GEICO Ranks Highest in Service Satisfaction, Mercury Ranks Highest in Shopping Satisfaction

With more property and casualty (P&C) insurance customers than ever migrating to digital channels during the past year, expectations for a superior user experience have grown and many insurers are struggling to keep pace. According to the J.D. Power 2021 U.S. Insurance Digital Experience Study,SM released today, overall customer satisfaction with insurers’ digital offerings does not improve this year, despite industry-wide improvements in best-practice competency.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210525005169/en/

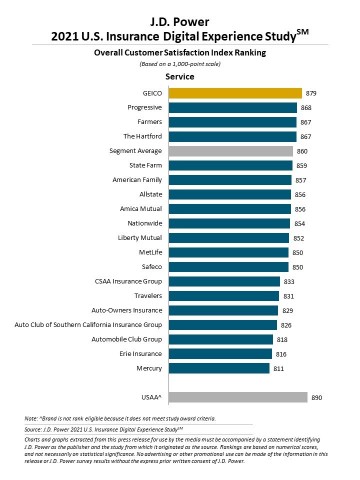

J.D. Power 2021 U.S. Insurance Digital Experience Study (Graphic: Business Wire)

“The bar just continues to get higher for customer expectations around digital, and while many insurers are hitting the mark on the digital basics, few insurers are using digital in new ways to drive growth and engagement,” said Tom Super, head of property and casualty insurance intelligence at J.D. Power. “The real challenge for insurers is pushing the envelope on digital innovation. Customers’ pace of expected change is accelerating, and insurers must be able to take steps to go beyond the basics of simply digitizing customer tasks. Those that can make this leap will be poised to separate themselves from the pack.”

The study, now in its 10th year, evaluates digital consumer experiences among both P&C insurance shoppers seeking quotes and existing customers conducting typical policy-servicing activities. The study examines the functional aspects of desktop, mobile web and mobile apps based on five factors: ease of navigation; appearance; availability of key information; range of services; and clarity of the information. The study was conducted in partnership with Corporate Insight, the leading provider of competitive intelligence and user experience research to the financial services and healthcare industries.

“Being ‘good enough’ doesn’t cut it in a world where consumers are managing so much of their lives through digital interfaces and upending conventional notions of customer engagement,” said Michael Ellison, president of Corporate Insight. “While most insurers are making it possible to perform basic functions online or via mobile, very few are delivering a markedly improved, highly personalized overall experience via digital, even though innovative firms are showing that it is possible to do that now.”

Following are key findings of the 2021 study:

- Insurer digital solutions not keeping pace with customer expectations: Overall customer satisfaction with the P&C insurance customer service experience improves to 860 (on a 1,000-point scale) from 858 in 2020 and overall satisfaction with the shopping experience declines to 788 from 800 a year ago, as record numbers of insurance customers transitioned to digital during the height of the pandemic. Beneath these headline figures, many individual insurers saw volatile year-over-year swings in their overall satisfaction scores.

- Basic digital competency not enough to drive improvements: Overall digital competency scores improve for nearly every insurer in the study, but many customers still cite challenges with several account service and shopping tasks. Notably, satisfaction scores improve about 100 points or more when customers say that completing tasks is “very easy” vs. “somewhat easy.”

- Complex tasks become new customer experience battleground: Across all account service and shopping engagements evaluated, the study finds that customer satisfaction scores consistently decline as tasks become more complicated. Complex tasks such as requesting a quote, researching policy information, adding a driver/vehicle and viewing policy-related information are among the areas in which insurers struggle to delight digital customers.

- Tech-savvy mobile app users set stage for future of digital insurance experience: Satisfaction is substantially higher across all factors in the study among mobile app users and those who describe themselves as tech savvy. Mobile app usage increases 26% this year.

Study Rankings

GEICO ranks highest in the service segment for a fourth consecutive year with a score of 879. Progressive (868) ranks second. Farmers (867) and The Hartford (867) rank third in a tie.

Mercury ranks highest in the shopping segment with a score of 821. Auto-Owners Insurance (816) ranks second and State Farm (807) ranks third.

The 2021 U.S. Insurance Digital Experience Study is based on 11,548 evaluations and was fielded in February-March 2021.

For more information about the U.S. Insurance Digital Experience Study, visit

https://www.jdpower.com/business/insurance/us-insurance-digital-experience-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021050.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

Corporate Insight is the recognized industry leader in competitive intelligence, user experience research and consulting services to the nation’s leading financial services and healthcare institutions for over 25 years. Its best-in-class research platform and unique approach of analyzing the actual customer experience help corporations advance their competitive position in the marketplace.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20210525005169/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com