Company’s largest exploration investment in its history delivering significant new results throughout its portfolio of North American precious metals assets

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today reported an update on its 2021 exploration programs at its Palmarejo and Kensington operations, following its update on February 17, 2021. The Company also highlighted new drilling results at its Silvertip and Wharf mines. Coeur drilled approximately 698,100 feet (212,775 meters) from 27 active rigs at six different locations through the first seven months of 2021, reflecting a year-over-year increase of roughly 58%. The Company plans to invest approximately $75 million1 in exploration this year, nearly 50% higher than last year’s record exploration investment, representing one of the sector’s largest exploration programs.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210909005142/en/

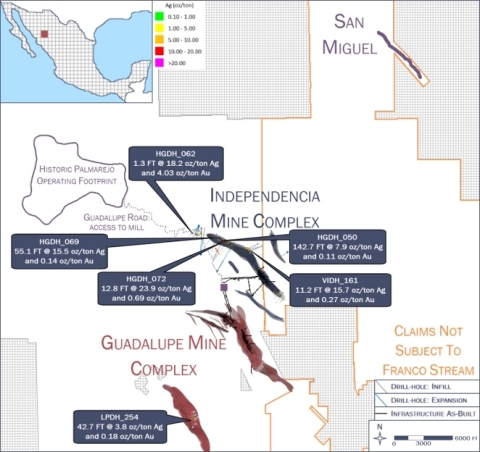

Palmarejo - Plan View (Graphic: Business Wire)

Key Highlights2,3

- Ongoing drilling success at Palmarejo leading to new high-grade growth – Coeur has been successfully generating results from its infill and expansion drilling campaign within the Independencia and Guadalupe deposits. Specifically, assays across multiple target areas, including the Hidalgo zone located at the northwest end of Independencia near existing infrastructure, have returned high-grade intercepts that demonstrate significant near-mine growth potential. Key highlights include:

Hidalgo zone (Independencia deposit) – Infill

- Hole HGDH_050 returned 142.7 feet (43.5 meters) of 0.11 ounces per ton (“oz/t”) (3.8 grams per tonne (“g/t”)) gold and 7.9 oz/t (270.9 g/t) silver

- Hole HGDH_069 returned 55.1 feet (16.8 meters) of 0.14 oz/t (4.8 g/t) gold and 15.5 oz/t (531.4 g/t) silver

- Hole HGDH_072 returned 12.8 feet (3.9 meters) of 0.69 oz/t (23.7 g/t) gold and 23.9 oz/t (819.4 g/t) silver

North Independencia (Independencia deposit) – Infill

- Hole VIDH_161 returned 11.2 feet (3.4 meters) of 0.27 oz/t (9.3 g/t) gold and 15.7 oz/t (538.3 g/t) silver

Hidalgo zone (Independencia deposit) – Expansion

- Hole HGDH_062 returned 1.3 feet (0.4 meters) of 4.03 oz/t (138.2 g/t) gold and 18.2 oz/t (624.0 g/t) silver

La Patria zone (Guadalupe deposit) – Infill

- Hole LPDH_254 returned 42.7 feet (13.0 meters) of 0.18 oz/t (6.2 g/t) gold and 3.8 oz/t (130.3 g/t) silver

- Drilling at Kensington identifying additional high-grade growth opportunities – Building on late last year’s infill program, Coeur began 2021 by drilling on the Elmira vein located approximately 2,700 feet (825 meters) east of the Kensington Main deposit while also testing expansion targets beyond Elmira, including the Johnson vein. Coeur’s elevated level of exploration investment at Kensington the past two years is intended to extend mine life and generate future potential growth opportunities beyond its existing reserves and resources. Notable assay results include:

Elmira – Infill & Expansion

- Hole EL21-0850-192-X30 returned 14.6 feet (4.5 meters) of 1.06 oz/t (36.3 g/t) gold

- Hole EL21-0850-192-X23 returned 19.7 feet (6.0 meters) of 0.48 oz/t (16.5 g/t) gold

- Hole EL21-0850-156-X11 returned 10.4 feet (3.2 meters) of 0.81 oz/t (27.8 g/t) gold, 0.8 feet (0.2 meters) of 6.43 oz/t (220.4 g/t) gold and 1.4 feet (0.4 meters) of 1.54 oz/t (53.7 g/t) gold

Johnson – Expansion

- Hole JN21-0900-181-X02 returned 1.2 feet (0.4 meters) of 1.31 oz/t (45.7 g/t) gold

- Hole JN21-0900-181-X04 returned 4.3 feet (1.3 meters) of 0.34 oz/t (11.7 g/t) gold

- Hole JN21-0900-181-X05 returned 3.6 feet (1.1 meters) of 0.72 oz/t (24.7 g/t) gold

- New Southern Silver zone at Silvertip continues to demonstrate growth potential – New surface and underground drilling has discovered a flat-lying “manto” portion of the Southern Silver zone. As highlighted below, the manto appears to be thicker in places than the previously drilled vertical breccia zones interpreted as mineralized feeder structures. After further analysis, the Company believes several other manto-feeder relationships may be present at the Discovery, Camp Creek and Central zones, and that underground drilling is the best approach to test these types of structures. Notable expansion drilling assay results from the Southern Silver zone manto mineralization include:

- Hole 65Z21-485-007-005 returned 65.6 feet (20.0 meters) of 2.7 oz/t (92.5 g/t) silver, 16.9% zinc and 0.5% lead

- Hole 65Z21-485-DDS1-015 returned 35.4 feet (10.8 meters) of 13.0 oz/t (445.7 g/t) silver, 19.4% zinc and 7.5% lead and 17.1 feet (5.2 meters) of 18.0 oz/t (617.1 g/t) silver, 7.7% zinc and 12.0% lead

- Positive results from largest drilling campaign at Wharf since acquisition – New significant oxide-gold assays were recently returned from the Portland Ridge – Boston claim group and Flossie area. Key highlights from the 2021 infill drilling campaign include:

- Hole W21R-4781 returned 120 feet (36.6 meters) of 0.22 oz/t (7.5 g/t) gold

- Hole W21R-4826 returned 200 feet (61.0 meters) of 0.12 oz/t (4.1 g/t) gold

- Hole W21R-4812 returned 40 feet (12.2 meters) of 0.31 oz/t (10.6 g/t) gold

- Hole W21R-4827 returned 70 feet (21.3 meters) of 0.14 oz/t (4.8 g/t) gold

“Our 2021 exploration program accelerated during the summer months with 27 rigs active across six sites,” said Hans J. Rasmussen, Coeur’s Senior Vice President of Exploration. “We remain on-track to deliver the largest exploration campaign in Company history and are regularly setting new monthly drilling records. We expect to complete roughly 1.2 million feet (365,750 meters) of drilling by the end of the year, with the primary objective of further extending mine lives across our portfolio. These goals, along with our track record of consistently growing our reserve and resource base through the drill bit, are true differentiators for Coeur. Assays from both Palmarejo and Silvertip continue to demonstrate significant growth potential, further validating our commitment to a higher-level of exploration investment at each site. The Hidalgo zone at Palmarejo represents the most significant near-mine opportunity since our focused exploration program began in 2012.”

Mr. Rasmussen continued, “Assay and drill thicknesses from the southern portion of Silvertip continue to exceed our expectations, specifically from the Southern Silver and Camp Creek zones. Additionally, airborne geophysical models suggest that these zones may continue another mile and a quarter (two kilometers) from our current drilling positions. Positive results like these, along with continued exploration success at Kensington and Wharf, give us confidence that we are making progress toward achieving our 2021 exploration objectives.”

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/_resources/news/2021-09-09-Exploration-Update.pdf. Please see the “Cautionary Statements” section for additional information regarding drill results.

Palmarejo2,3

Coeur has drilled a total of approximately 149,200 feet (45,475 meters) from up to eight diamond core rigs across six different zones (three infill targets and three expansion targets) through the first seven months of 2021, compared to roughly 118,600 feet (36,150 meters) during the same period in 2020.

Key highlights from the 2021 exploration program include:

Hidalgo zone (Independencia deposit)

- Up to four active rigs (two infill and two expansion)

- As previously discussed in Coeur’s February 17, 2021 news release, mineralization typically consists of several vein intercepts creating wide, high-grade “clavos” where mine planning could incorporate larger transverse stopes that support higher production rates

- Strategically located near existing mine infrastructure which has the potential to facilitate shorter development time to commence production

- Drill assay intervals have continued to produce the best grade-thickness at Palmarejo since drilling at the historic Clavo 76 prior to 2013

La Patria zone (Guadalupe deposit)

- Infill drilling with one drill rig has continued the exploration program that began in 2020, focusing on areas of historic drilling

- A second rig is currently being mobilized to test expansion targets to the southeast of the current resource area

North Independencia zone (Independencia deposit)

- Once the infill program is completed (currently estimated around mid-2022), Coeur plans to begin expansion drilling further northwest of the current resource limits

Guazapares district (greenfields exploration)

- Field reconnaissance has identified areas of surface alteration and quartz veining east of Palmarejo in the Guazapares district, which was acquired in 2015 as part of the acquisition of Paramount Gold and Silver Corp., sits outside the gold stream area of interest and totals nearly 15,000 hectares. Drill permitting at an initial target area (Carmela) is currently underway with the objective of commencing drilling at this new target by the end of the year

Coeur plans to transition its focus on various resource expansion targets in the remainder of 2021, while also continuing the infill program at the Independencia North, Hidalgo and La Patria zones. The Company’s priority targets for expansion drilling during the remainder of the year include (i) expanding the Hidalgo zone northwest towards the haul road, (ii) extending the North Independencia zone, (iii) drilling the southeast extension of the La Patria zone, (iv) scout drilling of the El Ojito zone, located in the northeastern portion of the Independencia deposit and subparallel to the Hidalgo zone, and (v) testing the new Carmela target located to the east within the Guazapares district.

Palmarejo 2021 Production & Exploration Guidance and Year-End 2020 Reserves and Resources:

- 2021E Production4: 100,000 - 110,000 ounces of gold and 6.5 - 7.8 million ounces of silver

- 2021E Exploration Investment1: Approximately $14 million ($9 million expensed and $5 million capitalized)

- 2020 Proven and Probable Reserves: 849,000 ounces of gold at an average grade of 0.06 oz/t (1.9 g/t) and 59.4 million ounces of silver at an average grade of 3.9 oz/t (132.8 g/t)

- 2020 Measured and Indicated Resources: 613,000 ounces of gold at an average grade of 0.05 oz/t (1.6 g/t) and 51.1 million ounces of silver at an average grade of 3.8 oz/t (130.6 g/t)

-

2020 Inferred Resources: 280,000 ounces of gold at an average grade of 0.06 oz/t (2.2 g/t) and 14.5 million ounces of silver at an average grade of 3.3 oz/t (114.6 g/t)

Kensington2,3

The 2021 Kensington exploration program started with two underground core rigs focused on infill drilling along the Elmira and Jualin vein structures. A limited number of expansion holes were also drilled into Johnson, located about 500 feet (150 meters) east of Elmira. Early in the third quarter, the Company ramped up to five core rigs, including three underground and two surface core rigs. Through the first seven months of 2021, Coeur drilled approximately 86,600 feet (26,395 meters) at Kensington compared to roughly 88,900 feet (27,100 meters) during the same period in 2020.

Elmira and the development drift established in late 2020 represent potential areas of future mining at Kensington. The Company plans to continue drilling these areas while focusing on refining the vein shapes through 2022. Coeur expects to declare a maiden reserve for Elmira at the end of the year with the goal of mining the deposit beginning in early 2023.

Additionally, Coeur has drilled the Johnson vein structure from the same platforms it used to test Elmira. The Company has completed approximately 23 holes into Johnson since the beginning of the year. Resource shapes for the new intercepts are still in the earliest phase of interpretation. Johnson also outcrops on surface where it has returned strong gold assays, representing about 1,000 feet (300 meters) of vertical dip length.

For the remainder of 2021, Coeur plans to (i) prioritize infill drilling at upper Kensington Zone 30, (ii) continue infill and expansion drilling around the edges of Elmira, (iii) conduct surface expansion drilling at upper Raven and Johnson, and (iv) execute helicopter-supported step-out drilling at the Comet, Big Lake and Gold King targets.

Kensington 2021 Production & Exploration Guidance and Year-End 2020 Reserves and Resources:

- 2021E Production4: 115,000 - 130,000 ounces of gold

- 2021E Exploration Investment1: Approximately $13 million ($9 million expensed and $4 million capitalized)

- 2020 Proven and Probable Reserves: 331,000 ounces of gold at an average grade of 0.20 oz/t (6.8 g/t)

- 2020 Measured and Indicated Resources: 830,000 ounces of gold at an average grade of 0.23 oz/t (7.9 g/t)

- 2020 Inferred Resources: 394,000 ounces of gold at an average grade of 0.25 oz/t (8.5 g/t)

Silvertip2,3

Coeur began the year drilling Silvertip with five surface rigs and one underground core rig focused on resource expansion, while also conducting infill drilling on select areas of the deposit to convert existing resources to reserves. Through first seven months of 2021, Coeur drilled approximately 199,900 feet (60,950 meters) at Silvertip compared to roughly 88,300 feet (26,925 meters) during the same period in 2020.

The Company’s news release on June 15, 2021 highlighted the discovery of the new Southern Silver zone, located adjacent to and enveloping the historic 65 zone manto mineralization. At that time, the new zone was interpreted to be primarily a series of vertically oriented breccia material with encouraging thicknesses and grades. Based on the positive results, the Company continued to advance underground development to support additional drilling in the area, which is now underway.

Recent drilling has encountered flat-lying, manto-style mineralization with meaningful thicknesses, highlighting the potential to grow resource tonnage with additional drilling. These results suggest that the ore body in the zone consists of both vertical- and flat-lying manto-style mineralization. Notably, this new interpretation may apply to other zones at Silvertip that have not yet had the benefit of underground drilling to test for both vertical- and flat-lying mineralization which could lead to higher angle structures that support additional resource tonnage.

Furthermore, the latest drill core is beginning to demonstrate that the mineralization within the Southern Silver zone continues to the southwest, south and southeast, connecting with the Camp Creek, Tour Ridge and Discovery zones, respectively.

Silvertip 2021 Exploration Guidance and Year-End 2020 Reserves and Resources:

- 2021E Exploration Investment1: Approximately $18 million ($15 million expensed and $3 million capitalized)

- 2020 Proven and Probable Reserves: 14.6 million ounces of silver at an average grade of 8.1 oz/t (278.2 g/t), 296.1 million pounds of zinc at an average grade of 8.2% and 193.2 million pounds of lead at an average grade of 5.4%

- 2020 Measured and Indicated Resources: 17.4 million ounces of silver at an average grade of 7.4 oz/t (255.0 g/t), 442.1 million pounds of zinc at an average grade of 9.4% and 216.5 million pounds of lead at an average grade of 4.6%

-

2020 Inferred Resources: 12.0 million ounces of silver at an average grade of 8.3 oz/t (283.3 g/t), 308.7 million pounds of zinc at an average grade of 10.6% and 143.9 million pounds of lead at an average grade of 5.0%

Wharf2,3

In early 2021, Coeur initiated the largest drilling campaign at Wharf since it acquired the operation in 2015. The Company plans to invest approximately $5 million1 on exploration at Wharf this year – roughly the same amount spent cumulatively since acquisition5. Through the first seven months of 2021, Coeur drilled approximately 85,800 feet (26,175 meters) at Wharf compared to roughly 10,600 feet (3,225 meters) during the same period in 2020.

The Company has essentially achieved its target drill footage for the year, efficiently reaching its goal approximately 30% under budget. Building on this momentum, Coeur plans to keep one active rig turning at Wharf for the rest of the year.

Coeur is targeting oxide-gold hosted in the Deadwood Formation. The team has received about half the outstanding drill assays with roughly 40% of the holes returning results above resource grade thickness cutoff. Based on information received thus far, the Company expects to incorporate these results into its year-end 2021 resource model.

Wharf 2021 Production & Exploration Guidance and Year-End 2020 Reserves and Resources:

- 2021E Production4: 85,000 - 95,000 ounces of gold

- 2021E Exploration Investment1: Approximately $5 million (substantially all capitalized)

- 2020 Proven and Probable Reserves: 720,000 ounces of gold at an average grade of 0.03 oz/t (0.9 g/t)

- 2020 Measured and Indicated Resources: 605,000 ounces of gold at an average grade of 0.02 oz/t (0.8 g/t)

-

2020 Inferred Resources: 67,000 ounces of gold at an average grade of 0.02 oz/t (0.7 g/t)

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, the Wharf gold mine in South Dakota, and the Silvertip silver-zinc-lead mine in British Columbia. In addition, the Company has interests in several precious metals exploration projects throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, exploration expenditures, drill results, growth, extended mine lives, grade, thickness, investments, mine expansion and development plans, resource delineation, expansion, upgrade or conversion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves, the potential effects of the COVID-19 pandemic, including impacts to the availability of our workforce, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Christopher Pascoe, Coeur’s Director, Technical Services and a qualified person under Canadian National Instrument 43-101, approved the scientific and technical information concerning Coeur’s mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, Canadian investors should refer to the Technical Reports for each of Coeur’s properties as filed on SEDAR at www.sedar.com.

Notes

The potential quantity and grade for the deposits described herein are conceptual in nature. There is insufficient exploratory work to define a mineral resource and it is uncertain if further exploration will result in the applicable target being delineated as a mineral resource.

- Reflects midpoint of guidance as published by Coeur on July 28, 2021.

- For a complete table of all drill results included in this release, please refer to the following link: https://www.coeur.com/_resources/news/2021-09-09-Exploration-Update.pdf.

- Rounding of grades, to significant figures, may result in apparent differences.

- Guidance as published by Coeur on July 28, 2021.

- Reflects cumulative investment in exploration at Wharf between 2015 and 2020.

2020 Year-End Proven and Probable Reserves

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| PROVEN RESERVES | |||||||||

| Palmarejo | 4,040,000 |

0.067 |

4.29 |

- |

- |

270,000 |

17,344,000 |

- |

- |

| Rochester | 396,867,000 |

0.003 |

0.41 |

- |

- |

1,047,000 |

162,645,000 |

- |

- |

| Kensington | 814,000 |

0.195 |

- |

- |

- |

159,000 |

- |

- |

- |

| Wharf | 19,181,000 |

0.024 |

- |

- |

- |

462,000 |

- |

- |

- |

| Silvertip | 186,000 |

- |

12.01 |

10.14% |

8.53% |

- |

2,233,000 |

37,647,000 |

31,656,000 |

| Total | 421,088,000 |

0.005 |

0.43 |

1,938,000 |

182,222,000 |

37,647,000 |

31,656,000 |

||

| PROBABLE RESERVES | |||||||||

| Palmarejo | 11,297,000 |

0.051 |

3.72 |

- |

- |

579,000 |

42,057,000 |

- |

- |

| Rochester | 62,554,000 |

0.003 |

0.37 |

- |

- |

172,000 |

22,863,000 |

- |

- |

| Kensington | 862,000 |

0.200 |

- |

- |

- |

172,000 |

- |

- |

- |

| Wharf | 9,186,000 |

0.028 |

- |

- |

- |

258,000 |

- |

- |

- |

| Silvertip | 1,618,000 |

- |

7.67 |

7.98% |

4.99% |

- |

12,403,000 |

258,418,000 |

161,569,000 |

| Total | 85,518,000 |

0.014 |

0.90 |

1,181,000 |

77,323,000 |

258,418,000 |

161,569,000 |

||

| PROVEN AND PROBABLE RESERVES | |||||||||

| Palmarejo | 15,337,000 |

0.055 |

3.87 |

- |

- |

849,000 |

59,400,000 |

- |

- |

| Rochester | 459,421,000 |

0.003 |

0.40 |

- |

- |

1,219,000 |

185,508,000 |

- |

- |

| Kensington | 1,676,000 |

0.197 |

- |

- |

- |

331,000 |

- |

- |

- |

| Wharf | 28,367,000 |

0.025 |

- |

- |

- |

720,000 |

- |

- |

- |

| Silvertip | 1,804,000 |

- |

8.11 |

8.21% |

5.36% |

- |

14,636,000 |

296,065,000 |

193,225,000 |

| Total | 506,606,000 |

0.006 |

0.51 |

3,119,000 |

259,545,000 |

296,065,000 |

193,225,000 |

||

2020 Year-End Measured and Indicated Resources

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| MEASURED RESOURCES | |||||||||

| Palmarejo | 1,840,000 |

0.052 |

3.67 |

- |

- |

95,000 |

6,746,000 |

- |

- |

| Rochester | 240,568,000 |

0.002 |

0.24 |

- |

- |

388,000 |

57,160,000 |

- |

- |

| Kensington | 2,390,000 |

0.233 |

- |

- |

- |

556,000 |

- |

- |

- |

| Wharf | 12,992,000 |

0.019 |

- |

- |

- |

245,000 |

- |

- |

- |

| Silvertip | 138,000 |

- |

11.17 |

9.83% |

7.88% |

- |

1,541,000 |

27,050,000 |

21,670,000 |

| Lincoln Hill | 4,642,000 |

0.012 |

0.34 |

- |

- |

58,000 |

1,592,000 |

- |

- |

| La Preciosa | 9,536,000 |

0.005 |

3.04 |

- |

- |

45,000 |

29,001,000 |

- |

- |

| Total | 272,106,000 |

0.005 |

0.35 |

1,387,000 |

96,040,000 |

27,050,000 |

21,670,000 |

||

| INDICATED RESOURCES | |||||||||

| Palmarejo | 11,591,000 |

0.045 |

3.83 |

- |

- |

518,000 |

44,398,000 |

- |

- |

| Rochester | 57,452,000 |

0.002 |

0.25 |

- |

- |

102,000 |

14,207,000 |

- |

- |

| Kensington | 1,204,000 |

0.228 |

- |

- |

- |

274,000 |

- |

- |

- |

| Wharf | 12,717,000 |

0.028 |

- |

- |

- |

360,000 |

- |

- |

- |

| Silvertip | 2,206,000 |

- |

7.20 |

9.41% |

4.41% |

- |

15,892,000 |

415,000,000 |

194,780,000 |

| Lincoln Hill | 27,668,000 |

0.011 |

0.31 |

- |

- |

306,000 |

8,655,000 |

- |

- |

| La Preciosa | 19,141,000 |

0.006 |

3.98 |

- |

- |

118,000 |

76,185,000 |

- |

- |

| Total | 131,979,000 |

0.013 |

1.21 |

1,678,000 |

159,337,000 |

415,000,000 |

194,780,000 |

||

| MEASURED AND INDICATED RESOURCES | |||||||||

| Palmarejo | 13,431,000 |

0.046 |

3.81 |

- |

- |

613,000 |

51,144,000 |

- |

- |

| Rochester | 298,020,000 |

0.002 |

0.24 |

- |

- |

489,000 |

71,368,000 |

- |

- |

| Kensington | 3,594,000 |

0.231 |

- |

- |

- |

830,000 |

- |

- |

- |

| Wharf | 25,710,000 |

0.024 |

- |

- |

- |

605,000 |

- |

- |

- |

| Silvertip | 2,344,000 |

- |

7.44 |

9.43% |

4.62% |

- |

17,433,000 |

442,050,000 |

216,450,000 |

| Lincoln Hill | 32,310,000 |

0.011 |

0.32 |

- |

- |

364,000 |

10,247,000 |

- |

- |

| La Preciosa | 28,677,000 |

0.006 |

3.67 |

- |

- |

163,000 |

105,186,000 |

- |

- |

| Total | 404,086,000 |

0.008 |

0.63 |

3,064,000 |

255,377,000 |

442,050,000 |

216,450,000 |

||

2020 Year-End Inferred Resources

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| INFERRED RESOURCES | |||||||||

| Palmarejo | 4,345,000 |

0.064 |

3.34 |

- |

- |

280,000 |

14,525,000 |

- |

- |

| Rochester | 226,049,000 |

0.002 |

0.27 |

- |

- |

409,000 |

61,671,000 |

- |

- |

| Kensington | 1,597,000 |

0.247 |

- |

- |

- |

394,000 |

- |

- |

- |

| Wharf | 3,389,000 |

0.020 |

- |

- |

- |

67,000 |

- |

- |

- |

| Silvertip | 1,452,000 |

- |

8.26 |

10.63% |

4.95% |

- |

11,998,000 |

308,700,000 |

143,880,000 |

| Lincoln Hill | 22,952,000 |

0.011 |

0.36 |

- |

- |

255,000 |

8,163,000 |

- |

- |

| Sterling | 31,903,000 |

0.028 |

- |

- |

- |

903,000 |

- |

- |

- |

| Wilco | 25,736,000 |

0.021 |

0.13 |

- |

- |

531,000 |

3,346,000 |

- |

- |

| La Preciosa | 1,761,000 |

0.003 |

3.31 |

- |

- |

6,000 |

5,835,000 |

- |

- |

| Total | 319,186,000 |

0.009 |

0.33 |

2,845,000 |

105,538,000 |

308,700,000 |

143,880,000 |

||

Notes to above Mineral Reserves and Resources:

- The qualified person for Mineral Reserve and Mineral Resources estimates is Christopher Pascoe, Coeur's Director, Technical Services.

- Mineral Reserve and Mineral Resource estimates are effective December 31, 2020.

- Assumed metal prices for estimated Mineral Reserves were $1,400 per ounce of gold, $17.00 per ounce of silver, $1.15 per pound of zinc, $0.95 per pound of lead.

- Assumed metal prices for estimated Mineral Resources were $1,600 per ounce of gold, $20.00 per ounce of silver, $1.30 per pound of zinc, $1.00 per pound of lead, except Lincoln Hill and Wilco at $1,350 per ounce of gold and $22.00 per ounce of silver, and La Preciosa at $1,500 per ounce of gold and $20.00 per ounce of silver.

- Mineral Resources are in addition to Mineral Reserves and do not have demonstrated economic viability. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be considered for estimation of Mineral Reserves, and there is no certainty that the Inferred Mineral Resources will be realized.

- Rounding of tons and ounces, as required by reporting guidelines, may result in apparent differences between tons, grade, and contained metal content.

- Excludes the impact of the gold stream agreement at Palmarejo.

- For details on the estimation of mineral resources and reserves, including the key assumptions, parameters and methods used to estimate the Mineral Resources and Mineral Reserves, Canadian investors should refer to the NI 43-101 Technical Reports for Coeur's properties on file at www.sedar.com.

Conversion Table

1 short ton |

= |

0.907185 metric tons |

1 troy ounce |

= |

31.10348 grams |

View source version on businesswire.com: https://www.businesswire.com/news/home/20210909005142/en/

Contacts

Coeur Mining, Inc.

104 S. Michigan Avenue, Suite 900

Chicago, Illinois 60603

Attention: Paul DePartout, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com