Company collaborates with the Nasdaq Entrepreneurial Center to provide coaching and its Open For Business Fund invests over $55M to help women and diverse-owned businesses gain expertise

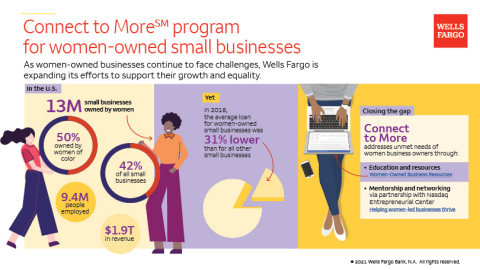

Wells Fargo today announced a new wave of support for entrepreneurs including an initiative focused on mentoring 500 women-owned businesses called Connect to More℠, and a second phase of funding from its Open for Business Fund aimed at providing 93 nonprofits with access to experts that can help grow their businesses.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210818005701/en/

Wells Fargo Delivers Mentorship for 500 Women-Owned Businesses; Announces Grants to Over 90 Nonprofits (Graphic: Wells Fargo)

“Access to trusted expertise helps small businesses move from surviving to thriving,” said Jenny Flores, head of Small Business Growth Philanthropy at Wells Fargo. “For many small businesses, having access to mentorship and trusted experts in areas like marketing, business planning, technology and legal can be a critical turning point for getting back to growth.”

Connect to More for women entrepreneurs

Connect to More is one example of how we’re supporting the success and sustainability of women-owned businesses through access to expertise and specialized resources. As part of the program, Wells Fargo partnered with the Nasdaq Entrepreneurial Center where women entrepreneurs can gain complimentary support through its signature Milestone Mapping Coaching Circles. Born from the challenges of COVID-19, participants get hands-on help setting and reaching business goals from a network of peer mentors and industry experts.

“As an entrepreneur, you don’t always have the time to sit and reflect on your business, it’s always go go go,” said Ruby Taylor, owner of Financial Joy School, and a current Circle participant. “Not only does this program give you that time, but it also includes a support system of amazing women. So far I’ve walked away with concrete marketing and social media strategies to promote more brand awareness for my business.”

"I love this program's heart-centered approach and how it’s helping me clarify the value and mission of my business,” said Amy Li, Founder & CEO of Dance4Healing, another current Circle participant. “Because my company is all about bridging creative arts and health care using technology, I’ve struggled with how to make it sustainable while also doing good. The Circle has helped me set milestone goals to develop a sales channel strategy and connect with the right support I need for my business to thrive toward a greater ecosystem.”

Connect to More will offer Milestone Mapping Coaching Circles throughout the year and into 2022 with the goal of helping 500 women-owned businesses. Each Circle is open to all women-identifying business owners in the U.S. and provides a biweekly opportunity for women entrepreneurs to work through specific challenges, celebrate milestones, attend workshops, and connect with small business experts and mentors. Those interested in applying must complete an application, and upon acceptance, will be placed in a Circle.

“As a non-profit committed to access and equity in entrepreneurship, we are grateful for this opportunity to help 500 women-owned businesses accelerate their personal growth as leaders and gain support as they solve big problems that make their families and communities stronger,” says Nicola Corzine, executive director of the Nasdaq Entrepreneurial Center. “We believe accelerating women business owners’ influence and economic opportunities are critical to addressing the intolerable wealth gap.”

Open for Business Fund announces technical assistance grants

The company is also distributing more than $55 million to 93 nonprofits from its Open for Business Fund, a roughly $420 million small business recovery effort. These grants will make experts in business planning, accounting, financial management, legal, marketing and more available to small business owners for coaching and guidance.

According to the Association for Enterprise Opportunity (AEO), small businesses with access to expertise have a lot to gain including a “30% difference in average annual revenue growth for a sample of businesses that got support compared to their peers that did not. In fact, with the right mix of resources and support systems, employment from microbusinesses in low-wealth communities alone could grow by well-over 10%.”

The nonprofits selected to join the Open for Business Fund range from universities to local chambers of commerce to economic development funds with an emphasis on reaching small business owners most disproportionately impacted by the pandemic. For a complete list of grantees, visit here.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial services company that has approximately $1.9 trillion in assets, proudly serves one in three U.S. households and more than 10% of small businesses in the U.S., and is the leading middle market banking provider in the U.S. We provide a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management. Wells Fargo ranked No. 37 on Fortune’s 2021 rankings of America’s largest corporations. In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health and a low-carbon economy. News, insights, and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo.

Cautionary Statement about Forward-Looking Statements

This news release contains forward-looking statements about our future financial performance and business. Because forward-looking statements are based on our current expectations and assumptions regarding the future, they are subject to inherent risks and uncertainties. Do not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the Securities and Exchange Commission, including the “Forward-Looking Statements” discussion in Wells Fargo’s most recent Quarterly Report on Form 10-Q as well as to Wells Fargo’s other reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, available on its website at www.sec.gov.

News Release Category: WF-SB

View source version on businesswire.com: https://www.businesswire.com/news/home/20210818005701/en/

Contacts

Media

Brittany Anthony, 925-451-0769

Brittany.Anthony@wellsfargo.com

Kim Erlichson, 201-463-4243

Kim.Erlichson@wellsfargo.com

Matt Paget, Extension PR for The Nasdaq Entrepreneurial Center

mpaget@extensionpr.com