Black investing remains stagnant at 1998 level while white stock market participation at historic low

Higher risk investments are growing in popularity, especially among younger Black investors

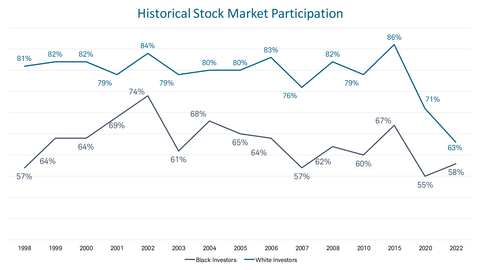

Against the backdrop of unprecedented stock market volatility since the beginning of the pandemic, the 2022 Ariel-Schwab Black Investor Survey reveals investor participation is at historic lows for both Black and white Americans. In 2022, just 58% of Black Americans and 63% of white Americans own stocks, compared to survey peaks: 74% of Black investors in 2002 and 86% of white investors in 2015.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220405005467/en/

Ariel-Schwab Black Investor Survey Historical Stock Market Participation (Graphic: Business Wire)

For 24 years, Ariel Investments and Charles Schwab have studied the investing and saving attitudes and behaviors of Black and white Americans. The 2022 survey compares Black and white survey respondents with an average household income of $99,000 and $106,000, respectively.

While the investment gap between Black and white Americans narrowed in 2022, there was a significant drop-off among white investors (down 8 percentage points from 71% in 2020) and only a nominal increase among Black investors (up 3 percentage points from 55% in 2020). However, stock market participation is higher among younger Black Americans, with 68% of Black respondents under 40 now investing, compared to 57% of younger white investors.

For Many Black Americans, Higher Risk Assets are First Foray into Investing

The popularity of new, higher risk investment options, especially among younger and first time Black investors, is striking.

-

One-quarter of Black Americans (25%) currently own cryptocurrency, and among Black investors under 40, that figure jumps to 38%.

- This is compared to only 15% of white investors who own cryptocurrency, and 29% of white investors under 40.

-

Black investors are more than twice as likely to say cryptocurrency was their first investment (11% of Black investors compared to 4% of white investors).

- Younger Black Americans are even more likely to first experience investing through this high-risk asset class. Nearly a quarter (23%) of Black investors under 40 first invested in the stock market through cryptocurrency.

- Black investors are also twice as likely to rank cryptocurrency as the best investment choice overall (8% of Black investors vs. 4% of white investors).

Cryptocurrency |

||||||

|

Black Americans by Age |

White Americans by Age |

||||

|

<40 |

40-59 |

60+ |

<40 |

40-59 |

60+ |

Current

|

38% |

27% |

10% |

29% |

19% |

7% |

View

|

13% |

8% |

3% |

7% |

6% |

2% |

There is clear evidence of an education gap between Black and white Americans. Despite headline-making news about volatility in cryptocurrency values, platform hacks, and a lack of government regulation, Black investors are less likely than white investors to think that cryptocurrency is a risky investment (68% vs. 73%). Black investors are also more likely than white investors to believe investments in cryptocurrency are both safe (33% vs. 18%) and regulated by the government (30% vs. 14%). This mindset is even more common among Black investors under 40, with 51% believing it is safe and 41% believing it is government-regulated.

More Education is Needed—Especially Among Younger Investors

Nearly half of all Black and white investors (47% and 45%, respectively) report investing in something they did not fully understand. This is even more pronounced among investors under 40 (58% and 46%, respectively). While both groups are entering the market without the information they need, Black investors are more likely to trust and make investment decisions based on less credible information sources, such as social media. One-third of Black investors (33%) say they have invested based on something they saw on social media, compared to less than a quarter of white investors (20%). This gap is even more pronounced among Black and white investors under 40 (51% and 36%, respectively).

Risky Investing Behaviors |

||||||

|

Black Americans |

White Americans |

||||

Invested in something they didn’t fully understand |

47% |

45% |

||||

Of those who invested in something they didn’t fully understand, did so because it seemed like a “sure deal” |

29% |

18% |

||||

Invested based on something seen on social media |

33% |

20% |

||||

Trust social media as investing information source |

13% |

6% |

||||

|

Black Americans by Age |

White Americans by Age |

||||

<40 |

40-59 |

60+ |

<40 |

40-59 |

60+ |

|

Invested in something they didn’t fully understand |

58% |

46% |

40% |

46% |

47% |

41% |

Invested based on something seen on social media |

51% |

35% |

15% |

36% |

22% |

13% |

“The confluence of low stock market participation, appetite for risky investment options, and alarming lack of knowledge about fundamental investing principles is a red flag about the critical need for greater investor education,” said Mellody Hobson, Co-CEO and President of Ariel Investments. “Many new and younger investors have never experienced market volatility like we’ve seen in the last couple years, and we have a responsibility to educate these new investors about the value of long-term investing to build wealth and achieve financial security.”

When asked about anticipated investment returns, more than one-in-four Black investors (27%) expect outsized annualized returns of 20% or higher, and 19% thought they could “get rich quick” through investing. This is compared to only 12% of white investors who anticipate returns of 20% or higher, and 7% who cite immediate profits as a reason to invest. Black investors under 40 have even higher expectations, with 34% expecting returns of more than 20%, compared to 15% among white investors of the same age.

Trust and Fear are Barriers to Investing, Respect is On the Move

Black Americans are less trusting of the stock market (30% vs. 23%) and financial institutions (28% vs. 18%) compared to white Americans. This has led to many Black investors pulling out of the market.

Since 2020, Black Americans who either stopped investing or have never invested were more likely to cite lack of trust in the stock market (36% vs. 29%) and financial institutions (25% vs. 19%), as well as having had a bad investing experience (15% vs. 9%), as reasons.

Black investors are also more fearful of losing money than white investors—56% cite it as a concern prior to investing compared to 46% of white investors. In parallel, Black investor perception of the stock market as offering a fair opportunity for all to profit improved in 2022 (48% vs. 40% in 2020), signaling optimism for the future.

While trust remains low, feelings of respect have also improved. As in 2020, Black Americans were less likely than white Americans to feel respected by financial institutions, however, that gap has decreased substantially. Black Americans feel more respected in 2022 (44% vs. 35%), while white Americans feel less respected (51% vs. 62%).

When it comes to growing and protecting their assets, Black Americans are less trusting of people (32% vs. 45%) and more trusting of technology (31% vs. 21%), than white Americans. Trust in technology among Black Americans is highest among men, new investors, and investors under 40.

“The survey shows a penchant for ‘get rich quick’ tactics, and if we don’t educate the next generation about the value of long-term investing, their financial prospects will be limited and it will be difficult for our industry to gain their trust,” said Carrie Schwab-Pomerantz, President of Charles Schwab Foundation.

Workplace Retirement Plans Not the Only Gateway to Investing

Over the last several decades, the Black Investor Survey has shown that 401(k) plans have been the entry point to investing for many Black Americans. While the defined contribution plan participation gap between Black and white investors has nearly closed, participation rates have stagnated and are well below 2015 numbers.

Additionally, investors are entering the stock market through a variety of investment vehicles. In 2020, 63% of Black investors reported first investing through a retirement plan. In 2022, respondents were given an expanded list of entry point options. Only 31% of Black Americans report first investing through a workplace plan.

Gateways to Investing |

||

|

Black Americans |

White Americans |

401(k) or another workplace plan |

31% |

33% |

Individual stocks/bonds |

28% |

34% |

Mutual Funds |

14% |

19% |

Cryptocurrency |

11% |

4% |

Fractional Shares |

5% |

3% |

Signs of Improvement

Black Americans are saving and investing more in 2022, with an impressive 40% increase in contributions—up to $657 per month on average from $393 in 2020. The increase is driven by new investors, high earners, and respondents under 40. Despite these strides, white Americans are saving and investing significantly more ($857 per month).

Historically, the survey has shown that Black Americans are less likely than white Americans to have discussed the stock market growing up. Today, however, the gap has closed as Black and white investors are almost equally as likely to discuss the stock market with their families (41% vs. 43%, respectively). Over the past two years during the pandemic, these “dinner table conversations” about investing have increased for both racial groups (up from 37% of Black investors and 36% of white investors in 2020).

Detailed survey results can be found here.

About the Survey

The online survey was conducted in January 2022 by Helical Research among 2,057 Americans age 18 and older with $50,000 or more household income in 2021. The average household income of Black and white survey participants is $99,000 and $106,000, respectively. The margin of error for the total survey sample is 3 percentage points. Detailed survey results can be found here. Historical survey data can be found here.

About Ariel Investments

Ariel Investments, LLC is a global value-based asset management firm founded in 1983. Ariel is headquartered in Chicago, with offices in New York City, San Francisco, and Sydney. As of December 31, 2021, Ariel’s firm-wide assets under management totaled approximately $18.3 billion, which includes $873.7 million in assets from Ariel Alternatives, a subsidiary of Ariel Investments. Ariel serves individual and institutional investors through five no-load mutual funds and nine separate account strategies. For more information, please visit Ariel’s website at arielinvestments.com.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us on Twitter, Facebook, YouTube and LinkedIn.

#0422-2UHK

View source version on businesswire.com: https://www.businesswire.com/news/home/20220405005467/en/

Contacts

Charles Schwab: Stephanie Corns

stephanie.corns@schwab.com

Ariel Investments: Christina Sciarrino

csciarrino@arielinvestments.com