Believes Fully-Financed Offer Represents Compelling and Certain Value for LL Flooring Shareholders and is a Highly Attractive Alternative to Substantial and Extended Value Erosion Overseen by LL’s Board and Management

Highly Qualified Director Nominees – Tom Sullivan, Jason Delves, and Jill Witter – Are Committed to Maximizing Shareholder Value

F9 Investments, LLC (“F9”) which, together with its affiliates, collectively owns approximately 8.8% of LL Flooring Holdings, Inc.’s (“LL Flooring” or the “Company”) (NYSE: LL) common stock, today sent a letter to the Board of Directors (the “Board”) of LL Flooring proposing to acquire all the issued and outstanding shares of common stock of LL Flooring for $3.00 per share (the “Proposed Offer”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231114412984/en/

(Graphic: Business Wire)

The Proposed Offer is not subject to any financing condition and is fully financed through cash on hand and borrowing under an existing revolving credit facility from an affiliate of F9. The value being offered by F9 reflects LL Flooring’s deteriorating financial and operational performance, as disclosed in its third quarter 2023 results, as well as the Board’s refusal to meaningfully engage with F9 and its affiliates or allow it to perform basic due diligence, following F9’s previously announced acquisition proposal.

F9’s owner, Thomas Sullivan said, “We believe our offer represents a compelling, immediate, and certain cash value for LL’s shareholders, in light of the Company’s deteriorating financial condition and declining stock price, which in our view reflects the market’s lack of confidence in the current Board’s strategy. LL Flooring’s most recent, dismal third quarter earnings performance further reflects the Board and management’s lack of urgency, credible plan, execution ability, or capacity to control costs despite numerous pledges to do so.”

F9 also announced that Mr. Sullivan intends to nominate three highly qualified candidates to LL Flooring’s Board of Directors at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The nominees include:

- Thomas Sullivan, Founder and Chairman of Cabinets to Go, LLC (“Cabinets to Go”), Founder and former CEO of Lumber Liquidators (currently known as LL Flooring), Sole Member, Manager and President of F9 Investments.

- Jason Delves, President and CEO of Cabinets to Go, former President of Wood Fiber Technologies, LLC and Beasley Flooring Products, LLC.

- Jill Witter, Chief Legal Officer and Secretary of F9 Investments, LLC, former Secretary of the Board of Directors of Lumber Liquidators (currently known as LL Flooring).

Mr. Sullivan added, “Given the LL Flooring Board’s lack of meaningful engagement with us over the past six months or any communication about its strategic review process, we have no choice but to assume that the Board is prioritizing its own self-interest over its fiduciary responsibility to maximize value for all LL Flooring shareholders. Accordingly, we have decided to nominate three candidates to the Board at the next annual meeting, who we believe collectively bring significant executive and public company board experience necessary to lead a successful exploration of potential strategic alternatives for the Company and who are committed to maximizing the value of LL Flooring for all shareholders.”

The full text of F9’s letter to the Board of LL Flooring follows:

VIA E-MAIL AND OVERNIGHT MAIL

November 14, 2023

Nancy M. Taylor

Chairperson of the Board

LL Flooring Holdings, Inc.

4901 Bakers Mill Lane

Richmond, VA 23230

Charles Tyson

Chief Executive Officer

LL Flooring Holdings, Inc.

4901 Bakers Mill Lane

Richmond, VA 23230

Dear Ms. Taylor and Mr. Tyson:

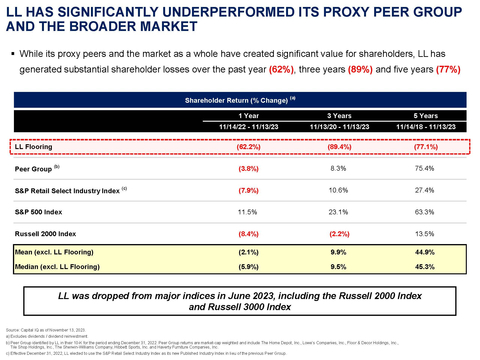

On behalf of F9 Investments, LLC, together with Thomas D. Sullivan and Jason Delves (collectively, “we” or “F9 Investments”), we are writing today to reiterate our strong interest in pursuing an all-cash acquisition of LL Flooring Holdings, Inc. (the “Company” or “LL”) by an affiliate of F9 Investments. As current shareholders, we are dismayed to see third quarter results continue the pattern of declining sales, transaction volume and earnings, concurrent with significant negative free cash flow and a nearly 100% increase in leverage. As shown in the attached charts, while LL’s peers have created significant value for shareholders, LL has generated substantial shareholder losses of 62% over the last twelve months, 89% over the past three years and 77% over the past five years. We believe our offer has strategic logic and presents your shareholders with immediate liquidity at a considerable and meaningful value for their shares.

We are prepared to offer $3.00 per share in cash for all of the issued and outstanding shares of common stock of the Company not owned by F9 Investments or its affiliates. Our offer is subject to confirmatory due diligence, including confirming the value and/or useful life of the current inventory, and to reviewing any potential off-balance sheet liabilities, including but not limited to the potential for future negative rulings related to antidumping and countervailing duties investigations, litigation liabilities and other commitments.

We believe our offer represents a compelling opportunity that your shareholders will find attractive, especially in light of the Company’s deteriorating financial condition and declining stock price which, we believe, reflects the market’s lack of confidence in the current Board’s strategy.

Despite LL’s substantial three-year decline in sales and earnings, we believe that a sale of the Company to F9 Investments is the most logical and strategic approach. We believe that our knowledge of the hard-surface flooring market positions us uniquely to address the Company’s declining performance and represents the best means for LL shareholders to maximize the value of their shares.

Our offer is not contingent on financing and we want to make clear that we have the financial ability to consummate a transaction. We plan to fund the acquisition through cash on hand and borrowing under our existing revolving credit facility. Upon request, we will provide proof of funds evidencing that we have sufficient capital to complete this proposed transaction.

On May 26, 2023, F9 Investments presented the Board of Directors of the Company with a cash offer of $5.76 per share, which at that time represented a premium of over 100% of the stock’s 52 week low of $2.75. The Board of Directors summarily rejected this proposal. We withdrew this offer following LL’s continued underperformance in the quarter ended June 30, 2023, in which LL reported a $1.35 net loss per common share, continued deterioration of operations and increasing selling, general and administrative (SG&A) expenses. LL's downward trajectory continued into the following quarter ended September 30, 2023, with negative 20% year-over-year net sales growth, an additional net loss per share of $1.25 and a $37M increase in total debt (from $40M as of June 2023 to $77M as of September 2023). The challenging macroeconomic and retail environment, coupled with LL’s sustained net sales declines, collective losses and increased leverage, have put LL in an even more precarious financial position than at the time of our previous offer, resulting in our revised proposal.

On August 14, 2023, the Company announced that the Board of Directors was initiating an exploration of “strategic alternatives” whereby the Board would consider a wide range of options for the Company including, among other things, “a potential sale, merger or other strategic transaction.” Despite our attempts to discuss a potential transaction, you refused to allow confirmatory due diligence that may have enabled us to resubmit our original offer unless and until we agreed to a “standstill agreement” that would have prevented us from nominating a slate of candidates for election to the Board of Directors at the next annual meeting of shareholders. Given the Board of Directors’ track record and repeated history of refusing to meaningfully engage with us, we were and continue to be unwilling to enter into a standstill agreement which prevents us from nominating candidates at the upcoming annual meeting.

In an effort to move forward with our offer, we are prepared to enter into a reasonable confidentiality agreement that would enable us to engage in confirmatory due diligence.

We and our advisors stand ready to move expeditiously and, assuming appropriate engagement from the Company, complete our confirmatory due diligence and get to a signed transaction in 30 days. To that end, we are committed to work collaboratively with the Company, its management and its Board of Directors. Of course, if, as a result of our confirmatory due diligence, we find evidence of significant additional value inherent in the Company based on matters we are not aware of, we may be willing to upwardly adjust the offer price.

It is Mr. Sullivan’s current intent to nominate a slate of qualified candidates for the election to the Board of Directors of the Company at the Company’s 2024 annual meeting, and accordingly, Mr. Sullivan has submitted a Notice of Stockholder Nominations to the Company. Given the Company’s declining performance and the Board of Directors’ refusal to meaningfully engage with us to maximize shareholder value, we view the nomination and election of our nominees as essential for the Company to bring the much-needed accountability, oversight and shareholder alignment to the boardroom to drive value for the benefit of all shareholders.

This proposal presents a non-binding offer and does not represent or create any legally binding or enforceable obligations. No such obligations will arise unless and until both parties (or their affiliates) execute mutually acceptable written definitive documentation with respect to a transaction. We reserve the right to withdraw or modify our proposal at any time.

We strongly urge the Board of Directors to engage with us regarding this proposal. We believe our proposal provides the Board of Directors the ability to attain the highest possible price for the Company’s shareholders.

Sincerely,

F9 INVESTMENTS, LLC

Thomas D. Sullivan

President

Advisors

Solomon Partners Securities, LLC is serving as F9’s financial advisor and Dentons US LLP is serving as its legal advisor.

About F9 Investments

F9 Investments is a private equity firm based in Miami Beach, Florida. We Invest in Clean Energy, Direct to Consumer Retail, Commercial and Industrial Real Estate.

Forward Looking Statements

Statements in this press release contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. These statements are intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act of 1995. When used in this press release, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, matters of which we may not be aware, the outcome of any discussions between LL Flooring Holdings, LLC (“LL Flooring”) and F9 Investments, LLC and its affiliates (collectively, “F9 Investments”) with respect to a possible transaction, the ultimate outcome of any possible transaction between F9 Investments and LL Flooring, including the possibility that LL Flooring will reject the proposed transaction with F9 Investments, uncertainties as to whether LL Flooring will cooperate with F9 Investments regarding the proposed transaction, the effect of the announcement of the proposed transaction or board changes on the ability of LL Flooring to operate its business and to maintain favorable business relationships, the timing of the proposed transaction, the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals), other risks related to the completion of the proposed transaction and actions related thereto, changes in financial markets, changes in economic, political or regulatory conditions, changes in facts and other circumstances and uncertainties concerning the proposed transaction; and other factors set forth from time to time in LL Floorings’ SEC filings, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, as well as other documents that will be filed by F9 Investments and LL Flooring, as applicable. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. In light of these risks and uncertainties, the forward-looking events discussed in this press release might not occur. Our forward-looking statements speak only as of the date of this press release or as of the dates so indicated. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Additional Information

This press release does not constitute an offer to buy or solicitation of an offer to sell any securities. This press release relates to a proposal which F9 Investments has made for an acquisition of LL Flooring and to nominate persons to serve on the LL Flooring Board of Directors. In furtherance of these proposals and subject to future developments, F9 Investments (and, if a negotiated transaction is agreed, LL Flooring) may file one or more proxy statements or other documents with the SEC. This press release is not a substitute for any proxy statement or other document F9 Investments and/or LL Flooring may file with the SEC in connection with the proposed transaction.

Investors and security holders of LL Flooring are urged to read the proxy statement(s), prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Public Storage and/or Life Storage, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by F9 Investments through the website maintained by the SEC at http://www.sec.gov.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

This press release is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, F9 Investments and its affiliates and its and their officers and employees, as well as the nominees named above, may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. You can find information about certain of these persons in the Schedule 13D and amendments thereto originally filed with the SEC on May 25, 2023. Additional information regarding the interests of such potential participants will be included in one or more proxy statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC's website at http://www.sec.gov.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231114412984/en/

Contacts

Media:

Jonathan Gasthalter/Nathaniel Garnick

Gasthalter & Co.

(212) 257-4170

F9Investments@gasthalter.com

Investors:

Michael Fein

Campaign Management

(212) 632-8422

michael.fein@campaign-mgmt.com