REDMOND, WA / ACCESSWIRE / August 7, 2024 / MicroVision, Inc. (NASDAQ:MVIS), a leader in MEMS-based solid-state automotive lidar and ADAS solutions, today announced its second quarter 2024 results.

Key Business Highlights for Q2 2024

Building momentum toward full year guidance with Q2 revenue from industrial customers.

Actively engaging with top-tier global automotive OEMs, with seven high-volume RFQs for passenger vehicles and custom development opportunities.

Pursuing multiple near-term revenue opportunities with industrial customers in heavy equipment vertical.

Extending financial runway and operational efficiencies, streamlining cash burn and leveraging near-term hardware and software sales to automotive and industrial customers.

"We are pleased with our continued engagement in RFQs with automotive OEMs and are also excited by the uptick in interest in pre-RFQ collaboration and development work. With project delays and other automotive industry headwinds, we have worked hard to position MicroVision to successfully withstand these challenges," said Sumit Sharma, MicroVision's Chief Executive Officer. "We've reduced operating expenses to extend our financial runway and are focused on near-term revenue opportunities in non-automotive markets."

"While automotive projects are taking longer to ramp up, we remain actively engaged with multiple global OEMs for near-term custom development projects involving passenger vehicles scheduled for launch later this decade," continued Sharma.

Key Financial Highlights for Q2 2024

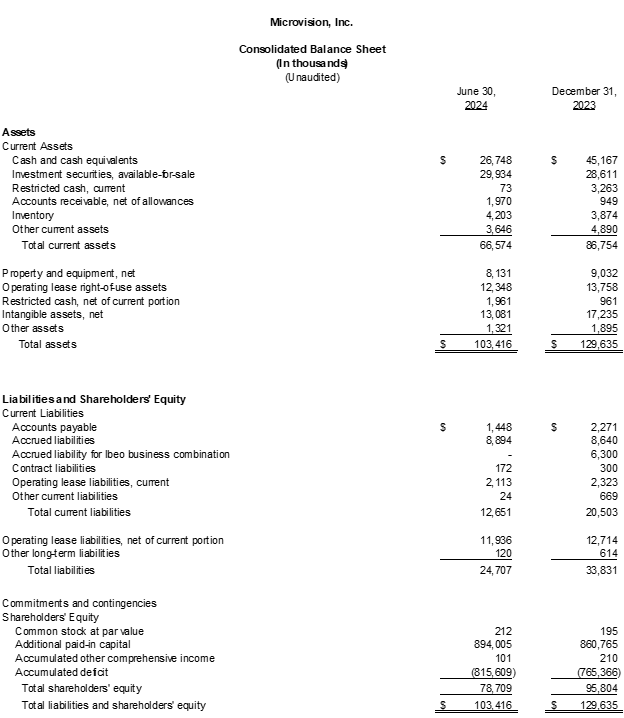

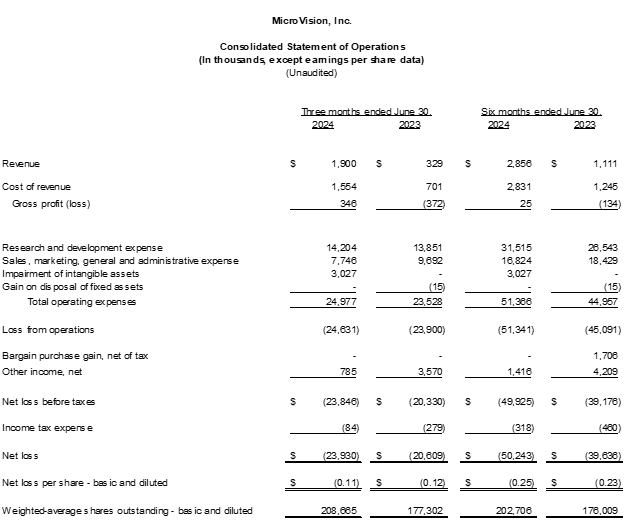

Revenue for the second quarter of 2024 was $1.9 million, compared to $0.3 million for the second quarter of 2023, primarily driven by hardware sales to a long-standing customer in the agricultural market.

Net loss for the second quarter of 2024 was $23.9 million, or $0.11 per share, which includes $3.4 million of non-cash, share-based compensation expense and $3.0 million of non-cash, asset impairment charge, compared to a net loss of $20.6 million, or $0.12 per share, which includes $3.9 million of non-cash, share-based compensation expense, for the second quarter of 2023.

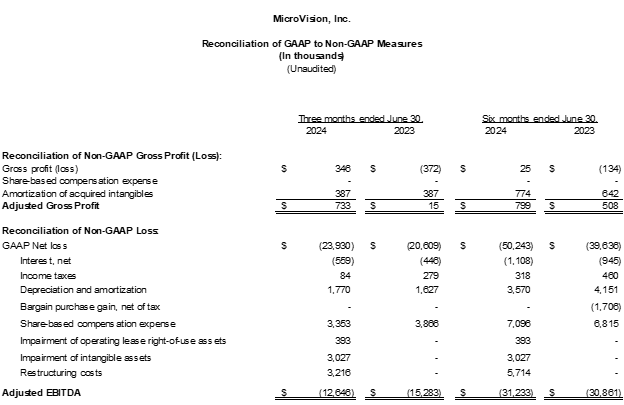

Adjusted EBITDA for the second quarter of 2024 was a $12.6 million loss, compared to a $15.3 million loss for the second quarter of 2023.

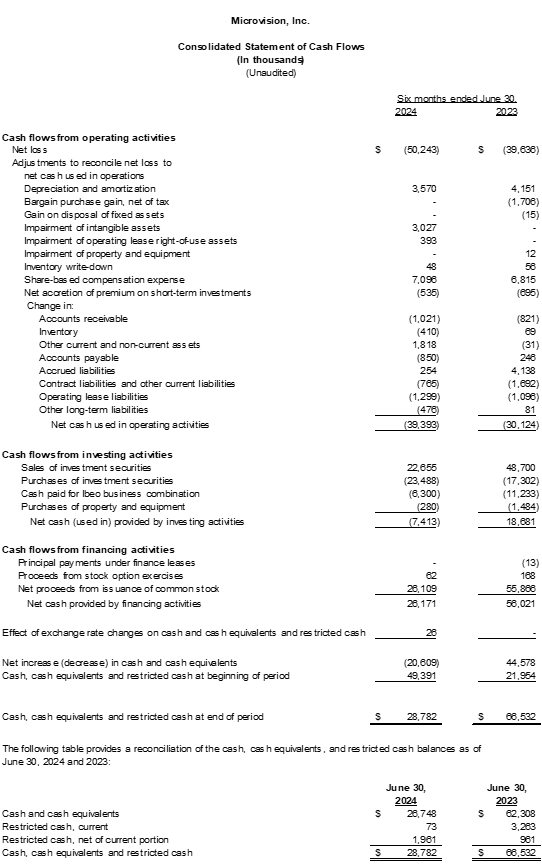

Cash used in operations in the second quarter of 2024 was $18.6 million, compared to cash used in operations in the second quarter of 2023 of $16.6 million.

The Company ended the second quarter of 2024 with $56.7 million in cash and cash equivalents, including investment securities, compared to $73.8 million at December 31, 2023.

Conference Call and Webcast: Q2 2024 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 1:30 PM PT/4:30 PM ET on Wednesday, August 7, 2024 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on August 7, 2024.

The live webcast and slide presentation can be accessed on the Company's Investor Relations website under the Events tab at https://ir.microvision.com/events. The webcast will be archived on the website for future viewing.

About MicroVision

With offices in the U.S. and Germany, MicroVision is a pioneering company in MEMS-based laser beam scanning technology that integrates MEMS, lasers, optics, hardware, algorithms and machine learning software into its proprietary technology to address existing and emerging markets. The Company's integrated approach uses its proprietary technology to provide automotive lidar sensors and solutions for advanced driver-assistance systems (ADAS) and for non-automotive applications including industrial, smart infrastructure and robotics. The Company has been leveraging its experience building augmented reality micro-display engines, interactive display modules, and consumer lidar modules.

For more information, visit the Company's website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc, and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision, MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

Non-GAAP information

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measures "adjusted EBITDA" and "adjusted Gross Profit." Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; bargain purchase gain; share-based compensation; impairment charges; and restructuring costs. Adjusted Gross Profit is calculated as GAAP gross profit before share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses these non-GAAP measures when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA and adjusted Gross Profit are useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA and adjusted Gross Profit are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent.

The Company compensates for limitations of the adjusted EBITDA measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

Similarly for adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profit which is the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation by backing out share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

Forward-Looking Statements

Certain statements contained in this release, including customer engagement and the likelihood of success, opportunities for revenue and cash, expense reduction, market position, product portfolio, product and manufacturing capabilities, and expected revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen

Darrow Associates Investor Relations

MVIS@darrowir.com

Media Contact

Marketing@MicroVision.com

SOURCE: MicroVision, Inc

View the original press release on accesswire.com