Metals Acquisition Limited (NYSE: MTAL):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230911314855/en/

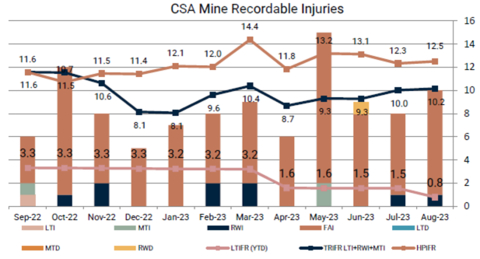

Figure 1 – CSA Copper Mine Recordable Injuries Trailing 12 months (Graphic: Business Wire)

Metals Acquisition Limited (“MAC” or the “Company”) today provides a market update on the following aspects of the CSA Copper Mine:

- Total Reportable Injury Frequency Rate (TRIFR) of 10 and 10.2 per million hours for July and August, respectively

- July and August 2023 production (the first two full months of MAC’s ownership) of 7,294 tonnes of copper

- Additional results from drilling previously not included in the 2022 Resource Estimate, including 50.4m @ 8.9% Cu and 36 g/t Ag from 170.6m in UDD20134

- Drilling at the shallow QTS South Upper mineralisation accelerated to support rapid mine development with first drill hole returning 3.4m @ 8.7% Cu and 21 g/t Ag in QSDD055A

- Downhole Electromagnetic Survey (“DHEM”) indicates the continuation of sulphide mineralisation for at least 800m below the deepest drill hole at the CSA Copper Mine

MAC CEO, Mick McMullen commented, “Since acquiring the CSA Copper Mine just over two months ago, our team has been working hard to produce as per our plan, identify and action new opportunities to unlock value, while also doing so safely. We continue to see great potential to create value for shareholders through exploration in the immediate mine environment as further evidenced by the results shared today. I would also like to thank our entire team for all of the hard work they have put in.”

Safety

The TRIFR for the CSA Copper Mine has remained steady at 10 and 10.2 for July and August 2023, respectively (refer Figure 1). Whilst MAC believes that this can be lowered in the future, MAC believes that remaining at this relatively low level is a great result coming immediately after a change of ownership.

Production

MAC took ownership of the CSA Copper Mine on June 16, 2023. Production during July and August 2023 (the first two complete months of ownership) totalled 7,294 tonnes of copper. MAC believes this is a positive result considering all the potential disruptions that can come from a change of ownership.

Mill throughput in July 2023 of 118kt of ore was a record and the focus is on increasing ore from the mine to fill the excess plant capacity.

Drilling and Exploration

QTSN and QTSC Drilling

Drilling has continued in the main QTSN and QTSC deposits to convert Inferred resources to higher confidence levels and to expand the known mineralisation. As of this date, there is an approximate 12,500m backlog of core to be assayed and additional effort is being focussed on bringing this information into the database.

Results from the most recent drillholes include highly encouraging intervals including:

- 50.4m @ 8.9% Cu and 36 g/t Ag from 170.6m in UDD20134 (QTSN)

- 3.2m @ 13.2% Cu and 41 g/t Ag from 173.9m in UDD20137 (QTSN)

- 8.4m @ 4.0% Cu and 41 g/t Ag from 92.3m in UDD22038 (QTSC)

The location of the most recent drill holes is shown in the Long Section below (Refer Figure 2). There is very limited step out drilling currently underway to extend the overall resource.

Refer to Table 1 below for a complete list of results.

Holes UDD20134 and UDD20137 are targeting the S Lens area in the southern portion of QTSN (Refer Figure 3).

Whilst they are at a similar mine relative level (RL) they are separated along strike (N/S) by 32m in the S Lens position. This separation is what produces the difference in intersection thicknesses as the lenses pinch and swell both along the strike and down dip.

In QTSC, 4 holes were drilled below the current stoping levels to upgrade the resource classification and test mineralization extent at depth. All 4 holes target the QC1 zone which is comprised of a number of internal lenses as shown in Figure 4.

DHEM Exploration

In massive sulphide deposits, DHEM is a standard tool for detecting sulphides that are proximal to drill holes that have yet to be intersected. The CSA Mine style mineralisation responds well to this style of exploration targeting tool but has not been widely used in the underground holes due to the difficulties associated with the ground conditions.

Recent efforts to utilise the technique at CSA have been successful, with the main “QTSN”, “K” and “L3” lenses in the QTSN deposit being shown to extend for at least 800m deeper than the deepest drillhole. This technique indicates the presence of sulphides, but the tonnes and grade of this can only be determined through future drilling.

The scale of these DHEM conductors can be seen in the Long Section and Cross Section (Figures 5 and 6 respectively) below, relative to the existing mineralisation that has supported mining since 1967.

QTS South Upper Drilling

The QTS South Upper mineralisation sits above the QTS South Deposit and is present approximately 120m below surface. Work is underway to complete a mineral resource using the existing drilling and to prepare a mine plan for development in the near term. Previous drill results included (Refer to Table 2 for a full list of drill results):

- 4.05m @ 17.1% Cu and 39 g/t Ag from 282m in QSDD027 and

- 4.9m @ 12.7% Cu and 30 g/t Ag from 227.4m in QSDD046

A surface drill rig has been mobilised to drill a small number of additional definition holes with the first hole intersecting 3.4m of massive sulphide (refer to Figure 7) grading 8.7% Cu and 21 g/t Ag in QSDD055A from 292.1m. Drilling of the remaining holes is being prioritized to enable their inclusion in the 2023 resource statement.

Note on Qualified Person(s)

The drilling results contained in this news release have been prepared in accordance with Regulation S-K, Subpart 1300 promulgated by the U.S. Securities and Exchange Commission (“Subpart 1300”).This news release has been reviewed by Patrick John Adams, BSc. FAusIMM Principal Geologist and Rebecca Prain BSc. Managing Director from Cube Consulting for Metals Acquisition Limited. Acting within the scope of their expertise, Patrick John Adams, BSc. FAusIMM Principal Geologist and Rebecca Prain, as Qualified Persons as defined by Subpart 1300, has reviewed the information provided and finds it to be accurate and reflect facts.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL) is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonization of the global economy.

Table 1 - Drill Results QTSN and QTSC

Hole ID |

Easting |

Northing |

RL |

Depth |

Planned Azimuth |

Planned Dip |

From |

To |

m |

Cu % |

Ag g/t |

Lens |

UDD22019 |

6,055.92 |

3,625.49 |

8,702.66 |

165.5 |

77.1 |

-35.2 |

100.4 |

103.4 |

3.0 |

3.0 |

3.0 |

QTS Central |

UDD22038 |

6,056.33 |

3,624.51 |

8,702.32 |

150.0 |

96.2 |

-41.9 |

92.3 |

100.7 |

8.4 |

4.0 |

41.0 |

QTS Central |

UDD22037 |

6,055.88 |

3,625.39 |

8,702.46 |

170.0 |

78.2 |

-41.9 |

100.6 |

105.6 |

5.0 |

3.5 |

16.0 |

QTS Central |

UDD22050 |

6,054.94 |

3,623.66 |

8,702.29 |

280.0 |

129.2 |

-66.2 |

231.7 |

237.7 |

6.0 |

3.8 |

0.0 |

QTS Central |

UDD20134 |

5,873.18 |

3,864.88 |

8,474.21 |

296.0 |

57.9 |

-37.0 |

170.6 |

221.0 |

50.4 |

8.9 |

36.0 |

QTS North |

UDD20137 |

5,873.19 |

3,864.70 |

8,474.27 |

300.0 |

65.7 |

-43.5 |

173.9 |

177.1 |

3.2 |

13.2 |

41.0 |

QTS North |

QSDD055A |

6,440.27 |

2,987.92 |

10,258.09 |

327.4 |

272.0 |

-62.0 |

292.1 |

295.5 |

3.4 |

8.7 |

21 |

QTSS Upper |

Table 2 - Drill Results for QTS S Upper

Hole ID |

Easting |

Northing |

RL |

Depth |

Planned Azimuth |

Planned Dip |

From |

To |

m |

Cu % |

Ag g/t |

Lens |

QSDD001 |

6,377.68 |

3,029.00 |

10,259.71 |

473.3 |

283.0 |

-60.0 |

209.0 |

211.0 |

2.0 |

3.7 |

8 |

QTSS Upper |

QSDD002 |

6,378.72 |

3,031.68 |

10,259.76 |

495.6 |

258.0 |

-60.0 |

201.0 |

203.2 |

2.2 |

8.8 |

23 |

QTSS Upper |

QSDD003 |

6,440.56 |

3,022.83 |

10,258.20 |

897.9 |

260.0 |

-70.0 |

354.0 |

357.0 |

3.0 |

0.3 |

1 |

QTSS Upper |

QSDD010 |

6,410.30 |

2,752.90 |

10,256.46 |

453.8 |

285.8 |

-62.0 |

292.0 |

293.0 |

1.0 |

0.9 |

5 |

QTSS Upper |

QSDD013 |

6,362.04 |

2,899.67 |

10,258.58 |

354.8 |

268.8 |

-61.0 |

206.0 |

210.9 |

4.9 |

7.9 |

56 |

QTSS Upper |

QSDD014 |

6,363.04 |

2,899.92 |

10,258.53 |

546.2 |

268.0 |

-73.0 |

268.9 |

278.8 |

9.9 |

2.2 |

8 |

QTSS Upper |

QSDD015 |

6,434.94 |

3,025.12 |

10,258.45 |

804.6 |

269.8 |

-59.0 |

270.3 |

279.0 |

8.7 |

5.6 |

12 |

QTSS Upper |

QSDD018 |

6,379.07 |

3,029.94 |

10,259.75 |

309.8 |

266.0 |

-64.8 |

218.7 |

219.5 |

0.8 |

23.0 |

53 |

QTSS Upper |

QSDD019 |

6,434.87 |

2,901.72 |

10,257.60 |

465.0 |

274.5 |

-59.8 |

290.0 |

294.0 |

4.0 |

6.5 |

17 |

QTSS Upper |

QSDD020 |

6,435.31 |

2,901.26 |

10,257.52 |

530.2 |

270.0 |

-70.0 |

364.6 |

368.0 |

3.4 |

6.1 |

17 |

QTSS Upper |

QSDD021 |

6,435.46 |

2,901.09 |

10,257.49 |

509.1 |

257.0 |

-63.0 |

309.5 |

313.0 |

3.5 |

7.9 |

40 |

QTSS Upper |

QSDD022 |

6,436.19 |

2,901.31 |

10,257.51 |

510.9 |

256.6 |

-67.1 |

344.0 |

348.2 |

4.2 |

1.7 |

6 |

QTSS Upper |

QSDD023 |

6,439.91 |

2,958.57 |

10,257.85 |

433.0 |

261.0 |

-55.0 |

278.5 |

279.3 |

0.8 |

3.1 |

12 |

QTSS Upper |

QSDD024 |

6,440.23 |

2,958.62 |

10,257.84 |

562.0 |

261.0 |

-63.0 |

310.0 |

312.0 |

2.0 |

0.6 |

2 |

QTSS Upper |

QSDD027 |

6,440.86 |

2,959.09 |

10,257.89 |

470.7 |

275.0 |

-60.0 |

282.0 |

286.1 |

4.1 |

17.1 |

39 |

QTSS Upper |

QSDD028 |

6,511.36 |

2,898.49 |

10,256.60 |

645.4 |

265.9 |

-67.1 |

474.1 |

475.3 |

1.3 |

3.4 |

10 |

QTSS Upper |

QSDD035A |

6,436.17 |

2,902.87 |

10,257.54 |

546.7 |

277.9 |

-67.1 |

330.0 |

335.0 |

5.0 |

5.0 |

12 |

QTSS Upper |

QSDD036 |

6,359.93 |

2,899.97 |

10,258.52 |

300.6 |

248.8 |

-55.4 |

208.3 |

210.0 |

1.7 |

1.2 |

63 |

QTSS Upper |

QSDD037 |

6,360.78 |

2,900.32 |

10,258.53 |

249.8 |

248.3 |

-62.9 |

217.4 |

222.5 |

5.1 |

0.3 |

11 |

QTSS Upper |

QSDD038 |

6,362.00 |

2,899.74 |

10,258.54 |

384.6 |

246.6 |

-69.1 |

250.1 |

256.1 |

6.0 |

8.1 |

86 |

QTSS Upper |

QSDD039 |

6,359.59 |

2,901.72 |

10,258.56 |

246.6 |

283.0 |

-55.2 |

186.6 |

188.2 |

1.6 |

18.0 |

49 |

QTSS Upper |

QSDD041 |

6,439.31 |

2,959.37 |

10,257.81 |

333.6 |

274.0 |

-55.0 |

264.1 |

265.1 |

1.0 |

7.2 |

13 |

QTSS Upper |

QSDD043 |

6,359.86 |

2,900.32 |

10,258.58 |

321.7 |

268.0 |

-55.0 |

191.7 |

192.3 |

0.6 |

1.4 |

7 |

QTSS Upper |

QSDD044 |

6,360.44 |

2,900.31 |

10,258.55 |

339.7 |

267.0 |

-68.0 |

228.8 |

231.7 |

2.9 |

1.3 |

21 |

QTSS Upper |

QSDD045 |

6,360.87 |

2,901.53 |

10,258.56 |

267.2 |

284.0 |

-63.7 |

203.8 |

204.6 |

0.8 |

5.6 |

21 |

QTSS Upper |

QSDD046 |

6,377.66 |

3,028.94 |

10,259.71 |

289.8 |

252.3 |

-66.7 |

227.4 |

232.3 |

4.9 |

12.7 |

30 |

QTSS Upper |

QSDD049 |

6,433.50 |

2,901.07 |

10,257.51 |

441.9 |

264.6 |

-65.0 |

335.2 |

337.0 |

1.9 |

2.9 |

10 |

QTSS Upper |

QSDD050 |

6,437.13 |

2,839.35 |

10,257.62 |

429.9 |

267.0 |

-61.0 |

303.9 |

305.8 |

1.9 |

2.6 |

19 |

QTSS Upper |

QSDD051 |

6,438.43 |

2,839.30 |

10,257.72 |

474.9 |

266.1 |

-66.4 |

353.3 |

353.9 |

0.6 |

4.8 |

17 |

QTSS Upper |

QSDD052 |

6,440.51 |

2,839.03 |

10,257.96 |

616.3 |

257.6 |

-77.9 |

482.3 |

487.0 |

4.7 |

4.1 |

14 |

QTSS Upper |

Forward Looking Statements

This press release includes “forward-looking statements.” MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation, MAC’s expectations with respect to future performance of the CSA Mine and anticipated financial impacts and other effects of the proposed business combination, the satisfaction of the closing conditions to the proposed transaction and the timing of the completion of the proposed transaction. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things; the supply and demand for copper; the future price of copper; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated reclamation expenses; claims and limitations on insurance coverage; the uncertainty in mineral resource estimates; the uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and dependence on key management personnel and executive officers; and other risks and uncertainties indicated from time to time in the definitive proxy statement/prospectus relating to the business combination that MAC filed with the SEC, including those under “Risk Factors” therein, and in MAC’s other filings with the SEC. MAC cautions that the foregoing list of factors is not exclusive. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or CSA Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward- looking statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230911314855/en/

Contacts

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited.

+1 (817) 698-9901

mick.mcmullen@metalsacqcorp.com

Dan Vujcic

Chief Development Officer and Interim Chief Financial Officer

Metals Acquisition Limited.

+61 451 634 120

dan.vujcic@metalsacqcorp.com