Amica Mutual Ranks Highest in Homeowners Insurance; Lemonade Ranks Highest in Renters Insurance

The great Boomer migration from home ownership to renting is upon us. About two-thirds of all rental housing growth between 2004 and 2019 was driven by adults age 55 and older, and that group now accounts for approximately 30% of the total rental market.1 According to the J.D. Power 2021 U.S. Home Insurance Study,SM released today, home insurers have struggled to navigate that transition with products and services designed to maximize customer lifetime value.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210921005183/en/

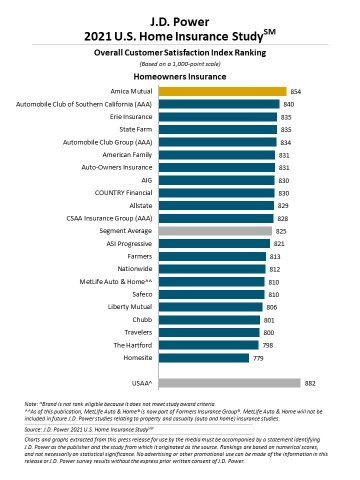

J.D. Power 2021 U.S. Home Insurance Study (Graphic: Business Wire)

“The generational shift from home ownership to renting represents a significant customer retention risk unless insurers figure out a better way to maintain customer loyalty throughout this critical life phase,” said Robert M. Lajdziak, senior consultant of insurance intelligence at J.D. Power. “So far, most insurers are missing that mark. Consider the stats: 44% of combined Boomers2 and Pre-Boomers who are renters today had homeowners insurance in the past, but only 52% of them now have their renters policy with the same carrier. Recognizing that annual retention for homeowners is 91.7%, there is a huge opportunity out there for insurers that get the life stage transition formula right, but the scale of this generational movement will likely drive a great deal of switching activity in the future.”

Following are some key findings of the 2021 study:

- Insurers struggle with transition from homeowners to renters policies: Just more than half (52%) of combined Boomers and Pre-Boomers who have transitioned from homeowners to renters policies stay loyal to the same insurer. That number falls to 44% among Generation X insureds and 36% among insureds in Generations Y and Z. Compared with the industry average, USAA, State Farm and Amica Mutual have particularly high rates of retention as their homeowners insurance customers transition to renters insurance customers.

- Service experience—not price—is key to lifetime value: Among renters who remain loyal to their previous homeowners insurance brand, the most common reasons for staying with the same carrier are good service experience, brand reputation, bundled products and convenience. Price is fifth on the list.

- Bundling builds loyalty, but legacy systems often limit cross-product visibility: Among renters who previously had a homeowners policy, those who bundle insurance products with their renters policy are two times more likely to stay loyal to the same carrier. Insureds interacting with agents are the most likely to have their household’s bundled products acknowledged, suggesting the legacy systems used by many insurers are not designed to enable customers to be treated as a household but rather as a policy number.

- Trust has significant influence on retention: Homeowners who have a strong perception that their insurer is trustworthy are four times more likely to say they “definitely will” renew with their insurer than those who do not have a favorable perception of their insurer’s trustworthiness.

- Smart home technologies create opportunity: More than half (59%) of homeowners with a smart home product installed in their home, such as a doorbell camera or automatic water shutoff valve, say that having a smart home feature has helped to prevent or lessen damage to property. This presents a clear opportunity for insurers to increase preventative service offerings, which is a major shift in the value proposition by focusing on preventing a loss rather than protection after a loss.

Study Rankings

Amica Mutual ranks highest in the homeowners insurance segment, with a score of 854 (on a 1,000-point scale). Automobile Club of Southern California (840) ranks second, while Erie Insurance (835) and State Farm (835) rank third in a tie.

Lemonade ranks highest in the renters insurance segment with a score of 870. State Farm (866) ranks second.

The U.S. Home Insurance Study examines overall customer satisfaction with two distinct personal insurance product lines: homeowners and renters. Satisfaction in the homeowners and renters insurance segments is measured by examining five factors: interaction; policy offerings; price; billing process and policy information; and claims. The study is based on responses from 11,828 homeowners and renters via online interviews conducted from May through July 2021.

For more information about the U.S. Home Insurance Study, visit https://www.jdpower.com/business/insurance/us-home-insurance-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021114.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 “Housing Perspectives,” Joint Center for Housing Studies of Harvard University, December 17, 2020 https://www.jchs.harvard.edu/blog/ten-insights-about-older-households-2020-state-nations-housing-report

2 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210921005183/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com