Bank of America Ranks Highest in Customer Satisfaction with Retail Banking Advice

Retail banks are finding the ultimate formula for customer engagement in a service few customers ask for, but many could benefit from: financial advice. According to the J.D. Power 2021 U.S. Retail Banking Advice Satisfaction Study,SM released today, 69% of customers who receive advice from their banks act on it, but just 19% of customers say they are interested in receiving it. These findings are notably important in a challenging economic environment in which fewer than half of retail bank customers are financially healthy and just 38% pass a basic financial literacy test.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210624005044/en/

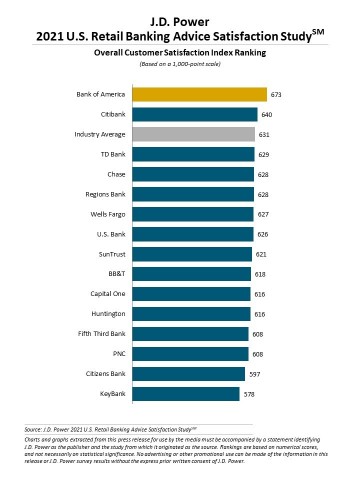

J.D. Power 2021 U.S. Retail Banking Advice Satisfaction Study (Graphic: Business Wire)

The study, now in its fourth year, measures retail banking customer satisfaction with the advice and guidance provided by national and regional banks in the United States. This year, the study has been redesigned to also include a series of measures related to personal financial health and literacy.

“Retail banks fill a critical role in customers’ financial lives and, even though customers may not think to seek financial advice from their bank, they tend to respond extremely well when that advice is proactively offered,” said Paul McAdam, senior director of banking intelligence at J.D. Power. “There is huge opportunity for retail banks to forge deeper relationships by helping customers with things like advice on investment and retirement planning, building savings to cover emergencies and techniques to ensure paying bills on time.”

Following are key findings of the 2021 study:

- Targeted, personalized financial advice drives gains in customer satisfaction: Overall customer satisfaction increases 229 points (on a 1,000-point scale) when customers are offered advice/guidance that completely meets their needs. Banks manage to achieve this 52% of the time, while 69% of customers who receive advice from their banks act on it.

- The perk no one asked for: Despite the significant customer satisfaction gains associated with financial advice/guidance, just 19% of retail bank customers say they are very interested in receiving it and 33% say they are not at all interested in receiving advice or guidance from their bank. Customers are more likely to receive financial advice/guidance from family members, friends, Internet searches or personal finance websites than they are from their primary bank.

- Many customers need advice: Just 49% of retail bank customers are classified as financially healthy, while 11% fall into the overextended category. Another 13% are classified as stressed and 27% as vulnerable. Just 38% of bank customers pass a basic financial literacy test.

- Big national banks lead the way on advice: The top four banks in the study are all national banks, earning high marks for their diverse advice offerings, the relevancy of advice/guidance and concern for customer needs while providing advice.

Study Ranking

Bank of America ranks highest in customer satisfaction with retail banking advice with a score of 673. Citibank (640) ranks second. The industry average is 631.

The 2021 U.S. Retail Banking Advice Satisfaction Study includes responses of 5,491 retail bank customers in the United States who received any advice/guidance from their primary bank regarding relevant products and services or other financial needs in the past 12 months. The study was fielded in March 2021.

For more information about the U.S. Retail Banking Advice Satisfaction Study, visit

https://www.jdpower.com/business/financial-services/jd-power-financial-health-and-advice.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021070.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20210624005044/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com