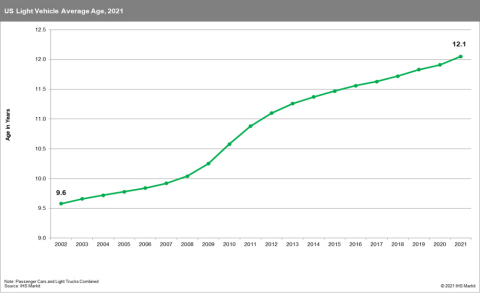

New research from IHS Markit (NYSE: INFO) shows that the average age of light vehicles in operation (VIO) in the U.S. has risen to 12.1 years this year, increasing by nearly 2 months during 2020 and elevated by the COVID-19 pandemic. The increase in average age will further drive vehicle maintenance opportunities from an increasingly aged vehicle fleet.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210614005149/en/

US Light Vehicle Average Age, 2021 (Source: IHS Markit)

COVID-19 and its impact across the U.S. caused a drastic reduction in new vehicle sales as well as a sudden increase in vehicle scrappage, which was a catalyst for increased velocity in the growth of the average age of light vehicles. The pandemic-induced rate of increase in average age is expected to be short-lived as 2021 will see a return of new vehicle registrations and increased activity in used registrations as we adapt to post-pandemic norms.

Pandemic kept people inside, and parked vehicles

In early 2020 the pandemic put significant pressure on new vehicle sales as dealerships worked to implement modified sales processes and deliveries to adhere to social distancing guidelines and create a comfortable vehicle purchasing experience for consumers, even moving some transactions online. A strong finish to 2020 demonstrated the resilience of new vehicle registration as over 8 million new vehicles were registered in the second half of the year, bringing new registrations up to 5.1 percent of VIO for the whole year.

While new vehicle sales proved resilient, the most significant impacts to VIO from the pandemic were felt in the rate of vehicle scrappage and vehicle miles traveled. Scrappage, the measure of vehicles exiting the active population, saw its highest volume in two decades at over 15 million units, and second highest rate at 5.6 percent of VIO. Vehicle Miles Traveled declined year over year by over 13 percent in 2020 due to lockdowns and work from home policies. Typically, an increase in scrappage rate would be expected to be a headwind to average age, but coupled with the lower new vehicle sales and reduced vehicle miles traveled, the combined impact proved to be a tailwind.

“2020 was a radical departure from the norm and challenged assumptions about how vehicle owners use their vehicles and accumulate miles; from a vehicle fleet perspective, one of the real surprises was the number of vehicles that suddenly exited the active population,” said Todd Campau, associate director of Aftermarket Solutions at IHS Markit. According to the analysis, the rate and mix of vehicles leaving the population point to the possibility that the volume may be inflated due to a larger percentage of vehicles that may not have been registered due to lags in state requirements for registration renewals, more vehicles being put into ‘storage’ due to COVID-19 restrictions in many locations and work from home initiatives.

Chip shortage and used vehicle sales to shape average age in 2021

2021 offers two related factors that are expected to mute average age growth, according to IHS Markit analysis. The ongoing microchip shortage is expected to continue to challenge new vehicle production volumes through the fourth quarter 2021, but rounding out the year, IHS Markit expects U.S. light vehicle sales to reach 16.8 million according to current forecasts, which can be expected to mute average age growth. In addition, during the height of pandemic, some vehicle owners may have allowed registrations to expire because their vehicles were not being driven.

“The microchip shortage and subsequent inventory levels for new vehicles have created a situation in which used vehicle values have gotten extremely high, so a vehicle owner who may have kept a vehicle in the garage that they were not using in 2020, now instead may take advantage of the opportunity to either reduce the number of vehicles in their garage, or trade up to something newer while the demand and value is extremely high on their used vehicle,” according to Campau. “This is great news for the aftermarket as subsequent vehicle owners typically have a higher propensity to use independent repair shops for necessary maintenance and repair.”

Vehicles in operation decline in 2021 to 279M, while electric vehicles in operation approach 1 million

The combined impact of the factors at play in 2020 led to the first decrease in VIO since 2012, with 279 million vehicles in operation as of January 2021, down from nearly 281 million a year prior. That said, the industry is entering a period of strong growth in the aftermarket ‘sweet spot’ – those vehicles 6-11 years of age – as record sales years begin moving into that age group over the next 5 years which will serve as a tailwind to aftermarket revenue growth.

In addition, electric vehicles continued to increase, with strong registrations through 2020, pushing total electric vehicles in operation to near 1 million units. The average age of electric vehicles in the US is 3.9 years of age and has been hovering between 3.8 and 4.1 years since 2016 as the volume of new registrations of electric vehicles continue to represent a large share of overall EV VIO. 89% of 2016-2020 model year EVs are still registered by their first owner, as compared to 68% of gasoline vehicles for those same model years. As EV’s begin to gain more market share and become more prominent in the used vehicle market, it is expected that their average age will begin to increase. At that time, the aftermarket will begin to see repair opportunities shift in response to the increased EV market share.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

Automotive offerings and expertise at IHS Markit span every major market and the entire automotive value chain—from product planning to marketing, sales and the aftermarket. For additional information, please visit www.ihsmarkit.com/automotive or email automotive@ihsmarkit.com.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2021 IHS Markit Ltd. All rights reserved.

Editor’s Note: Average age and vehicles in operation based on a snapshot of vehicles in operation on Jan. 1, 2021, the most recent analysis from IHS Markit.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210614005149/en/

Contacts

Michelle Culver

IHS Markit

+1 248 728 7496

michelle.culver@ihsmarkit.com

Press Team

IHS Markit

press@ihsmarkit.com