- Like-for-like growth excluding Covid contracts*: +8.6%

- Like-for-like growth** (including the -€131m impact of the end of the Covid contracts): +1.9%

- Total growth: +2.2%

- Sustained growth outlook for 2023

- Revised full-year 2023 targets, with no impact on net value creation

Regulatory News:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230425005729/en/

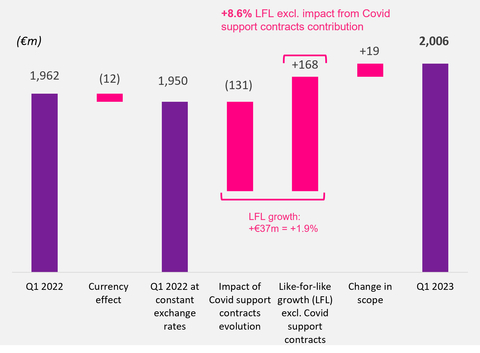

Analysis of first-quarter 2023 revenue growth (Graphic: Teleperformance)

Teleperformance (Paris:TEP), a global leader in digital business services, today released its quarterly revenue figures for the three months ended March 31, 2023.

First-quarter 2023 revenue

- €2,006 million

- up +8.6% like-for-like excluding Covid contracts*

- up +1.9% like-for-like**

- up +2.2% as reported

Solid, diversified growth

- Strong momentum in Core Services activities in the social media, financial services and travel sectors and with government agencies (excluding Covid contracts)

- Sustained expansion of offshore activities serving the North American market, which lowered the level of like-for-like growth (price effect of around -0.6 points) but conversely had a positive impact on margins

- Positive impact of China’s reopening on both Core Services and Specialized Services (TLScontact)

- Expected impact over the quarter of the end of the contribution from Covid contracts (-€131 million)

Strong growth outlook for 2023 and revised targets

- Like-for-like revenue growth target, excluding Covid contracts, of between +8% and +10%

- Like-for-like revenue growth target, including Covid contracts, of around +7%

- EBITA margin target raised to around 16%, a record high, versus 15.7% previously

- Further targeted acquisitions capable of creating value

* At constant scope of consolidation and exchange rates, excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

** At constant scope of consolidation and exchange rates

Commenting on this performance, Teleperformance Chairman and Chief Executive Officer Daniel Julien said: “Our solid first quarter promises to usher in another year of significant growth and margin gains. Despite a still uncertain and volatile macroeconomic and geopolitical environment, recurring like-for-like revenue growth came in at +8.6%. This performance, largely in line with our objectives for the year, was notably driven by the accelerated expansion of offshore activities, which lowered the level of revenue growth but conversely had a positive impact on earnings.

We’ve enjoyed robust sales momentum in a variety of client sectors, including social media, financial services, travel and government agencies, as well as in many countries, particularly in Europe, where our multilingual hub business is growing at a healthy pace. China’s reopening has also been a boon for all our activities, particularly visa application management services.

The Group's 2023 growth outlook is strong. Given the changing internal dynamics of the business, we are adjusting our initial targets for the year, with no impact on net value creation. We remain more committed than ever to pursuing targeted acquisitions capable of creating value, leveraging our efficient TP Cube development model.”

------------------------

Consolidated revenue

€ millions |

2023 |

2022 |

% change |

|||

Like-for-like

|

Like-for-like |

Reported |

||||

Average exchange rate |

€1 = US$1.07 |

€1 = US$1.12 |

|

|

|

|

First quarter |

2,006 |

1,962 |

+8.6% |

+1.9% |

+2.2% |

|

* Excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

Consolidated revenue came in at €2,006 million for the first quarter of 2023, representing a year-on-year increase of +1.9% at constant exchange rates and scope of consolidation (like-for-like) and of +2.2% as reported. The unfavorable currency effect, which had a -€12 million impact on revenue, stemmed primarily from declines against the euro in the Colombian peso, the Egyptian pound and the Indian rupee, despite the positive impact from a stronger US dollar. Changes in the scope of consolidation had a +€19 million positive impact, reflecting the consolidation of PSG Global Solutions from November 1, 2022 (+€15 million) and of Capita Translation & Interpreting from January 1, 2023 (+€4 million).

The expected non-recurring impact of a decline in the contribution from Covid support contracts in 2023 compared with 2022 (-€131 million in the first quarter) weighed on like-for-like growth. Adjusted for this impact, like-for-like growth stood at +8.6% for the period.

This sustained performance, delivered against a backdrop of continued economic and geopolitical uncertainty, attests to the resilience and diversity of the Group's client portfolio, as well as the validity of its “TP Cube” growth strategy. Teleperformance has positioned itself as the digital transformation partner of choice for its clients by deploying its expertise in digital solutions by client sector and by country. During the first quarter, the success of this strategy was demonstrated by rapid business growth in the financial services and travel sectors, as well as with government agencies (excluding Covid contracts) and in Trust & Safety content moderation.

The fast-developing offshore solutions to serve the North American market, particularly in the Philippines, nevertheless had a negative impact of -0.6 point on the level of the first-quarter revenue growth. This trend should continue in the coming quarters. Growth in offshore activities still has a positive impact on the Group's margins.

Specialized Services also expanded at a sustained pace, led by the continued recovery of TLScontact’s visa application management business, which benefited from China’s reopening in particular, and the steady development of LanguageLine Solutions' online interpretation business.

Revenue by activity

|

Q1 2023 |

Q1 2022 |

% change |

||

€ millions |

|

|

Like-for-like |

Like-for-like excluding

|

Reported |

CORE SERVICES & D.I.B.S.* |

1,685 |

1,711 |

-0.4% |

+7.3% |

-1.6% |

North America & Asia-Pacific |

646 |

628 |

+0.8% |

+0.8% |

+2.8% |

LATAM |

396 |

382 |

+7.0% |

+7.0% |

+3.6% |

Europe & MEA (EMEA) |

643 |

701 |

-5.7% |

+13.6% |

-8.2% |

SPECIALIZED SERVICES |

321 |

251 |

+17.0% |

+17.0% |

+28.3% |

TOTAL |

2,006 |

1,962 |

+1.9% |

+8.6% |

+2.2% |

* Digital Integrated Business Services

** Excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

- Core Services & Digital Integrated Business Services (D.I.B.S.)

Core Services & D.I.B.S. revenue amounted to €1,685 million in first-quarter 2023, remaining stable year-on-year (-0.4%). Reported revenue growth was down -1.6%, primarily due to declines against the euro in the Colombian peso, the Egyptian pound and the Indian rupee, despite a stronger US dollar.

Excluding the impact of the decline in revenue from Covid support contracts, Core Services & D.I.B.S. activities delivered like-for-like growth of +7.3% over the period. This very good performance is chiefly attributable to the Group’s robust and diversified client portfolio. Business growth is strong, particularly in the financial services and travel sectors, as well as in the Trust & Safety content moderation business.

- North America & Asia-Pacific

Regional revenue came to €646 million in first-quarter 2023, up +0.8% like-for-like and +2.8% as reported, lifted by the dollar’s rise against the euro.

Like-for-like growth was limited in the first quarter due in particular to the continued acceleration of growth in offshore activities in India and the Philippines to the detriment of US onshore activities. The resulting deflationary impact had a slightly negative impact on regional revenue.

Asia-Pacific operations saw sustained revenue growth, driven by the incipient, rapid recovery of business in China on its government's decision to reopen the country, and by the swift start-up of new contracts in the financial services and travel sectors.

- LATAM

First-quarter 2023 revenue for the LATAM region amounted to €396 million, a year-on-year increase of 7.0% like-for-like. On a reported basis, growth came out at +3.6%, primarily reflecting the decline in the Colombian peso against the euro. This is a satisfactory performance given the high basis of comparison in the same period last year, when a large number of new contracts got underway.

In first-quarter 2023, the Group's businesses enjoyed particularly robust growth in the social media, online entertainment and financial services sectors. Travel sector activities also continued to expand at a satisfactory pace.

Business growth was particularly strong in Colombia and Peru, but more limited in Mexico's offshore segment due to weaker competitiveness against other offshore geographies further to a rise in the Mexican peso against the US dollar.

- Europe & MEA (EMEA)

Revenue in the EMEA region amounted to €643 million in the first three months of 2023, a year-on-year decline of -5.7% like-for-like and of -8.2% as reported, with the difference corresponding to negative currency effects due mainly to the decline of the pound sterling against the euro. The like-for-like decline in revenue is due to the discontinuation of Covid support contracts at the end of 2022 in the Netherlands, France and Germany. Excluding the “Covid contracts” impact, like-for-like growth was very robust at +13.6%, furthering the momentum seen in the second half of 2022.

Multilingual activities, which are the primary contributors to the region’s revenue stream and mainly serve the large global leaders in the digital economy, reported sustained growth for the quarter, in Greece in particular. The hubs in Egypt and Turkey are continuing to scale up rapidly across a variety of sectors, such as social media, online entertainment, financial services, consumer electronics, travel and e-commerce.

Operations in the United Kingdom enjoyed strong growth, driven by the start-up of new contracts in the financial services sector and with government agencies (excluding Covid support contracts).

Lastly, business was robust in Germany, driven by the ongoing, highly brisk expansion of nearshore activities in Croatia, Kosovo and Bosnia-Herzegovina and contracts recently won in travel among other sectors.

- Specialized Services

Revenue from Specialized Services stood at €321 million in first-quarter 2023, a year-on-year increase of +17.0% like-for-like and of +28.3% as reported. The difference between like-for-like and reported growth stemmed from positive currency effects, primarily the rise of the US dollar against the euro, and the positive impact of consolidating PSG Global Solutions from November 1, 2022 and Capita Translation & Interpreting from December 1, 2023.

The first quarter also saw the continued recovery of TLScontact's business, supported by the recent reopening of China's economy, and these favorable conditions are expected to benefit TLScontact over the full year.

LanguageLine Solutions, the main contributor to Specialized Services revenue, continued in the first quarter to see the sustained growth observed from second-half 2022. The continued swift ramp-up of video interpreting solutions and growth in global solutions are supporting this positive trend.

Outlook

In a still uncertain environment, the Group's growth outlook remains strong in 2023.

The Group should continue to benefit from healthy sales momentum in the financial services, travel and content moderation sectors.

Given the changing internal dynamics of the business, Teleperformance has adjusted its targets for 2023:

- Like-for-like revenue growth excluding Covid contracts: between +8% and +10%;

- Like-for-like revenue growth including Covid contracts: around +7%;

- EBITA margin target raised to around 16%, a record high, versus a margin target of 15.7% previously.

This dual adjustment to the initial objectives, both upwards and downwards, has no impact on net value creation.

-----------------

Disclaimer

All forward-looking statements are based on Teleperformance management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a detailed description of these factors and uncertainties, please refer to the “Risk Factors” section of our Universal Registration Document, available at www.teleperformance.com. Teleperformance undertakes no obligation to publicly update or revise any of these forward-looking statements.

Conference call with analysts and investors

Tuesday, April 25, 2023 at 6:15p.m. CET

A replay of the conference call will be available for subsequent listening on Teleperformance’s website, along with the relevant documentation, in the Investor Relations section under Financial Publications (www.teleperformance.com), and by clicking on the following link:

https://www.teleperformance.com/en-us/investors/publications-and-events/financial-publications/

Indicative investor calendar

First-half 2023 results: July 27, 2023

Third-quarter 2023 revenue: November 2, 2023

About Teleperformance Group

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA - Bloomberg: TEP FP), a global leader in digital business services, serves as a strategic partner to the world’s largest companies in many industries. It offers a One Office support services model including end-to-end digital solutions, which guarantee successful customer interaction and optimized business processes, anchored in a unique, comprehensive high touch, high tech approach. More than 410,000 employees, based in 91 countries, support billions of connections every year in over 300 languages and 170 markets, in a shared commitment to excellence as part of the “Simpler, Faster, Safer” process. This mission is supported by the use of reliable, flexible, intelligent technological solutions and compliance with the industry’s highest security and quality standards, based on Corporate Social Responsibility excellence. In 2022, Teleperformance reported consolidated revenue of €8,154 million (US$8.6 billion, based on €1 = $1.05) and net profit of €645 million.

Teleperformance shares are traded on the Euronext Paris market, Compartment A, and are eligible for the deferred settlement service. They are included in the following indices: CAC 40, STOXX 600, S&P Europe 350, MSCI Global Standard and Euronext Tech Leaders. In the area of corporate social responsibility, Teleperformance shares are included in the CAC 40 ESG since September 2022, the Euronext Vigeo Euro 120 index since 2015, the EURO STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders index since 2019, the FTSE4Good index since 2018 and the S&P Global 1200 ESG index since 2017.

For more information: www.teleperformance.com Follow us on Twitter: @teleperformance

Appendix

Glossary - Alternative Performance Measures

Change in like-for-like revenue:

Change in revenue at constant exchange rates and scope of consolidation = [current year revenue - last year revenue at current year rates - revenue from acquisitions at current year rates] / last year revenue at current year rates.

EBITDA before non‑recurring items or current EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization):

Operating profit before depreciation & amortization, amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

EBITA before non‑recurring items or current EBITA (Earnings before Interest, Taxes and Amortization):

Operating profit before amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

Non‑recurring items:

Principally comprises restructuring costs, incentive share award plan expense, costs of closure of subsidiary companies, transaction costs for the acquisition of companies, and all other expenses that are unusual by reason of their nature or amount.

Net free cash flow:

Cash flow generated by the business - acquisitions of intangible assets and property, plant and equipment net of disposals - financial income/expenses.

Net debt:

Current and non-current financial liabilities - cash and cash equivalents

Diluted earnings per share (net profit attributable to shareholders divided by the number of diluted shares and adjusted):

Diluted earnings per share is determined by adjusting the net profit attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding by the effects of all potentially diluting ordinary shares. These include convertible bonds, stock options and incentive share awards granted to employees when the required performance conditions have been met at the end of the financial year.

-------

NB: The alternative performance measures (APMs) are defined in the Appendix

View source version on businesswire.com: https://www.businesswire.com/news/home/20230425005729/en/

Contacts

FINANCIAL ANALYSTS AND INVESTORS

Investor relations and financial

communication department

TELEPERFORMANCE

Tel: +33 1 53 83 59 15

investor@teleperformance.com

PRESS RELATIONS

Europe

Karine Allouis – Laurent Poinsot

IMAGE7

Tel: +33 1 53 70 74 70

teleperformance@image7.fr

PRESS RELATIONS

Americas and Asia-Pacific

Nicole Miller

TELEPERFORMANCE

Tel: + 1 629-899-0675

nicole.miller@teleperformance.com