Urges Immediate Refinancing of 2024 Notes

Chatham Asset Management, LLC (“Chatham”), a private investment firm and the largest creditor of Rayonier Advanced Materials (“RYAM” or the “Company”) (NYSE: RYAM), today issued the following statement regarding the upcoming maturities of the Company’s 5.50% Senior Notes due June 1, 2024 (the “2024 Notes”) and 7.625% Senior Secured Notes due January 15, 2026 (the “2026 Notes”):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230524005865/en/

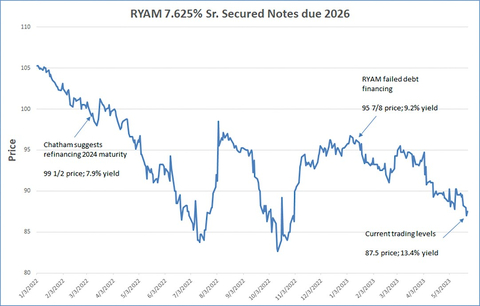

RYAM 7.625% Sr. Secured Notes due 2026 (Graphic: Business Wire)

“Following an extended period of inaction and unsuccessful refinancing attempt earlier this year, we are deeply dismayed by RYAM’s continued lack of urgency in addressing its debt maturities as the 2024 Notes become current next Thursday, June 1, 2023. Rather than shopping around for what it deems as ‘acceptable terms,’ the Board’s fiduciary duty should be to accept the prevailing market rate for its debt, regardless of whether this represents a concession to the current trading level of the 2026 Notes, which recently traded at a year-to-date low of $87.50, or a 13.4% yield to maturity.

“Notably, the current trading levels of RYAM’s 2026 Notes are significantly lower than they were in both January 2023 and March 2022, when the Board refused a proposed refinancing transaction and when Chatham first suggested the Company begin the process of addressing its debt maturities, respectively. The price of RYAM’s common equity has also declined since March 2022, which we believe is due to the overhang of a substantial near-term debt maturity, the absence of a concrete financing strategy, and poor capital allocation by management.

“We strongly urge RYAM to engage in proactive dialogue with its financial advisor and auditors about a rational solution to its debt, as the Company faces a perilously tight maturity window for a below investment grade entity, and we fear going concern language in the Company’s next financials. RYAM is a solvent, eminently financeable company, and the obvious remedy is a prompt financing package.”

Funds affiliated with Chatham hold significant positions in RYAM debt including the 2024 and 2026 Notes as well as short positions and put options in shares of RYAM.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230524005865/en/

Contacts

Jonathan Gasthalter/Sam Fisher

Gasthalter & Co.

(212) 257-4170