), with US$191 million principal outstanding at December quarter end.

As of the date of this report the Company had US$42 million of cash on hand and approximately US$10 million of outstanding Quotational Period receipts at current prices.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL) is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonization of the global economy.

Forward Looking Statements

This press release includes “forward-looking statements.” MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation, MAC’s expectations with respect to future performance of the CSA Mine . These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things; the supply and demand for copper; the future price of copper; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated reclamation expenses; claims and limitations on insurance coverage; the uncertainty in mineral resource estimates; the uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and dependence on key management personnel and executive officers; and other risks and uncertainties indicated from time to time in the definitive proxy statement/prospectus relating to the business combination that MAC filed with the SEC relating to its acquisition of the CSA Copper Mine, including those under “Risk Factors” therein, and in MAC’s other filings with the SEC. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward- looking statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-IFRS financial information

MAC’s results are reported under International Financial Reporting Standards (IFRS), noting the results in this report have not been audited or reviewed. This release may also include certain non-IFRS measures including C1 costs. These C1 cost measures are used internally by management to assess the performance of our business, make decisions on the allocation of our resources and assess operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication of or alternative to an IFRS measure of financial performance.

_______________________________

1 MAC’s results are reported under International Financial Reporting Standards (IFRS), noting the results in this report have not been audited or reviewed. This release may also include certain non-IFRS measures including C1 costs. These C1 cost measures are used internally by management to assess the performance of our business, make decisions on the allocation of our resources and assess operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication of or alternative to an IFRS measure of financial performance. Historical C1 costs for the CSA Copper Mine prior to the acquisition by MAC include the costs of the previous offtake agreement that was terminated on closing of the acquisition by MAC in June 2023.

* Includes $0.11 per pound of costs relating to additional shipment made post Q3 cut-off.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240124060205/en/

Contacts

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited.

+1 (817) 698-9901

mick.mcmullen@metalsacqcorp.com

Dan Vujcic

Chief Development Officer and Interim Chief Financial Officer

Metals Acquisition Limited.

+61 451 634 120

dan.vujcic@metalsacqcorp.com